BCFP Issues Rule Implementing S.2155 HMDA Exemptions

Written by Brandy Bruyere, Vice President of Regulatory Compliance, NAFCU

On August 31, 2018 the Bureau of Consumer Financial Protection (bureau) published a final rule that implements recent statutory amendments to the Home Mortgage Disclosure Act (HMDA) which were passed as part of S.2155. We blogged on this issue here and here for more background, but the amendments exempted credit unions that originate fewer than 500 “closed-end mortgage loans” or 500 “open-end lines of credit” in the preceding 2 calendar years from collecting and reporting on certain data points added to HMDA by Dodd-Frank. The statutory language of HMDA gave some indication as to which data points this might include, like the total points and fees paid, credit score, property value, etc. but clarity was needed to determine how credit unions might benefit from this regulatory relief. The rule does a few key things:

- Specifies which data points are covered by the partial exemption;

- Designates a non-universal loan identifier;

- Clarifies that only loans and lines of credit that are covered loans under HMDA count towards the 500 loan thresholds; and

- Allows a credit union in some situations to optionally report exempt data fields.

Here’s a summary of these key points.

Data Points Included in the Partial Exemption

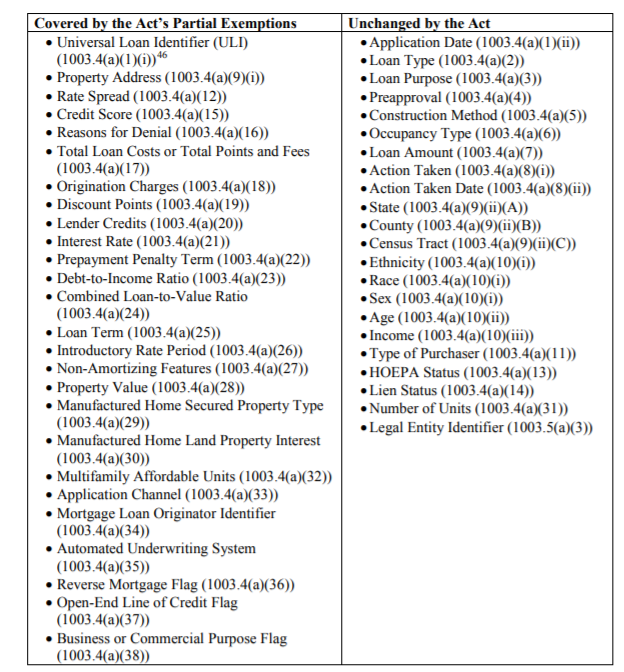

The bureau identified 26 data points as those which were added by Dodd-Frank and thus eligible for the partial exemption – 12 that are specifically listed in the statute, and 14 that were based on the bureau’s discretionary authority (which was also added to HMDA by Dodd-Frank). For those keeping score, that leaves 22 data points to collect and report for credit unions who are below the threshold for the exemption. Here is a table the bureau created summarizing which data points are and are not covered by the partial exemption:

Universal Loan Identifier

Leading up to this year’s implementation deadline for HMDA, our team received many questions about the universal loan identifier (ULI), particularly the requirement to obtain a “legal entity identifier” or LEI as one of the components of the ULI. Note in the chart above, this is one of the data points that is eligible for the partial exemption. While this means credit unions that are below the threshold may no longer need an LEI, the bureau notes that the prior version of HMDA still required “loans and applications [to] be identifiable in the HMDA data to ensure proper HMDA submission, processing, and compliance.” As a result, while the ULI will not be required for some credit unions, there is still a requirement “to provide information so that each loan and application” reported is identifiable. The rule is amended to require a “non-universal loan identifier” that “does not need to be unique within the industry” so a LEI is not needed. Instead, the non-universal loan identifier can have up to 22 characters and meet requirements that mirror those that are already listed as part of the ULI in section 1003.4(a)(1)(b):

(1) May be letters, numerals, or a combination of letters and numerals;

(2) Must be unique within the credit union (e.g. only one is assigned to any particular covered loan/application, and each corresponds to a single application); and

(3) Must not include any information that could be used to directly identify the applicant or borrower (e.g. name, date of birth, Social Security number, driver’s license or identification number, etc.)

Calculating the 500 Loan Threshold

S.2155 creates a threshold for which credit unions would be eligible for a partial exemption from data collection and reporting, but did not particularly define which loans would count towards the 500 loan thresholds. The bureau is interpreting “closed-end mortgage loan” and “open-end lines of credit” to mean those loans that would otherwise be HMDA-reportable, meaning HMDA covered loans (more information in this NAFCU article, member log in required).

The rule will be effective upon publication in the Federal Register.

Monthly Research Survey: Help Us Help You! NAFCU's Economic and Research Team conducts monthly surveys of NAFCU members in order to compile meaningful data reports for your credit union. These survey results are also critical to NAFCU's advocacy efforts on your behalf, both in the halls of Congress and before federal agencies, such as NCUA, CFPB, and the Federal Reserve.

September 11 is the last day to share your voice on the topic of Overdraft & Small Business Lending. We rely on your survey responses for our industry analysis and advocacy efforts on behalf of all credit unions.

Click here to participate in this month's survey. Your participation helps us help you!

Nolan & Lemmy in Maine. We took a family vacation last week to Maine. Lemmy, who just turned 7 years old, got to come with us. He enjoyed hanging out near the water’s edge. Nolan enjoyed mountain views and rock climbing!

About the Author

Brandy Bruyere, NCCO, Vice President of Regulatory Compliance/Senior Counsel, NAFCU

Brandy Bruyere, NCCO was named vice president of regulatory compliance in February 2017. In her role, Bruyere oversees NAFCU's regulatory compliance team who help credit unions with a variety of compliance issues.

Brandy Bruyere, NCCO was named vice president of regulatory compliance in February 2017. In her role, Bruyere oversees NAFCU's regulatory compliance team who help credit unions with a variety of compliance issues.