India's Last Telegram: 3 Thoughts

Written by Anthony Demangone

Last Sunday, someone in India sent the country's last telegram. That event should give us all moment to pause.Â

If someone tells you something is impossible, think about that last telegram. If someone tells you that a trend will never reverse, think about that last telegram. If someone tells you that consumers will always do this or that, think about that last telegram.

In India, telegrams had a rich history going back more than 150 years. In the 1980s, there were 44,000 telegraph offices in the country. That was not a typo. 44,000. Today, there are none.

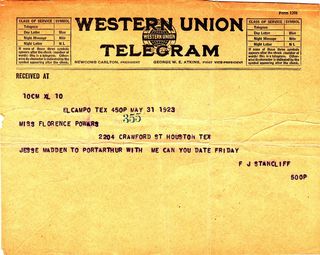

Granted, India is not the U.S. Indian telegraph offices were government-controlled. But even in the U.S., telegrams lasted longer than you might think. Western Union sent its last telegram in 2006.

In India, as well as in the United States, the death of the telegram was brought about by email, cell phones and text messages. Â

So, will consumers ever give up branches? Â Checks? Â Credit unions? Â I don't think so, but I'll never say never. Here are some lessons that we might take from that last telegram.

- Don't confuse consumer use with consumer loyalty. Consumers switched from telegrams to phone calls, emails, and text messages. It isn't that consumers don't want to talk or send messages. They simply wanted to talk and send messages faster, easier and at a lower cost. Whatever you provide, if someone allows your members do it more easily and at a lower cost, you will lose that business eventually.Â

- The threat was always there. Peter Sheahan spoke at NAFCU's CEOs and Senior Executives Conference. He made this point: Every time there has been a fundamental change to a new technology, that new technology had been around for a long time. In the beginning, cars were expensive, clunky and not very useful. I'm sure some laughed at the fools who purchased them - noting that horses were still the best way to get from here to there. At its peak in the 1980s, India had 44,000 telegraph offices. At that time, a very small number of people had cell phones. Big. Clunky.  Not very reliable. Not much of a threat to telegrams, right? What technology will revolutionize financial services next? I don't know, but chances are, you've already read about it.Â

- Are you a "telegram" company or a communications company? Let's say you were a telegram company that only saw itself as a telegram company. Â You'd be out of business. Â But in reality, you were more than a telegram company...you were a communications company. Â If you saw yourself as a communications company, you would have looked into emerging technologies that help people communicate. Â It makes you think about what we do as credit unions. What are we at the end of the day? Â Perhaps a company that helps people get, save and spend money the way they want, when they want and how they want?Â

Well, perhaps that's enough to chew on for today. Have a great weekend, everyone.

***

NAFCU's Management and Leadership Institute is a mere 80 days away! It is a one-week crash course on leadership, with a credit-union edge. You'll learn from CEOs and industry experts on how to manage finances, marketing, compliance, and more. You'll learn how to work with boards. How to communicate effectively. All the while, you'll do it within small hand-picked groups of other attendees. I hope to see you there!