Cracking the Code on Health Savings Accounts for Your Members (Part 1)

By Kevin Boyles, Vice President, Business Development at Ascensus

By Kevin Boyles, Vice President, Business Development at Ascensus

In this two-part series, weâre going to expand your knowledge about the various aspects of health savings accounts (HSAs) and the benefits available for your credit union members. HSAs can do more than most people realize and there are an abundance of myths and misconceptions out there about them.

Although HSA technically stands for âHealth Savings Account,â there are a number of other meanings that can be associated with these tax-preferred savings accounts due to their versatility and usefulness for your members. So, hereâs the first installment  to help your credit union crack the code on HSAs.

HSA = Health Savings Account

Health Savings Accountâa savings account is what they are and is their intended use. HSAs offer a great opportunity to save for immediate or future medical expenses, which is why they are called health savings accounts.

HSAs were created to pair with high deductible health plans (HDHPs) in order to achieve several different objectives:

- Lower employersâ costs associated with providing health coverage to employees, as well as incentivize smaller employers to offer health coverage.

- Change the culture of how Americans use the health care system, with the goal of making people more conscious of the healthcare costs.

- Create an opportunity for individuals to accumulate savings to pay for future medical expenses, particularly in retirement.

Every year, more and more large employers migrate their employees to HDHPs and millions of Americans have to learn how HDHPs and HSAs coordinate. These plans can be beneficial, but the education surrounding them often is lacking, to say the least, so employees generally struggle with the transition. In addition, many employers are potentially looking to send their employees directly to the public healthcare exchanges to purchase their own health insurance by providing âdefined contributionâ dollars in lieu of offering health insurance.

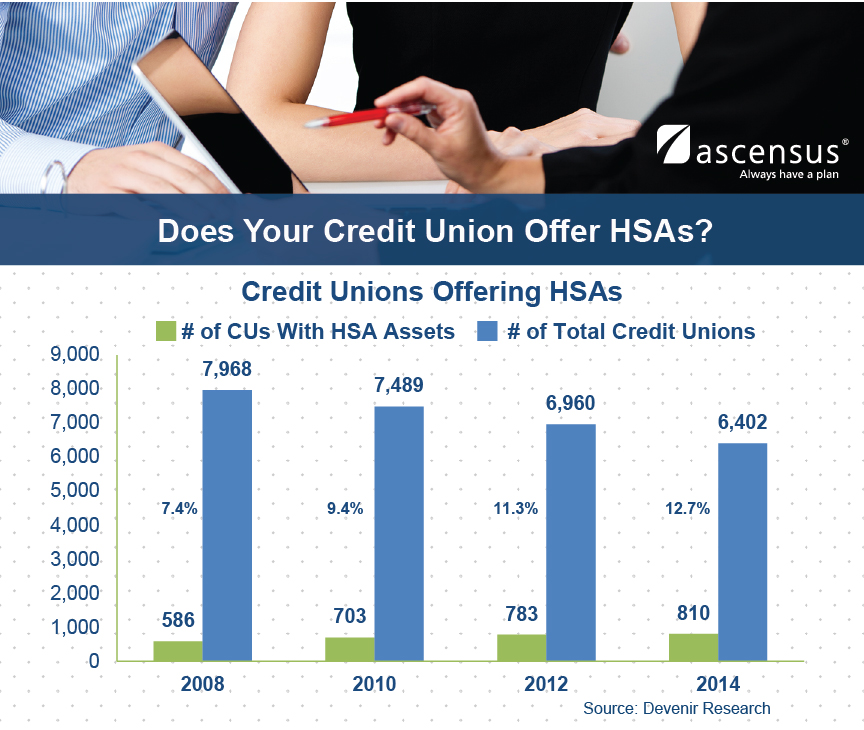

From 2013 to 2014, the number of people covered under these plans increased from around 14 million to over 17 million. With that number steadily rising, itâs time for financial organizations, like your credit union, to get involved in helping your member, and possibly your employees, get the HSA education they need.

From 2013 to 2014, the number of people covered under these plans increased from around 14 million to over 17 million. With that number steadily rising, itâs time for financial organizations, like your credit union, to get involved in helping your member, and possibly your employees, get the HSA education they need.

HSA = Honestly Staying Around

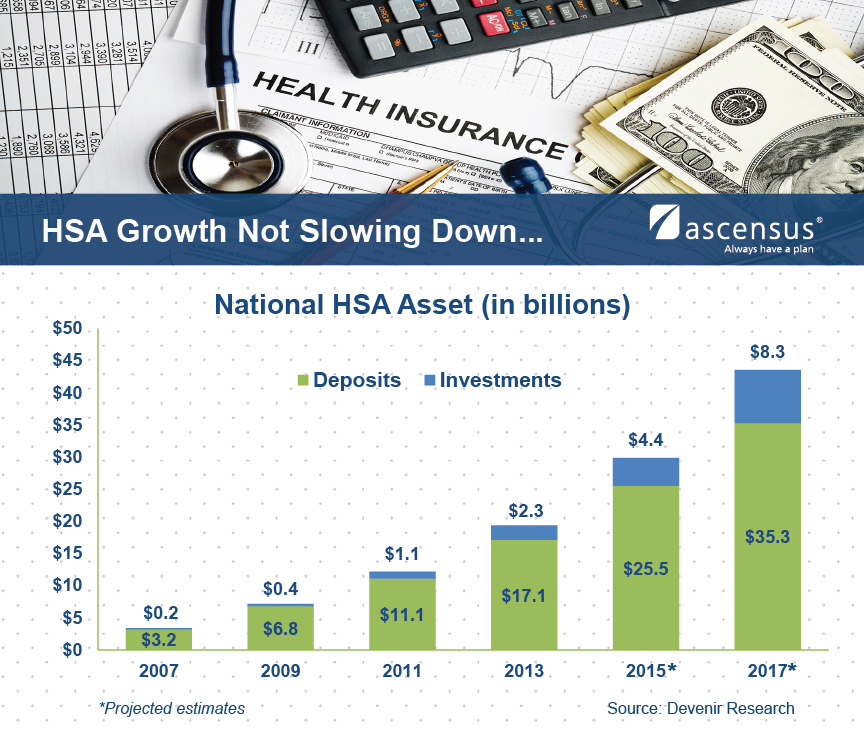

When HSAs first came into existence in 2004, there was a lot of concern because many people did not think that they would exist for very long. Many institutions used the uncertainty surrounding HSAs as an excuse not to get involved in offering these accounts to their customers right away. The early adopters of HSAs benefitted greatly from hesitancy in the market as HSAs grew exponentially right out of the gate and the growth rate has not slowed down since.

In 2008, when President Obama took office and began discussing the ideas related to universal healthcare that eventually formed into The Affordable Care Act (ACA), the stated goal was to eliminate HSAs. The new system would remove the need for HSAs, much like how the process works in Hawaii today. In Hawaii, state healthcare mandates require employers to offer health plans that do not meet the qualifications for pairing with HSAs. Consequently, the questionable survival of HSAs influenced some financial institutions to avoid offering HSAs.

However, when the bulk of the ACA went into effect and the state and federal healthcare exchanges opened, these exchanges began offeringâyou guessed itâHDHPs that can be paired with HSAs. HSAs have weathered more than a decade of naysayers predicting their extinction and trying to make them go away, yet HSAs have grown rapidly both in the number of accounts and in dollars every single year. The Great Recession had little or no impact on HSAsâ growth, and neither has any other economic downturn since then. As a result of the widespread use of HSAs today, it is safe to say that they are âHonestly Staying Around.â

HSA = Hereâs Something Awesome

So what if your organization is already offering HSAs or is committed to getting into them? You should be marketing and promoting HSAs to your members for several reasons:

- HSAs are AWESOME! If used properly, these accounts can become a true cornerstone that assists your members with skillfully saving for retirement and paying for their current and future medical expenses.

HSAs offer extended value. The fact that many organizations will continue to avoid offering HSAs creates a great opportunity for your credit union to attract members who are seeking a HSA and can benefit from your broader product and services suite.

HSAs offer extended value. The fact that many organizations will continue to avoid offering HSAs creates a great opportunity for your credit union to attract members who are seeking a HSA and can benefit from your broader product and services suite.- HSAs are flexible. Members can allow their money to accumulate and can also use tax-free distributions to pay for deductibles and various qualified medical expenses that are not covered by their health insurance plan. Covered expenses include, but are not limited to, vision and dental costs that most traditional health care plans do not offer.

- HSAs benefit members 65+. HSAs can also be used to pay for certain premiums of individuals over age 65 or the HSA can be treated like an IRA in retirement. These benefits are awesome incentives that can encourage your members to let their HSA savings grow, even if they have to use some of these funds each year for various medical expenses. Accumulating money in HSAs that can be used to pay for large insurance premiums in traditional healthcare plans allows many Americans to save money previously wasted on those premiums, year-over-year.

Discover how HSAs can help your credit union and members sustain your assets in the upcoming concluding installment of âCracking the Code on Health Savings Accounts for Your Members.â

Kevin Boyles will speak about this topic and be available to answer your questions about HSAs during NAFCUâs Annual Conference and Solutions Expo held in Montréal, Canada. Join us for the session âHealth Savings Accounts, IRAs, & Millennials: A New Generation Presents New Opportunitiesâ on Wednesday, June 24th.

Kevin Boyles will speak about this topic and be available to answer your questions about HSAs during NAFCUâs Annual Conference and Solutions Expo held in Montréal, Canada. Join us for the session âHealth Savings Accounts, IRAs, & Millennials: A New Generation Presents New Opportunitiesâ on Wednesday, June 24th.

Location: Solutions Theater, Exhibit Hall 220

Time: 1:45 p.m. â 2:15 p.m.

Ascensus, Inc. is NAFCU Services Preferred Partner for IRA, retirement plan, and health savings account (HSA) solutions software, training, documents and consulting. For more information on Ascensusâ products and services, visit www.nafcu.org/ascensus.

Ascensus, Inc. is NAFCU Services Preferred Partner for IRA, retirement plan, and health savings account (HSA) solutions software, training, documents and consulting. For more information on Ascensusâ products and services, visit www.nafcu.org/ascensus.