Why Personal Insurance is More Important than Ever Before

By Kym Ortiz | VP, Business Development | Franklin Madison

People need insurance for a lot of things in life. We need insurance for our cars, health insurance for when we go to see the doctor, and life insurance to help lighten the burden for our loved ones left behind.

However, American consumers seem to be scared to buy insurance for the most precious thing that needs protection: themselves! It’s prudent for credit unions, as trusted financial advisers, to help educate consumers on the benefits of insurance. But first we must understand why this hesitation exists when it comes to purchasing personal insurance, and what can be done to dispel consumers’ misconceptions.

Multiple factors influence why consumers are afraid to consider getting personal insurance for themselves. First, they simply don’t want to think about the reasons why they would ever need it. This is understandable; it’s not pleasant to imagine emergency situations like going to the hospital for a serious injury. Also, consumers often believe the very process of getting personal insurance to be too much of a hassle. This concern usually stems from experiences or perceptions of the complications associated with obtaining life insurance. But the truth is that many kinds of personal insurance are very easy to obtain.

With so many misconceptions about personal insurance, much work needs to be done to educate consumers.

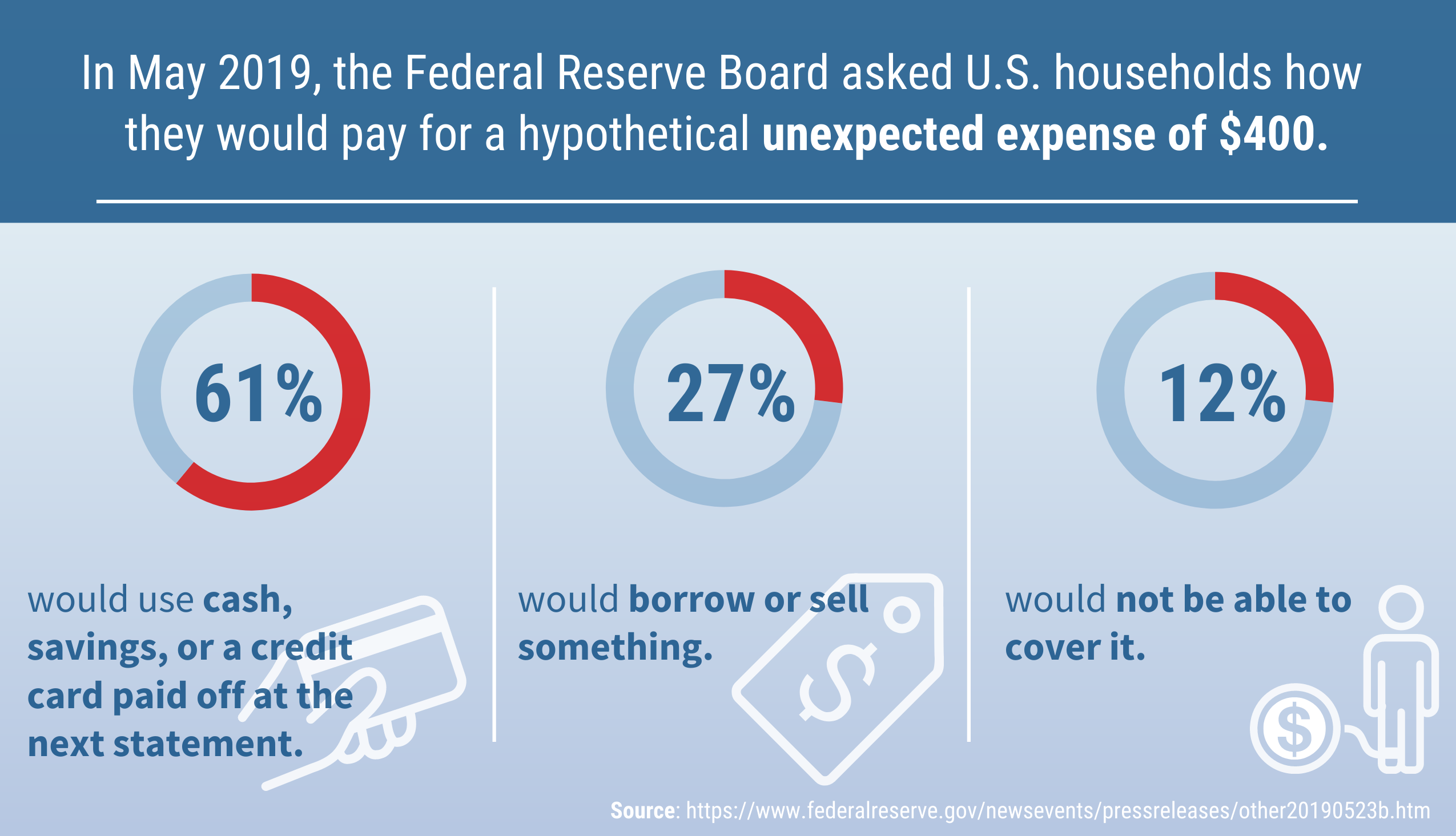

Insurance is particularly important given that many households in the United States may not be prepared for an unexpected expense should something happen to the main breadwinner. In a survey conducted by the Federal Reserve Board in May of 2019, when asked if they could cover a surprise expense of $400, 12% of respondents said that they would not be able to cover the cost. That is a lot of people that are in financial trouble, and if the one primary income earner was to become unable to work, that number would increase. According to the 2019 Trends Report from U.S. Financial Health Pulse, only 29% of Americans are financially healthy, which leaves two-thirds of American families facing a crisis should anything happen to the primary earner.

With the coronavirus affecting all of us and medical expenses continuing to rise, the need for personal insurance is greater than ever. Time and care must be taken to dispel misconceptions and let Americans know that if there was ever a time to protect themselves, it is now. Equip your credit union with the right educational resources and be part of the solution.