RBC: Nuts and Bolts, pt 1

Written by Alicia Nealon, Director of Regulatory Affairs

In case you didn't see, the NCUA Board finalized its risk-based capital (RBC) rule last week with an effective date of January 1, 2019. With that in mind, we are launching a series of posts where NAFCU's Compliance Blog will break down different portions of the final rule in order to help our compliance colleagues learn the basic framework of NCUA's new RBC requirements. While your credit union's CFO will likely be responsible for the nuts and bolts of RBC, NAFCU hopes that this series of blog posts will help the compliance community have a working knowledge of the rules overall structure and requirements. (this is my polite way of saying don't try this at home kids without accounting supervision).

Today's topic is the RBC ratio. Under the final rule, a complex credit union determines its RBC ratio by calculating the percentage, rounded to two decimal places, of its RBC numerator to its total risk-weighted assets denominator.

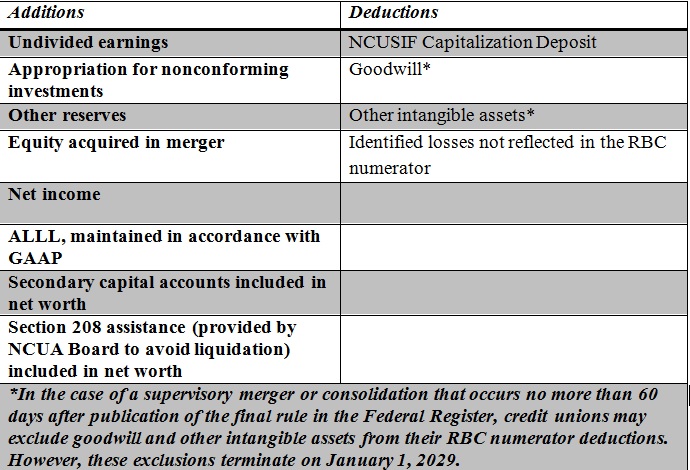

Let's start with the numerator. The RBC ratio numerator is calculated by adding together a particular list of relatively tangible or liquid capital elements and subtracting other specified capital that is less tangible or liquid. In other words, capital that would be available to cover losses is added together, and then specified balance sheet items are subtracted to determine the capital ratio numerator.

Is your head spinning yet? As someone who has an aversion to accounting, I find charts exceptionally helpful. Below is a chart illustrating the RBC numerator:

Turning now to the denominator, the RBC ratio denominator represents a credit union's total risk-weighted assets which includes risk-weighted on-balance sheet assets, plus certain off-balance sheet assets, plus risk-weighted derivatives, and minus the items deducted from the RBC numerator. This is a complex and highly technical calculation involving ten categories of risk weights based on the particular risk posed by the asset to the credit union's operations. Because I can't help myself, Download Here a chart detailing the risk categories and the risk-weights assigned to each specifically defined on-balance sheet asset.

As your credit union is making its way through RBC, be sure to take a look at NAFCU's Final Regulation 15-EF-15, our Capital Reform Issue Page, or reach out to me directly (anealon@nafcu.org, 703-842-2266) with your questions.

***

A Look at the Final Risk-Based Capital Rule

Free Live Webcast: Monday, October 26 | 3:30 p.m. - 5:00 p.m. EST

Deep dive into NCUA's final risk-based capital rule with Larry Fazio, NCUA's Director of Examination and Insurance and architect of the final rule. This free webcast will provide a closer look at the final rule, and offer NCUA's outlook for implementing this rule through its examination and supervision process in 2019. You'll also be able to ask questions of Fazio and NAFCU's team. Click here to register.