The 2 Reasons Members Switch Insurance

By Tina Buttchen, TruStage Specialist, CUNA Mutual Group

In any given year, most of your membership will need some combination of home and auto insurance—80% is typically seen as a logical estimate. That stat might create the impression that home and auto insurance is a huge opportunity for your credit union. But the reality is more nuanced.

That 80% includes almost no new market share—research from J.D. Power reports just 2-3% of new customers enter the auto insurance market each year.1 This means growing your credit union’s insurance business typically requires you to take customers away from a competitor.

How likely is that? Let’s take a closer look.

First, what’s the potential to gain for market share?

How many of your members are likely to switch their insurance? J.D. Powers reports that in 2019, for every 100 auto protection policies, 33 policyowners investigated new insurance options. But of those 33 policy owners, just 35% actually went on to make a switch.1

Let’s attach some numbers to those stats to get a better feel for what they really mean.

Say your credit union has 100,000 members. As we mentioned earlier, about 80% will need auto and/or home protection, which means an initial potential market of 80,000 members. But almost all of those members already have insurance, so our real target is actually much lower. As the chart below captures, based on the J.D. Powers findings, 26,400 of these members will take the time to investigate an insurance switch; but only 9,240—or 9.2%—will go through with it.

|

Action |

Percentage of members that will take this action |

Potential market |

|

Investigate an insurance switch |

33% x 80,000 |

26,400 |

|

Switch insurance |

35% x 26,400 |

9,240 |

Next, consider the competition

We’ve established roughly 9% of your members are likely to switch to a new insurance provider this year. But will they switch to your credit union? Unfortunately, it’s far from a sure thing as the competition is spending big to win this battle. In 2019, the top three providers spent almost $5 billion on advertising: Geico spent $1.94 billion, Progressive spent $1.66 billion, and State Farm spent $1.21 billion.2 Considering that most adults could easily rattle off the main characters in each of those companies’ ad campaigns, it seems fair to say your credit union has a big challenge in front of it.

The credit union’s secret weapon

Fortunately, credit unions have something the big insurance companies might not: loyal members. Members who have built a relationship with you and might be willing to trust you more than they trust a talking lizard, Flo, or Jake.

How can you attract members and optimize your bottom line?

First, consider the factors that drive consumers to research an insurance switch. According to J.D. Powers, these are two of the most important:

1. Cost-effective pricing. Price is the leading reason consumers seek a new insurance provider (64% cited this as their reason to shop and 33% said it was the most influential driver in the closing decision).1 How does your insurance compare? Do you make multiple options available to meet the needs of the largest percentage of members?

2. Excellent customer service. There’s a strong correlation between customer satisfaction and propensity to shop a policy. Can members rely on you for exceptional support via the channels they prefer to research and buy insurance? The big players have made substantial investments in each of the following: direct mail, social media, online tools, traditional media channels, and call centers. Does your process include a similar streamlined, integrated, and omnichannel process?

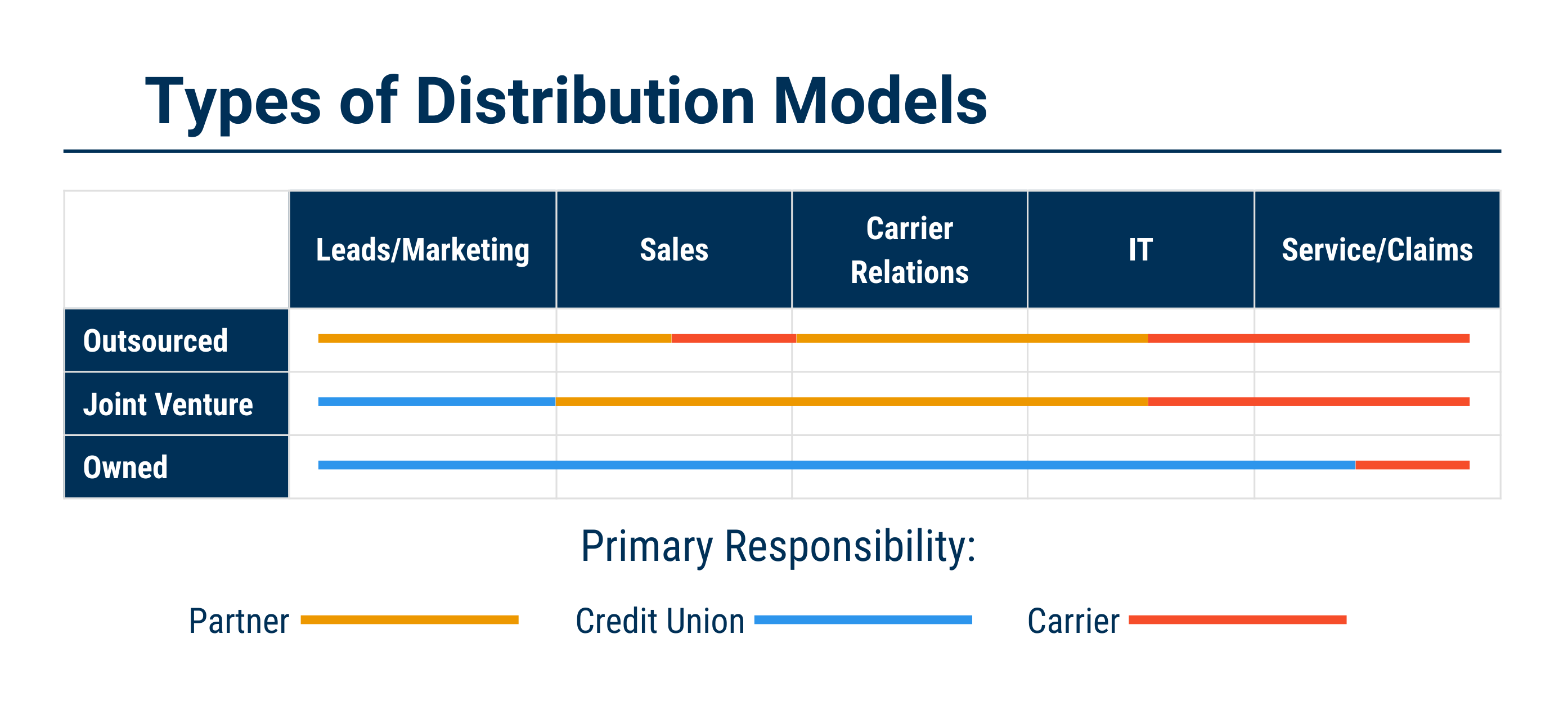

Next, consider which insurance model makes the most sense for your credit union: Outsourced, joint venture, or owned by the credit union. Each of these models requires a different investment in resources and a different level of expertise. The chart below provides a quick hit of each player’s responsibilities for each model.

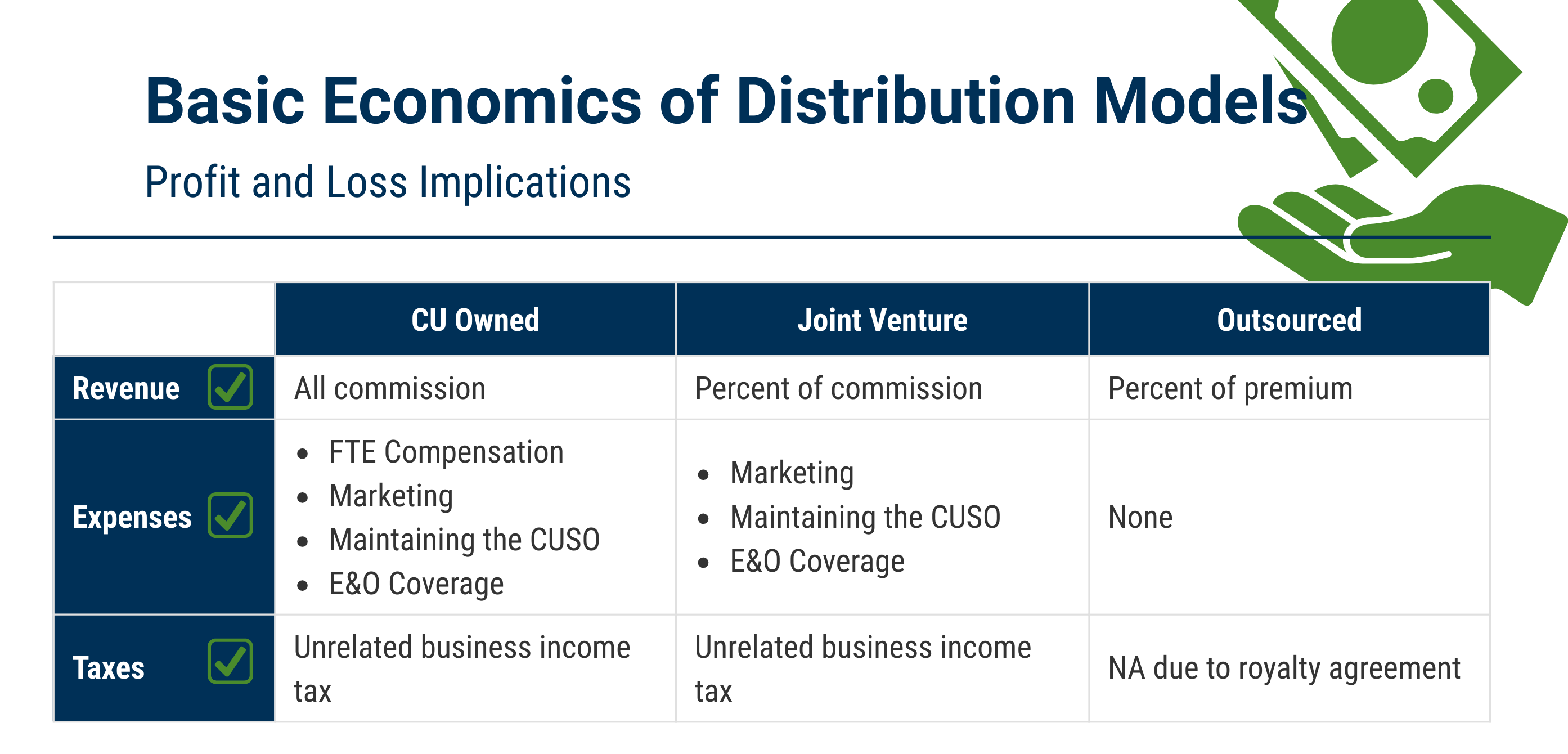

And, as the following chart captures, the revenue, expense, and tax implications also vary widely.

Insurance can be an important way to connect with members and build a stronger relationship. Although convincing them to make a switch isn’t a slam dunk, with the right product and sales support, it can be an opportunity worth pursuing.

Ready to learn how to optimize your credit union’s ability to make auto and home protection products available to your members? Listen to 7 Tips for Educating Members on Insurance Coverages.

TruStage® Insurance products and programs are made available through TruStage Insurance Agency, LLC. Life insurance and AD&D insurance are issued by CMFG Life Insurance Company. Auto and Home Insurance Program are made available through TruStage Insurance Agency, LLC and issued by leading insurance companies. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. The TruStage® Health Insurance Program is made available through TruStage Insurance Agency, LLC and GoHealth LLC. GoHealth LLC is licensed to sell nationwide and operates in all states with the exception of Massachusetts, Vermont. Note: CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, Further Reproduction, Adaptation or Distribution Prohibited. ICC16-A10a-039, A10a-039-2016, ICC17-SIT-2, 2017-SIT-2. |