Determining the Loan Purpose: The New Challenges [Part 1]

By Cathy Brown, Wolters Kluwer

One of the common threads running across the new Uniform Residential Loan Application (âURLAâ), the disclosure requirements of Regulations X and Z (âTRIDâ), and the reporting requirements of Regulation C (âHMDAâ) is the requirement that the lender identifies the loan purpose.[1] It is possible for the loan purpose to be the same for the new URLA and under TRID and HMDA. This blog examines the need to recognize that the loan purpose may be different for each and what lenders can do to prepare for that eventuality.

Can there be more than one loan purpose choice for a single-purpose loan?

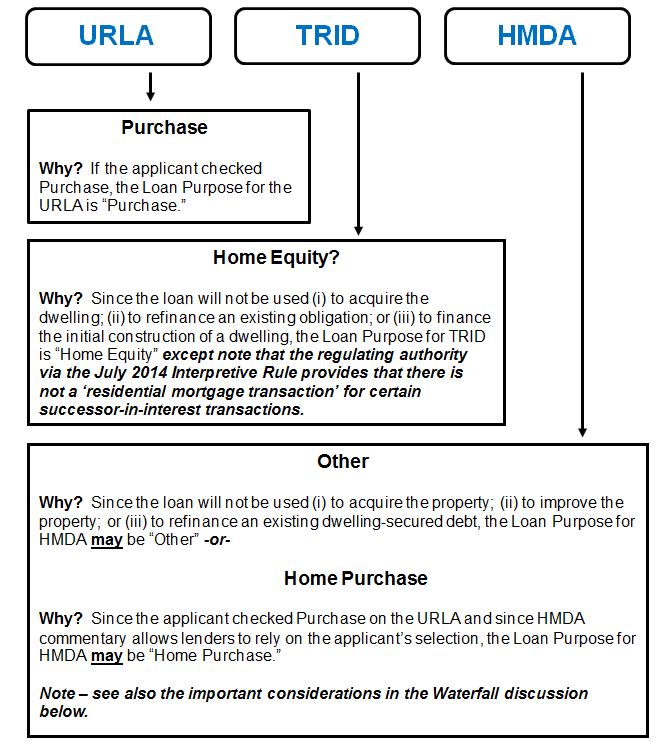

Consider the following single-purpose loan. A prospective borrower takes title to a dwelling with an existing loan as a successor-in-interest. The loan is assumable with the lenderâs approval but the prospective borrower only seeks approval after taking the title. The prospective borrower selects âPurchaseâ for the loan purpose on the new URLA. But is that itâis the loan purpose âPurchaseâ for the URLA and under TRID and HMDA?

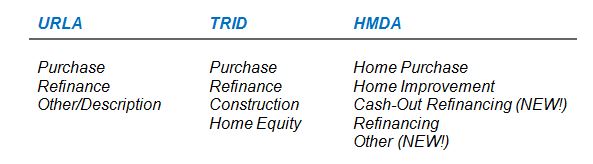

In order to answer the question with certainty, lenders may wish to start with a review of the possible choices. Those choices vary.  The bare choices follow.

It is also helpful to recognize why the loan purpose choices are different between TRID and HMDA. The choices under TRID are intended âto aid consumersâ understanding of their loan transactions.â See Integrated Mortgage Disclosures under the Real Estate Settlement Procedures Act (Regulation X) and the Truth in Lending Act (Regulation Z).

Notice that the new URLA no longer contains choices for Construction or Construction-Permanent. Also, there are two new choices under HMDA; those new choices are âCash-Out Refinancingâ[2] and âOther.â

By contrast, the choices under HMDA are intended to aid regulatory agencies and the public when analyzing the mortgage market. An obvious difference is that âConstructionâ is a loan purpose choice under TRID, but not under HMDA. âConstructionâ is an important category from a customer perspective. For covered loans under HMDA, âConstructionâ is primarily absorbed into the âHome Purchaseâ and âHome Improvementâ choices. Presumably, that approach aids analysis and it does avoid double-counting when there are separate construction and permanent loans.

Going back to our example, there is a prospective borrower seeking approval to assume an existing loan after taking title to the property, and that prospective borrower selects âPurchaseâ on the URLA. See the following analysis showing how one single-purpose loan may have three different loan purposes.

Although the example transaction may not occur with great frequency, it is just one loan purpose question that lenders should be prepared to answer.

The first question above was whether there can be more than one loan purpose choice for one loan. The answer is a qualified yes for the example given, but an unqualified yes for other loans because the available choices are different between the URLA, TRID, and HMDA.

In Part Two of this blog series, Wolters Kluwer discusses the HMDA Loan Purpose âwaterfallâ methodology and other requirements your credit union needs to know. They also share hidden requirements and next steps.

Wolters Kluwer is the NAFCU Services Preferred Partner for Consumer and Member Business Lending & Deposit Services. More educational resources and partner contact information are available at www.nafcu.org/wolterskluwer/.

Wolters Kluwer is the NAFCU Services Preferred Partner for Consumer and Member Business Lending & Deposit Services. More educational resources and partner contact information are available at www.nafcu.org/wolterskluwer/.