Newsroom

Lawmakers, hearing witnesses agree with NAFCU: Fintechs, FIs need level playing field

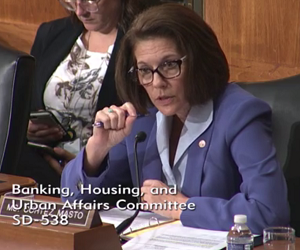

Sen. Catherine Cortez Masto, D-Nev., directly citing a NAFCU-submitted letter, received agreement from a panel of witnesses on the association's position that fintech companies and financial institutions should compete on a level playing field. Also during Tuesday's hearing, each witness provided an explanation of why rules for fintech companies should align with those followed by financial institutions.

Cortez Masto, a member of the Senate Banking Committee, was part of yesterday's committee hearing examining fintech companies. She specifically pointed to NAFCU's letter delivered to the committee ahead of the hearing urging that "when fintechs compete with regulated financial institutions, they must do so on a level playing field where smart regulations and consumer protections apply to all actors in that space."

Furthermore, the hearing's panel of witnesses – including professors and representatives from private industries and consumer groups – also largely agreed with NAFCU's point that fintechs need to be accountable for protecting consumer financial data, and that an entity that leaks said data should be the one responsible for making the consumer whole. NAFCU has consistently called for a national data security standard that would hold all entities that handle consumer financial data to similar standards as credit unions under the Gramm-Leach-Bliley Act.

NAFCU agrees that fintech produces real benefits to consumers, including increased speed, convenience and new product offerings that make it easier for them to manage their financial lives. Fintech also offers the possibility of bringing banking and financial products to underserved communities and the underbanked. However, flexibility within a regulatory regime must be tempered with concern for overall sector stability and competitive equality.

NAFCU continues to support a fair playing field so credit unions have as many opportunities as banks and non-regulated entities as part of its 2018 priorities.

Share This

Related Resources

A Furnisher's Guide to the FCRA

Articles

Defining Abusive Acts and Practices

Articles

Explaining Unfair Acts or Practices

Articles

Get daily updates.

Subscribe to NAFCU today.