5 Member Benefits of Multi-Channel Outreach

By Kristin Simonis, TruStage Program Specialist, CUNA Mutual Group

Working hard to make affordable, effective auto and home protection available to your members? That’s great news. Being the resource members rely on for this valuable coverage gives your credit union a member-friendly income stream, protects two of members’ most valuable assets, and can prevent members from moving to big insurance players—some of which have morphed into financial institutions in recent years (which puts more than your insurance relationship at risk).

But are you delivering a streamlined, omni-channel experience to help members research, buy, and use the insurance you make available? If not, you could be compromising members’ ability to get the protection they need—and putting your member relationship at risk.

1. Members expect a streamlined, integrated, omni-channel experience. Your members live in an Amazon.com world. They’re used to speed. They’re used to tools. They’re used to having everything at their fingertips. They expect to move easily from one channel to the next. They don’t expect to be asked for information you should already have. Are your online forms already populated? Do members have to fill out their VIN multiple times—especially if you hold their auto loan?

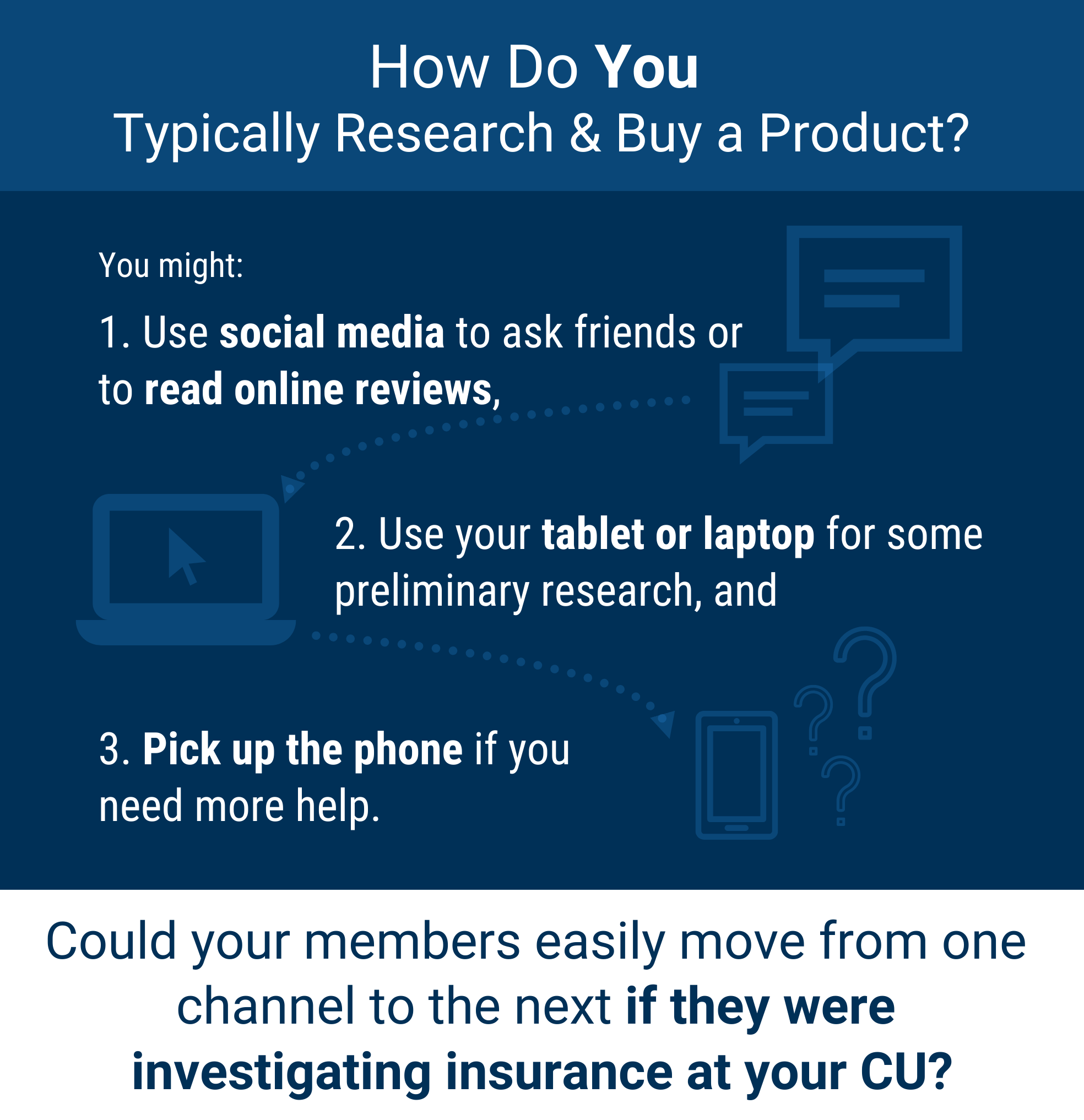

2. Members actually use multiple channels. Members don’t just expect the companies they work with to have multiple channels—they use them too. Think of how you typically research and buy a product or service. If you’re like many people, you might use social media to ask friends which products they use or to read online reviews, start poking around on your tablet or laptop for some preliminary research, and pick up the phone if you need more help. Could your members easily move from one channel to the next if they were investigating insurance at your credit union?

3. Direct mail is more important than you might think. It would be difficult to overstate the importance of strong digital tools, but direct mail still plays a big role in the insurance purchase process. Consumers like and trust it1, respond to it, and keep it and see it in their home2—where they tend to make decisions about important things like insurance. Last, but not least, your competition knows direct mail works and they’re spending big on this channel.3

(Want more proof of the importance of direct mail? Check out this recent post).

4. Members demand the ability to get a web-based quote. Consumers expect to get at least a rough idea of insurance costs online—and to get that information almost immediately. Sure, they might still need more help (see the next point), but they won’t tolerate a paper-based process that requires them to mail you a form or wait for a call back. Instant feedback is crucial.

5. Call centers and face-to-face are still critical. Auto and home protection products can be confusing. No matter how thorough your website or digital tools, or how knowledgeable the member, at some point in the research or purchase process, a completely digital experience can leave even the most informed and digital-savvy member wanting more. They want the option to pick up a phone or schedule an appointment with a knowledgeable person who can answer their questions.

What does your current process look like?

Put yourself in a member’s shoes. What does it take to research and purchase auto or home protection products through your credit union? Do you offer the channels and tools they’re likely to be looking for? Is your process fast and easy?

If you’re not happy with your current process, you have three options: outsource, partner, or build your own solution. Each of those has pros and cons in terms of costs, control, time to break even, ability to scale, revenue opportunities and more.

Want to learn more about the importance of delivering an omni-channel experience and what it takes to make that happen? Listen in to 7 Tips for Educating Members on Insurance Coverages.

1Waggener, Ryan, “Direct Mail Statistics That Proves It Works,” Action Mailing, Print Solutions, April 2019 2Lesonsky, Rieva, “Direct Mail is Hot Again,” US Small Business Administration, April 2019 3ACUC Coverage. Reprinted With Permission, CUToday.info, “The ‘Hidden Risks’ Masked by Strong Auto Lending Numbers,” July 2, 2018

TruStage® Auto & Home Insurance Program is made available through TruStage Insurance Agency, LLC and issued by leading insurance companies. To the extent permitted by law, applicants are individually underwritten; not all applicants may qualify. Discounts are not available in all states and discounts vary by state. A consumer report from a consumer reporting agency and/or motor vehicle report will be obtained on all drivers listed on your policy where state laws and regulations allow. Please consult your policy for specific coverage and limitations. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. AUT-3309937.1-1020-1122 |