Newsroom

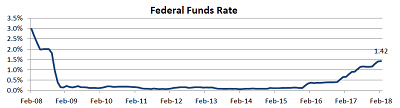

Fed raises rates to highest level in 10 years

The Federal Open Market Committee (FOMC), at the close of its two-day policy-setting meeting Wednesday, said it will increase the federal funds target rate by a quarter-point to a range of 1.5 to 1.75 percent. This widely expected move – anticipated by NAFCU – lifts rates to a level last seen in 2008.

The Federal Open Market Committee (FOMC), at the close of its two-day policy-setting meeting Wednesday, said it will increase the federal funds target rate by a quarter-point to a range of 1.5 to 1.75 percent. This widely expected move – anticipated by NAFCU – lifts rates to a level last seen in 2008.

The committee, in its release, said the "stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation."

"As anticipated, the FOMC initiated its first rate hike of the year," said NAFCU Chief Economist and Vice President of Research Curt Long. "In addition, the Fed's latest projection shows markedly higher expectations for economic growth and lower expectations for the unemployment rate in 2018 and 2019. The inflation forecast increased only slightly."

The median rate forecast for 2018 continues to call for three hikes overall (including the March move), but seven of the 15 committee participants now expect four or more rate hikes this year.

The FOMC expects inflation to "move up in coming months and to stabilize around the Committee's 2 percent objective over the medium term." The committee noted that it is "monitoring inflation developments closely."

Long, in a NAFCU Macro Data Flash report, said that "NAFCU agrees with the committee's view that inflation is poised to increase in the coming months." If that happens, Long added, "it will bring a fourth rate hike during 2018 more squarely into view."

The Fed will continue to reduce its securities holdings by decreasing its reinvestment of the principal payments from its holdings of Treasury securities and agency mortgage-backed securities. In accordance with the Addendum released in June, March's reinvestment will be trimmed by $20 billion. Effective in April, the amount of balance sheet reduction will increase to $30 billion per month.

The FOMC will meet again May 1-2.

Share This

Related Resources

Compliance Monitor - December 2018

Newsletter

NCUA Supervisory Priorities for 2018

Articles

Get daily updates.

Subscribe to NAFCU today.