Newsroom

CFPB’s Chopra, NAFCU’s Berger, member CUs discuss issues impacting the industry

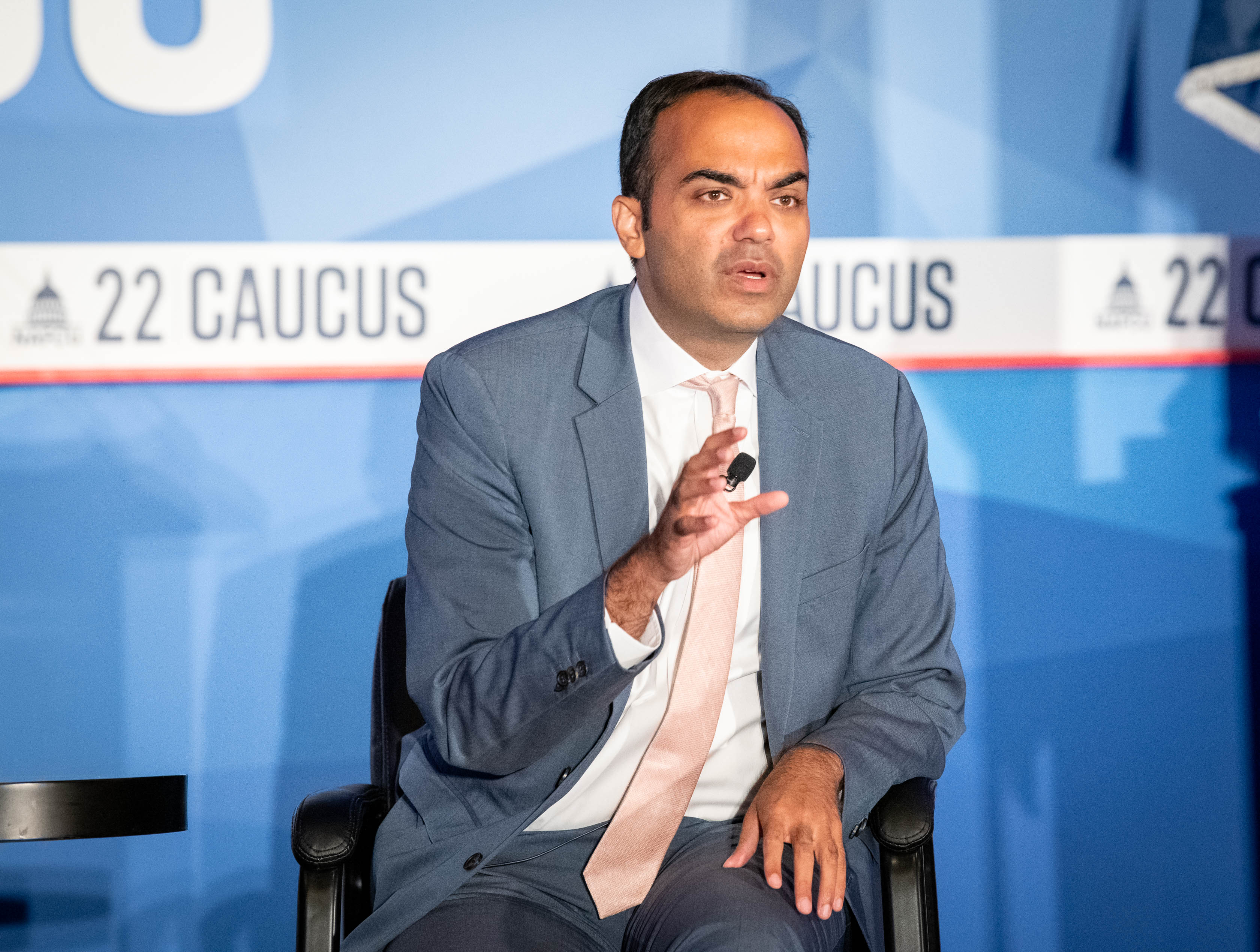

CFPB Director Rohit Chopra joined NAFCU President and CEO Dan Berger and member credit unions Tuesday for a virtual town hall discussion on a broad range of issues impacting the credit union industry.

Berger asked Chopra questions on various topics, including the bureau’s rulemaking on “junk fees,” its guidance on adverse action notices when using artificial intelligence, and oversight of the mobile payment ecosystem.

When asked about the differences between credit unions and banks, Chopra remarked he does see the credit union model as different, specifically “that it does not necessarily have the same incentives.”

Chopra discussed the interplay between fintechs and relationship banking and concerns about "non-depository and sometimes unlicensed entities being able to provide [financial services] without necessarily providing the customer service on the backend.” He also noted that those who have relationship banking business models have lower consumer complaints and fewer problems because there “tends to be a way to work things out.”

In addition, they discussed credit union priorities, such as the need for increased fintech supervision and what the bureau is currently doing to protect consumers from emerging threats and fraud. Following the discussion, participants engaged in a live Q&A session.

NAFCU remains engaged with the CFPB and is monitoring the Supreme Court’s hearing of the CFPB v. CFSA case.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Get daily updates.

Subscribe to NAFCU today.