Newsroom

Berger slams bank lobbyists' attacks on CUs, shines light on 'egregious offenses of trust'

Pointing out "egregious offenses" of consumer trust, along with fines and settlement fees that total more than two times the size of the nation's largest credit unions, NAFCU President and CEO Dan Berger told bank lobbyists they should spend their time ensuring their industry doesn't repeat past mistakes rather than peddling misunderstandings of the credit union industry.

Berger's comments ran in an American Banker op-ed that published Monday. He explained that bank lobbyists continue to attack the credit union industry for one specific reason: to create "less competition with credit unions and other small financial institutions."

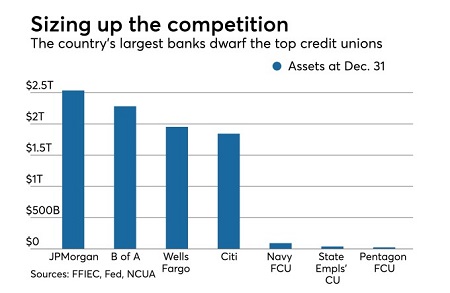

Explaining why these attacks are ridiculous, Berger added: "JP Morgan, Wells Fargo, Bank of America and Citigroup's asset sizes are not only well-over 20 times that of our nation's largest credit union, but each one of these individual banks holds more assets than the entire credit union industry combined."

Berger's op-ed railed on the fact that these big banks continue to take issue with credit unions' growth as their fines and settlement fees resulting from the financial crisis already amount to $174 billion – again, nearly two times the size of American's largest credit union.

He explained that credit unions' growth is a result of the industry's better service, rates and mission.

"Unlike banks – who are beholden to shareholders' bottom line – credit unions are committed to serving their membership and local communities," wrote Berger. "As long as credit unions maintain their nonprofit, member-owned structure, they will remain distinct from banks, regardless of their asset size. To suggest anything otherwise would be a gross misunderstanding of credit unions' core values, its cooperative structure and those who credit unions are designed to serve."

He urged the bank lobbyists to ensure their industry does not repeat past mistakes rather than focusing all their energy on well-respected institutions that pale in comparison to the asset size of large banks.

Share This

Related Resources

Get daily updates.

Subscribe to NAFCU today.