Newsroom

Consumer credit decelerating as interest rates rise

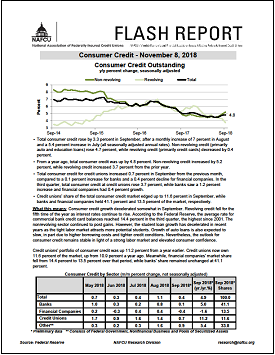

Total consumer credit rose 3.3 percent in September – somewhat of a deceleration from previous months. Revolving credit (primarily credit cards) fell for the fifth time this year, decreasing 0.4 percent in September, as interest rates continue to rise.

Total consumer credit rose 3.3 percent in September – somewhat of a deceleration from previous months. Revolving credit (primarily credit cards) fell for the fifth time this year, decreasing 0.4 percent in September, as interest rates continue to rise.

NAFCU Chief Economist and Vice President of Research Curt Long points out in a NAFCU Macro Data Flash report that the average rate for commercial bank credit card balances reached 14.4 percent in the third quarter – the highest since 2001 – according to the Federal Reserve.

Non-revolving credit (primarily auto and education loans) rose 4.7 percent in September. Long notes that "student loan growth has decelerated in recent years as the tight labor market attracts more potential students." He added that growth of auto loans is also expected to slow, "in part due to higher borrowing costs and tighter credit conditions."

Total consumer credit increased 7 percent in August and 5.4 percent in July (all seasonally adjusted annual rates).

Total consumer credit for credit unions increased 0.7 percent in September from the previous month, compared to a 0.1 percent increase for banks and a 0.4 percent decline for financial companies. In the third quarter, total consumer credit at credit unions rose 3.7 percent, while banks saw a 1.2 percent increase and financial companies had 0.4 percent growth.

Credit unions' share of the total consumer credit market edged up to 11.6 percent in September, up from 10.9 percent a year ago. Meanwhile, financial companies' market share fell from 14.4 percent to 13.5 percent over the past year, while banks' share remained unchanged at 41.1 percent.

Share This

Related Resources

Compliance Monitor - September 2018

Newsletter

Get daily updates.

Subscribe to NAFCU today.