Newsroom

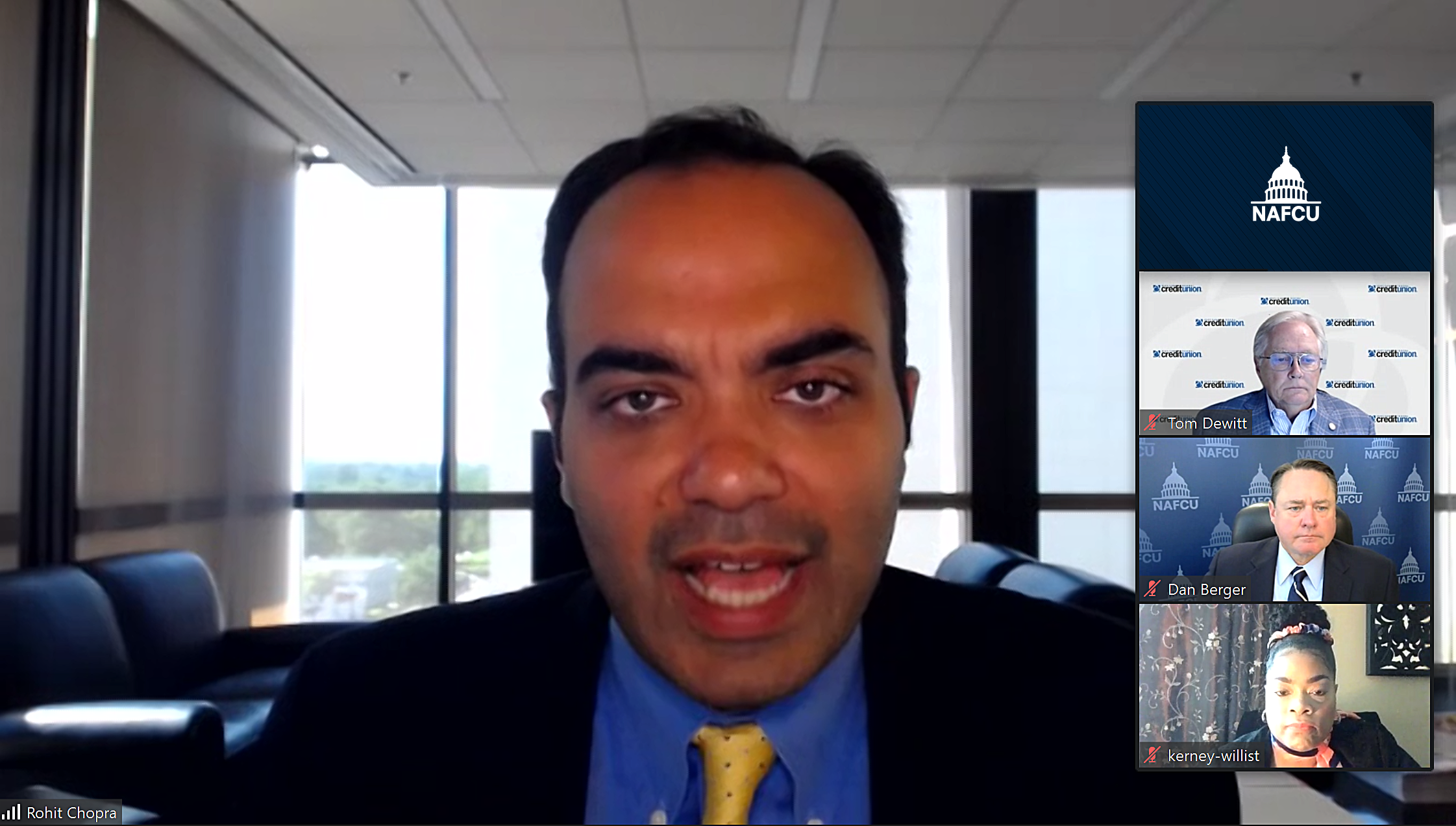

NAFCU Board meets with CFPB Director Chopra

The NAFCU Board of Directors along with the association’s staff Tuesday met with CFPB Director Rohit Chopra to discuss several credit union related topics and share the industry’s thoughts on several of CFPB’s rulemakings. NAFCU Board Chair Gary Grinnell, NAFCU President and CEO Dan Berger, Senior Vice President of Government Affairs Greg Mesack, and Vice President of Regulatory Affairs Ann Petros were in attendance.

NAFCU shared insights on credit union industry trends. NAFCU recently released the latest CU Industry Trends report, which provides insights based on call report data from the first quarter of 2022. NAFCU also discussed fintech accountability and supervision and the CFPB’s recent announcement that it would begin exercising supervisory authority over nonbank entities, under a largely unused legal provision of the Dodd-Frank Act to examine such nonbank financial entities that pose risks to consumers.

NAFCU offered support for the CFPB’s expanded supervision over fintechs and other nonbank entities, encouraging “all relevant regulators to ensure that when fintechs compete with traditional financial institutions, they do so on a level playing field where smart regulations and consumer protections apply to all actors in the consumer marketplace.” The association characterized the bureau’s efforts as positive first steps but emphasized the need for exercising its “larger participant” authority and suggested that it do so over peer-to-peer payment providers and buy-now-pay-later lenders.

The group also discussed the CFPB’s proposed section 1071 data collection rule, to which NAFCU has sought a number of changes, sighting the significant compliance costs and the additional burden it would place on credit unions as proposed.

Of note, the group also discussed the CFPB’s focus on supervisory efforts on discrimination and "unfair" practices and its revised examination procedure guide for unfair, deceptive, or abusive acts or practices (UDAAP). NAFCU has sought feedback from members on the expected impact of the CFPB’s increased focus on discrimination and has updated its UDAAP issue brief to highlight the revision in the exam manual.

In addition, NAFCU’s Board and staff shared several thoughts on the CFPB’s request for information on consumer financial products and services, or "junk fees." The association recently submitted feedback stating that while it is generally supportive of the CFPB improving consumers’ understanding of financial products and services, its mischaracterization of fees in the financial services industry as “junk fees,” “excessive or exploitative fees,” or “inflated or surprise fees,” only confuses and frustrates consumers.

The CFPB also issued an Advance Notice of Proposed Rulemaking (ANPR) on credit card late fees that financial institutions, including credit unions, collect. NAFCU and several trades requested the bureau provide a 60-day extension to the comment deadline, currently due on July 22. The association sent members a Regulatory Alert last month inviting credit union feedback on the ANPR.

NAFCU continues to engage the CFPB to ensure credit union priorities and concerns remain top of mind as they oversee the financial institution regulatory space.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 2024 Mid-Year Fraud Review Listen On: Key Takeaways: [01:16] Check fraud continues to be rampant across the country. Card fraud is affecting everyone. [04:31] Counterfeit US passport cards are just another new toolbox in the bad actors’ toolbox. [07:21] Blocking the fallback is the only way to defeat counterfeit cards. [11:17] The best way is constant education to your members in as many channels as you can. [13:02] We are still seeing overdraft lawsuits. Make sure the programming you have at your credit union matches what you have displayed for the members. Web NAFCU digital@nafcu.org America/New_York public

2024 Mid-Year Fraud Review

Strategy & Growth, Consumer Lending

preferred partner

Allied Solutions

Podcast

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

Get daily updates.

Subscribe to NAFCU today.