Newsroom

Fed raises rates as labor market, economic activity strengthen

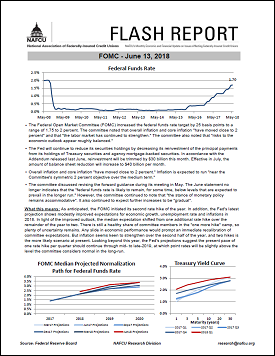

The Federal Open Market Committee (FOMC), at the close of its two-day policy-setting meeting Wednesday, said it will increase the federal funds target rate by a quarter-point to a range of 1.75 to 2 percent.

The Federal Open Market Committee (FOMC), at the close of its two-day policy-setting meeting Wednesday, said it will increase the federal funds target rate by a quarter-point to a range of 1.75 to 2 percent.

The committee, in its release, said that the "labor market has continued to strengthen and that economic activity has been rising at a solid rate."

"As anticipated, the FOMC initiated its second rate hike of the year," said NAFCU Chief Economist and Vice President of Research Curt Long. "In addition, the Fed's latest projection shows modestly improved expectations for economic growth, unemployment rate and inflations in 2018. In light of the improved outlook, the median expectation shifted from one additional rate hike over the remainder of the year to two. There is still a healthy share of committee members in the 'one more hike' camp, so plenty of uncertainty remains.

"Looking beyond this year, the Fed's projections suggest the present pace of one rate hike per quarter should continue through mid- to late-2019, at which point rates will be slightly above the level the committee considers normal in the long-run, Long added.

Regarding inflation, the FOMC said that on a "12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent. Indicators of longer-term inflation expectations are little changed, on balance."

Long, in a NAFCU Macro Data Flash report, pointed out that the committee is no longer indicating that the "federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run." Though, the committee continued to note that "the stance of monetary policy remains accommodative" and that it expects further increases to be "gradual."

The Fed will continue to reduce its securities holdings by decreasing its reinvestment of the principal payments from its holdings of Treasury securities and agency mortgage-backed securities. In accordance with the Addendum released last June, reinvestment will be trimmed $30 billion this month. Effective in July, the amount of balance sheet reduction will increase to $40 billion per month.

The FOMC will meet again July 31-Aug. 1.

Share This

Related Resources

Compliance Monitor - September 2018

Newsletter

Get daily updates.

Subscribe to NAFCU today.