Your Members are Worried about their Finances

Here's How Life Insurance Could Help

By Kevin Cummer, Director, TruStage Life Products

Your members are worried about their financial well-being—and who can blame them? This past year alone, COVID continued to wreak havoc, inflation reached a four-decade high[1], and recession has been a looming threat.

Members may need your credit union more than ever. Luckily, you have the tool that might help to lessen their anxiety: life insurance. Life Insurance Awareness Month is a great opportunity to educate members about the role this important coverage can play.

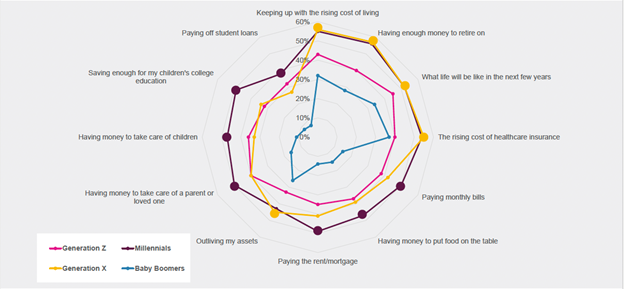

Consumers of All Ages Are Worried

According to findings from CUNA Mutual Group’s What Matters NowTM (WMN) research[2], although financial worries cross generational lines, one group stands out in every category: Millennials. This generation reached adulthood just as the 2008-2009 recession hit, and their lives have been buffeted by unemployment, student loan debt, exploding housing prices, and, of course, the impact of COVID. They’re closely followed by Gen Xers, who show nearly the same high levels of worry in many categories.

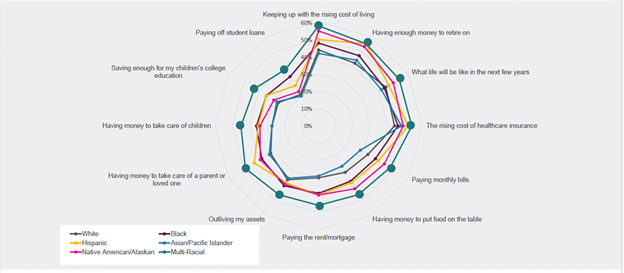

Worry Crosses Racial and Ethnic Lines Too

Examine worry through the lens of race and ethnicity, and no population is left unscathed. Retirement tops the worry list for all groups, followed by worries about the growing cost of healthcare and keeping up with the rising cost of living.

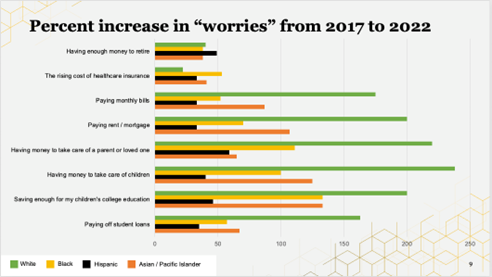

Multi-racial consumers showed the highest levels of worry in every category, while White consumers had the biggest percent increase in worries from 2017 to 2022.

Life Insurance Could Make a Difference

When it comes to financial worries, life insurance can be an invaluable resource in helping to provide your members with a sense of peace of mind.

- Help increase the feeling of security for those with dependents

According to the 2022 Insurance Barometer Study from LIMRA, having life insurance was associated with a higher level of financial security for people with dependents. More than two-thirds (68%) of those who had life insurance felt financially secure, vs. less than half (47%) of those who didn’t have life insurance.[3] - Can help provide for those with limited financial resources

Life insurance can be especially valuable for households that would quickly face financial hardship if their primary wage earner died. The LIMRA study showed a disconcertingly large percentage of the population fell into this category. Ten percent of survey respondents said they’d feel the impact of losing their primary wage earner within one week and 44% said they’d feel it within six months—and more than half of this group said they wouldn’t make it past one month without hardship.3

According to LIMRA, two of the most popular reasons for purchasing life insurance were to replace lost wages and to pay off a mortgage—items that could be especially concerning for those with limited resources who lost their main wage earner.3

More Consumers Are Opting for Life Insurance

According to LIMRA, since the start of the pandemic, there’s been an increase in consumer demand for life insurance and 2021 saw the highest annual growth in almost 40 years. [4]

The WMN research showed strong uptake among Black and Multiracial consumers. Six in 10 Black (58%) and Multiracial (61%) consumers purchased life insurance in the last five years and four in 10 Black (42%) and Multiracial (43%) consumers plan to purchase life insurance in the next five years. WMN also found Millennials and LGBTQ+ consumers represent strong market segments for life insurance products in the coming five years.

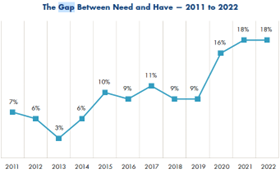

...But the Gap Between "Need" and "Have" Is High

Although the pandemic has driven increased life insurance uptake, the gap between those who need and have life insurance has grown in recent years, with the biggest recent gap occurring in the last three years.3

Close the Gap and Help Reduce Worries with Education

Move members from “need” to “have” by helping them understand the following:

- Life insurance might be more affordable than they think. Consumers tend to overestimate the cost of life insurance. LIMRA research suggested that more than half the population thinks life insurance is three times more expensive than it actually is.3

- The differences between term and whole life. Age, family situation, income, and personal preferences can all play a role in determining which option is a better fit.

- How to investigate insurance options. Confusion about what kind of life insurance to buy and how much is one of the biggest barriers to purchase.3 Provide flexible coverage options and user-friendly research tools that help members choose the life insurance that’s right for them.

Worried members may need you now more than ever. Be the partner they can always count on with access to and education about life insurance options.

You can access more data and insights from the What Matters Now study here.

[1] U.S. Bureau of Labor Statistics, “Consumer prices up 9.1 percent over the year ended June 2022, largest increase in 40 years,” July 18, 2022.

[2] CUNA Mutual Group, “What Matters Now” 2022

[3] LIMRA “2022 Insurance Barometer Study” pp. 9, 14, 15, 16, 23, 27, 35

[4] LIMRA’s 2021 Fourth Quarter U.S. Retail Life Insurance Sales Survey as cited in LIMRA’s 2022 Barometer study p. 35

|

Disclaimer: The views expressed here are those of the author and do not necessarily represent the views of TruStage or CUNA Mutual Group. TruStage® Life Insurance is made available through TruStage Insurance Agency, LLC and issued by CMFG Life Insurance Company. The insurance offered is not a deposit, and is not federally insured, sold, or guaranteed by your credit union. Product and features may vary and not be available in all states. Corporate Headquarters 5910 Mineral Point Road, Madison, WI 53705. GEN-4927884. 1-0822-0924 © CUNA Mutual Group |