Organizational Alignment Part 2: Case Studies and the Important Secrets They Reveal

By Peter Myers, Senior Vice President, DDJ Myers, Ltd.

One of the most important growth strategies a credit union can implement is a routine test of the degree of alignment within the organization. But oftentimes, this is a poorly executed or entirely missed opportunity at many institutions. The Harvard Business Review study, The New Game Plan for Strategic Planning, found that 84% of respondents ranked “management alignment” as the most important task, with only 41% saying their organization performed it well. In my last post, I addressed new approaches to alignment, and methods for measuring them. Here we’ll review two case studies on credit unions that assessed, clarified, and planned for improving their alignment.

One billion-dollar credit union we worked with found that they were not diving deep enough into strategy development conversations, which require more frequent cross-functional communication. We could have done 1:1 interviews or group workshops for feedback, but we proposed a quicker, more measurable and trackable approach. Here’s what we uncovered:

- At this organization, only 8% of the senior staff felt strongly that they, as a senior team, do a good job of listening when developing short- and long-term priorities.

- 12% straight up disagreed; most were middle of the road.

The message landed more effectively than a typical consultant’s documented analysis...because it was their own assessment. The group further explored topics such as organizational core competencies, competitive advantages, and strategic direction. It wasn’t that they didn’t have a direction, or know the core competencies; rather, they were not aligned on exactly what they were or could be, which limited the potential to execute and fulfill their organization’s potential.

The message landed more effectively than a typical consultant’s documented analysis...because it was their own assessment. The group further explored topics such as organizational core competencies, competitive advantages, and strategic direction. It wasn’t that they didn’t have a direction, or know the core competencies; rather, they were not aligned on exactly what they were or could be, which limited the potential to execute and fulfill their organization’s potential.

Another CEO, who was new to their role, asked us for a professional development program to push the organization forward. This metrics-driven CEO wanted a comprehensive understanding of their existing strategic and tactical plan clarity, team capabilities and capacities, and the state of their culture.

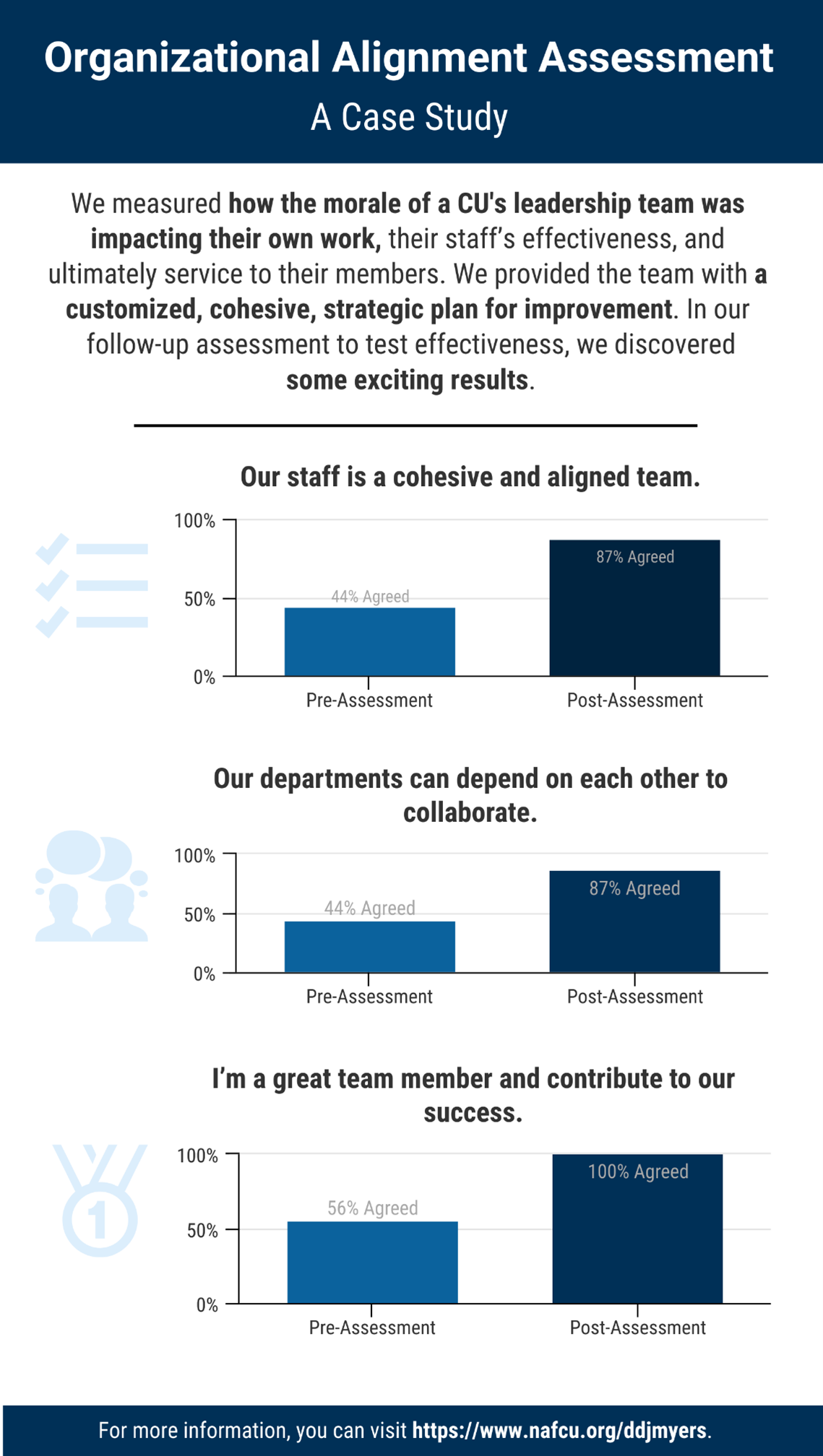

Our assessment quickly revealed that the morale of the leadership team was affecting their own work, their staff’s effectiveness, and ultimately service to their members. We reported some key findings:

- Our staff is a cohesive and aligned team: 44% agreed.

- Our departments can depend on each other to collaborate: 44% agreed.

- I’m a great team member and contribute to our success: 56% agreed.

The team was sobered, but convicted in a shared commitment to be both accountable as individuals, and open to the hard conversations coming their way. And most importantly, to achieve a team-embraced, strategic plan. They understood a key insight that management alignment is not a switch you flip. It takes continued work.

Fast forward several months, and the CEO wanted to assess their progress. The team’s scores were cause for celebration, and the organization felt validation for the intense work they had done. On average, their scores improved by 15%. Some comparative highlights:

- Our staff is a cohesive and aligned team: 87% agreed

- Our departments can depend on each other to collaborate: 87% agreed.

- I’m a great team member and contribute to our success: 100% agreed.

As a reminder, this initiative started with a focus on professional development and culture by focusing on measurable strategic alignment, which brought the culture score up by 13%. If we want to move the numbers, we focus on the work it takes to get strategic, tactical, and cultural alignment done. We’re honored that many credit unions have asked us to help with this work, and that some new tools and methods are helping them get there.