Newsroom

CUs' SBA loans up from 2017, says NAFCU

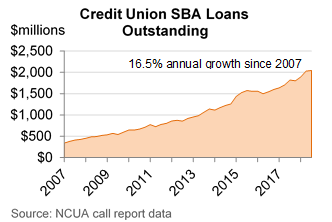

NAFCU highlighted that the number of federally insured credit unions' outstanding Small Business Administration (SBA) loans was up 4 percent in the fourth quarter of 2018 compared to the prior year during yesterday's meeting with SBA Administrator Linda McMahon.

NAFCU President and CEO Dan Berger, Executive Vice President of Government Affairs and General Counsel Carrie Hunt and Regulatory Affairs Counsel Kaley Schafer attended Thursday's meeting.

NAFCU shared data with McMahon from the NCUA's newly released fourth-quarter call report. NAFCU's February Economic & CU Monitor report also revealed that credit unions continue to invest in their communities and are an important source of credit for small businesses, but regulatory obstacles create barriers to business lending growth.

In addition, NAFCU and McMahon discussed the ongoing partnership aimed at increasing even further credit unions' participation in SBA lending programs, as well as the agency's initiatives to expand access to capital.

On its fall regulatory agenda, the SBA included goals to expand access to capital through its lending network, support veterans and military families looking to start or expand their businesses, among others. The agency is also working to implement the NAFCU-supported Small Business 7(a) Lending Oversight Reform Act.

They also discussed other industry issues, such as website accessibility concerns under the Americans with Disabilities Act (ADA) and efforts to modernize the Telephone Consumer Protection Act (TCPA). Last year, NAFCU attended a roundtable hosted by the SBA and Justice Department focused on ADA issues, and has previously met with SBA staff to discuss ways to ensure credit unions and small businesses can contact consumers with needed information without fear of violating the TCPA.

The association will continue to work closely with the SBA to improve access to credit union small-dollar loans to small businesses across the nation.

Share This

Related Resources

The Ride-Share Conundrum: An Exception to an Exception

Business Lending

Blog Post

Taking Care of Business: Recent Developments in Commercial Lending

Business Lending

Blog Post

Marijuana Banking Issue Brief

Whitepapers

Loan Maturity Issue Brief

Whitepapers

Get daily updates.

Subscribe to NAFCU today.