Fiduciary Duties Rule: Financial Literacy

Posted by Anthony Demangone

Late last month, NCUA established the "effective dates" for its federal credit union duties rule.Â

The new NCUA rule addressing the duties of federal credit union boards will be effective in January 2011, and compliance with the financial literacy portion of the rule will be required by July 2011.

Directors elected or appointed on or before January 27, 2011, including those directors serving prior to NCUA finalization of the rule, must be in compliance with the financial literacy requirements by July 27, 2011. Directors elected or appointed after January 27, 2011 must satisfy the financial literacy requirements within six months following seating.

This clearly show's NCUA's expectations that existing directors who were in place before NCUA finalized its rule are subject to  its financial literacy requirements.  And what is that financial literacy requirement?Â

"Each FCU director has the duty to... At the time of election or appointment, or within a reasonable time thereafter, not to exceed six months, have at least a working familiarity with basic finance and accounting practices, including the ability to read and understand the Federal credit unionâÂÂs balance sheet and income statement and to ask, as appropriate, substantive questions of management and the internal and external auditors...."

Here are my 2 cents on this:

- Does this mean all directors must receive financial literacy training? Â No. The regulation doesn't mandate training. Â It mandates a level of knowledge. Â If you have existing board members (or new board members) who can meet the test above, there's no need for additional training. Â This does beg the question though...how do you decide exactly which directors meet this test, and how do you show examiners that Director A didn't need it, while Director B did? Â You could come up with an internal system to determine who needs the training and document your decision. Or it might be easier to give all existing and income directors some sort of training. Â That creates fewer moving parts, and even seasoned veterans can benefit from a refresher course. Â I know I do.Â

- Ugh, so now we have to run out and purchase some new-fangled training program? Â Absolutely not. You may do so, but there's no reason why you couldn't do this in-house. Does your credit union have a CFO who could go over balance sheets, important ratios, basic accounting and finance issues, etc.? If so, why not consider building an in-house training program? Â Again, some folks will seek outside solutions to simplify the process.Â

- Try to embrace the new requirement as a way to improve your board. Â Believe me, I know that new requirements are a drag, and credit unions often see them as yet another "check the box" requirement. Â But this new duty is NCUA's attempt to ensure that each federal credit union director has the necessary tools to do the job. Now that is a requirement, take advantage of the opportunity to strengthen and improve your board. Â Better boards equal better credit unions, in my humble opinion.

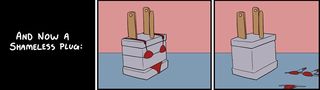

Stop reading if you dislike shameless plugs.

NAFCU has a few ways you can prepare for NCUA's new fiduciary duties rule.

- I'll be presenting a webcast on February 2, 2010Â 2011 (ugh, I'll be writing 2010 until June) that gives a broad overview of the new rule. Â Stay tuned for an opportunity to sign up.

- NAFCU does have an online training "solution" created for federal credit union directors (that's vendor speak) that includes a module on financial literacy.Â

- Our volunteer's conference will have a session devoted to reading financial statements, as well as other training opportunities for directors and other officials.Â