Are You Liquid Enough?

Written By: Reginald Watson, Regulatory Compliance Counsel, NAFCU

Greetings Compliance Friends!

One of NCUA’s primary areas of supervisory focus for 2019 is to examine for liquidity risk, and in particular “credit union management’s ability to meet liquidity needs given the increased competitive pressures that affect share balances.” See, Letter to Credit Unions 19-CU-01. While the NAFCU Compliance Team does not address liquidity risk very often, NCUA does provide some guidance that credit unions may find helpful to better understand NCUA’s expectations.

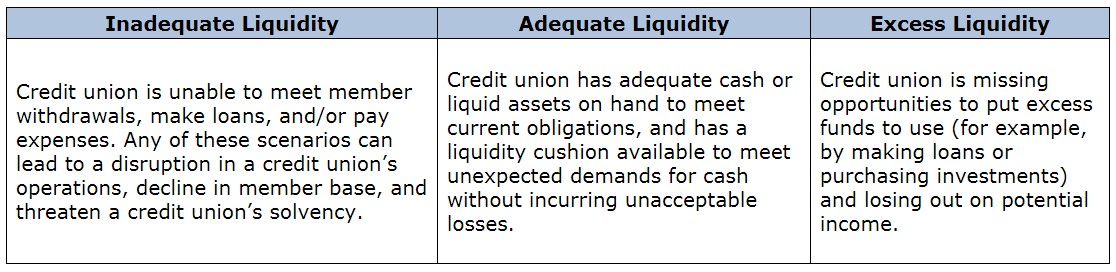

Liquidity describes a credit union’s ability to meet its expected and unexpected cash and collateral obligations without an adverse effect on daily operations. A credit union’s liquidity risk is increased when assets cannot be quickly turned into cash to make loans or pay expenses. NCUA’s Examiner’s Guide provides three categories which demonstrate possible liquidity scenarios:

Each asset in the credit union’s portfolio carries a different level of liquidity. Generally, the longer it will take to transform an asset into cash, the less liquid the asset becomes. If your credit union’s balance sheet includes significant amounts of assets considered to be less liquid, this may represent inadequate liquidity or at least a heightened liquidity risk. Credit unions can manage this risk by matching expected investment cash flows from its long-term assets against anticipated future funding needs.

Section 741.12 of NCUA’s rules and regulations requires credit unions with $50 million or more in assets to craft a contingency funding plan that outlines strategies for addressing liquidity shortfalls in the case of an emergency. The rule specifies that the plan must include a written policy commensurate with its complexity, risk profile, and scope of operations, and a list of contingent liquidity sources. Credit unions with at least $250 million in assets are also required to establish and document access to at least one contingent federal emergency liquidity source, such as NCUA’s Central Liquidity Facility or the Federal Reserve’s Discount Window. Section 741.12(c) also requires these credit unions to conduct advance planning and periodic testing to ensure that contingent funding sources will be readily available when needed.

Regulatory guidance also indicates that the board of directors is ultimately responsible for the credit union’s liquidity risk. The board is required to understand the nature of this risk, and adopt risk management policies to address liquidity and contingency funding needs. The Interagency Policy Statement on Funding and Liquidity Risk Management requires that the board:

· Establish executive-level lines of authority and responsibility for managing the credit union’s liquidity risk;

· Ensure that management properly identifies, measures, monitors, controls and reports on liquidity risk;

· Understands and periodically reviews the credit union’s contingency funding plan for handling potential adverse liquidity events; and

· Understands the liquidity risk profiles of important subsidiaries and affiliates as appropriate.

Credit union senior management is responsible for overseeing the development and implementation of the liquidity policy, including appropriate risk measurement and reporting systems, liquid buffers and an adequate internal control infrastructure. Senior management is also required to regularly report on the liquidity risk profile of the credit union to the board. As competitive pressure on the industry from other financial institutions and “fintechs” increases, NCUA will keep a watchful eye to ensure credit unions are well positioned and maintain adequate liquidity.

These additional resources may help when preparing for an examination focused on liquidity risk management:

· NCUA Examiners Guide: Liquidity Section and Liquidity Resources

· NCUA’s AIRES Exam Questionnaires: Liquidity Review Tab

· NCUA Letter to Credit Unions 13-CU-10: “Guidance on How to Comply with NCUA Regulation §741.12 Liquidity and Contingency Funding Plans”

· NCUA Letter to Credit Unions 2000-CU-13: “Liquidity and Balance Sheet Risk Management.”