RBC-Nuts and Bolts, pt 2

Written by Alicia Nealon, Director of Regulatory Affairs

Boo! Happy Halloween and welcome back to the second installment of our RBC series where NAFCU's Compliance Blog will break down different portions of the final rule in order to help our compliance colleagues learn the basic framework of NCUA's new RBC requirements. One of the phrases that dominated the RBC conversation for the past 22 months has been two-tiered structure. In honor of Halloween, I thought today's topic should be unmasking what the two-tiered structure really means.

Part 702 currently evaluates a complex credit union's risk-based net worth (RBNW) on a pass/fail basis. Each credit union calculates its RBNW based on its portfolio of assets, using weighting prescribed by Part 702. That calculation yields an RBNW percentage that is then compared to a credit union's net worth ratio. A complex credit union's net worth ratio must exceed its RBNW requirement. If a credit union's net worth ratio falls below its RBNW requirement, it will be deemed undercapitalized.

The final RBC rule establishes a different approach. Unlike the current system, the final rule requires complex credit unions to calculate an RBC ratio. The RBC ratio must, itself, exceed certain thresholds. Most notably, for a complex credit union to be deemed well capitalized, its RBC ratio must exceed 10 percent. Specifically, the final requires complex credit unions that otherwise qualify as well capitalized based on their net worth ratio to also satisfy this separate 10 percent RBC threshold in order to maintain a well capitalized classification. As a result, under the final rule, a credit union that is otherwise well capitalized based on its net worth ratio could lose that designation if its RBC ratio falls between 8 percent and 9.99 percent, in which case it would be deemed adequately capitalized. A comparable situation cannot occur under NCUA's current capital adequacy rules.

Make sense? It's tricky, I know. So here's a little treat for this trick let's break it down through pictures.

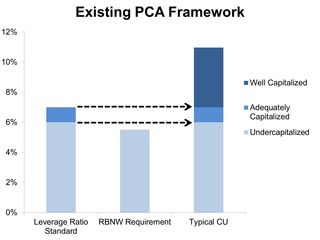

Below is a picture of Part 702's current framework- leverage ratio and RBNW.

As you can see, the current framework only requires a credit union to compares its RBNW requirement to one leverage ratio tier the one between adequately and under-capitalized. Specifically, a credit union would compare the leverage ratio requirement (6%) with the RBNW requirement and the higher of the two forms the governing standard. Thus, the existing one-tiered RBNW only affects that first hurdle that a credit union faces to avoid being designated as under-capitalized. As such, the RBNW requirement only comes into play when it exceeds 6%, which is not the case for the majority of credit unions.

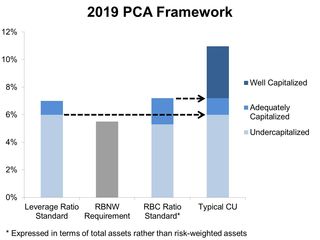

Now compare it to a picture of how Part 702 will be structured in 2019 leverage ratio and RBC:

As you can see, under the final rule, RBNW goes away and is replaced by RBC, which has two tiers indicated by the dark and light blue bars. Therefore, the final rule requires a credit union to compare its RBC requirement with that of the leverage ratio for both tiers the one between well and adequately capitalized and the one between adequately and undercapitalized. For most credit unions, this will not affect the lower standard, since it has generally been governed by the leverage ratio anyways. However, for many credit unions the standard for the well capitalized designation will increase as a result of this rule.

Phew!! Who needs candy? I think you all earned it after reading this blog post. Have a happy and safe Halloween. When you get back from your weekends, please be sure to take a look at NAFCU's Final Regulation 15-EF-15, our Capital Reform Issue Page, or reach out to me directly (anealon@nafcu.org, 703-842-2266) with any RBC questions.