For most credit unions, the global pandemic led to unprecedented deposit growth and a sharp decline in branch traffic due to changing member behavior. Water and Power Community Credit Union (WPCCU) in Los Angeles, California, was no exception. Ultimately, with Upstart, WPCCU quickly put excess deposits to work while expanding its reach to new members and territories.

- Read the case study to learn how Upstart helped this credit union by:

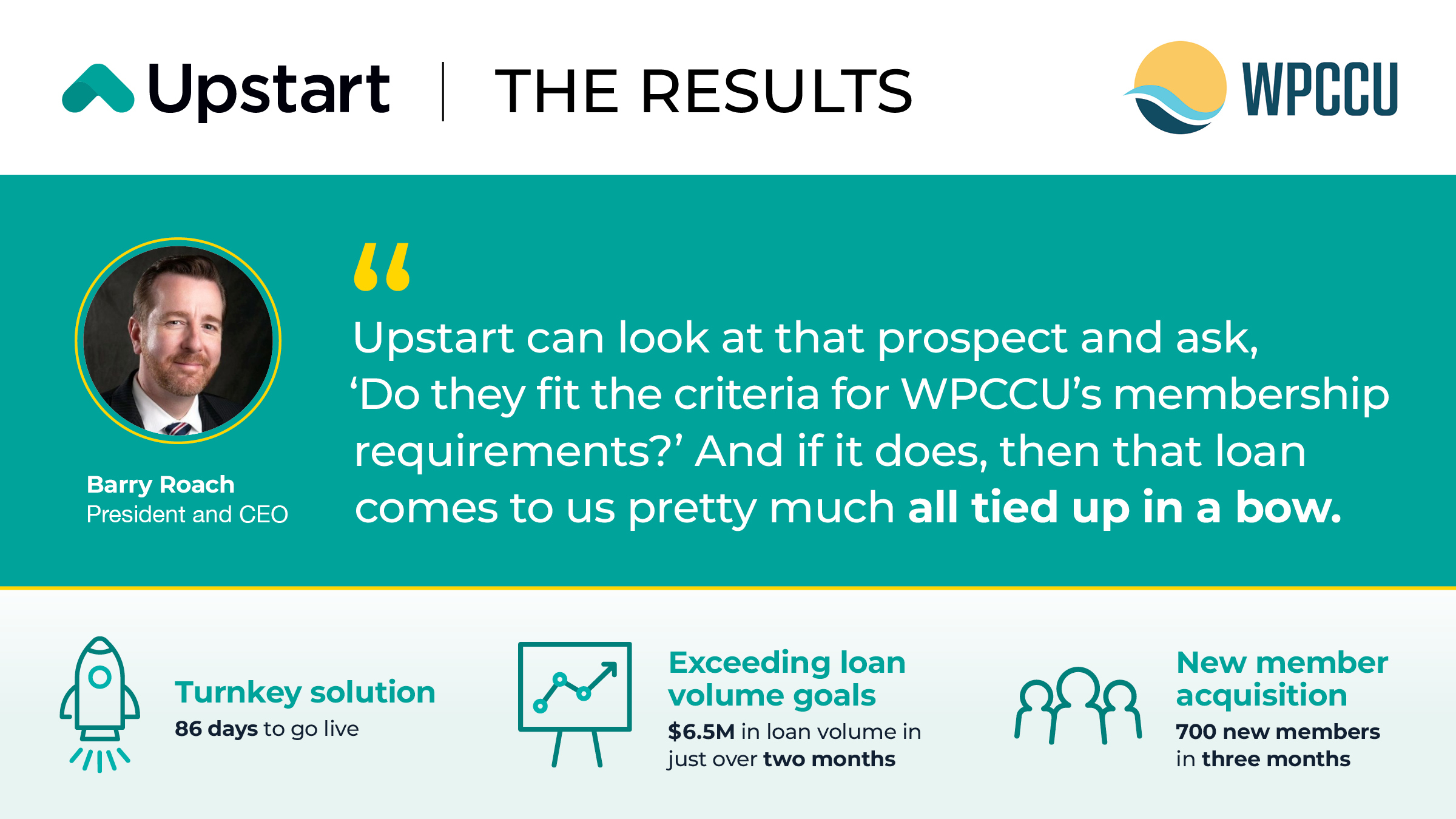

- Exceeding loan volume goals while mitigating risk

- Expanding membership relationships and lending footprint

- Helping with member acquisition