Shameless Plug Monday: NAFCU Compliance School Revamp; Online Training; This and That

Posted by Anthony Demangone

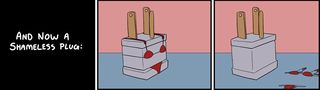

Warning...warning...shameless plug alert.

For those into compliance, you may have heard of NAFCU's Regulatory Compliance School. Â It is a week-long, intense educational conference designed to hammer compliance into the minds of its attendees. There is optional testing, all with the goal of obtaining the NAFCU Certified Compliance Officer (NCCO) designation. Â

We are revamping the school, from top to bottom. Â Check out the new agenda.

Why we are revamping it.  Any product or service must adapt.  For those who attended the School in the past, you may recall that it had entire sessions devoted to the Right to Privacy Act and NCUA's Credit Practices Rule.  But the school didn't address credit union bylaws, share insurance, RegFlex, the right of offset, and many other important topics.  In addition, while the old format shoveled information at attendees, the School never talked about research skills, how to write effectively, or what the role of the compliance officer really is.Â

What we did. Â You'll see many more topics in the agenda. However, you may see that many of the sessions are shortened. Â We simply can't touch on many new things while devoting 2 hours to Regulation Z. Â Or an hour to the Right to Financial Privacy Act. Â We've tried to create a School manual that provides detailed information about each regulatory area, while also providing research tips and resources. Â In addition, we devote an entire day (Wednesday) on "compliance officer skills." Â Finally, we're moving to a four-test format. Â Many attendees in the past indicated that they were simply burned out by the end of the week. Â We decided that cutting a test allowed us to create a day (Wednesday) when attendees could learn how to be a better compliance officer without the stress of a test hanging over their head.Â

If I had to sum up why we're changing school and what our goal is, it would be this.

In the current regulatory climate, rote memorization and intense study will only get you so far.  Memories fade, and regulations morph.  The true way to achieve regulatory success is to build skills through which a compliance officer can assimilate and research new changes as they come along, while maintaining a solid understanding of basic regulatory framework.Â

That's our goal. Â We hope you consider joining us.

***

NCUA's fiduciary duties proposal (we expect the final will likely released in December) has quite a few credit unions looking at training programs for their board of directors.  With that in mind, consider signing up for a free (and fairly short) webinar that highlights NAFCU's Online Training Program for Volunteers and New Employees. It will be held tomorrow at 2 p.m. (EST)

***

Here are a few tid-bits to get us started:

- FinCEN has released a guidance document that provides a number of questions and answers about it Travel Rule requirement.Â

- The Fed has released a consumer's guide to credit reports, credit scores and credit report errors. Â It might be something for you to consider including on your website to help your members understand how these things affect them.

- There are never enough hours in the day! Â With that in mind, NAFCU members should know that our overview of the Regulation Z proposal concerning mortgages, HELOCs and reverse mortgages is available. Â (The proposal addresses other things as well.) Â These overviews can be a great resource.Â