Newsroom

NAFCU Defends Credit Unions and Their Commitment to All Communities

NAFCU responds to bank lobbyists’ efforts to mislead policy discourse on CRA

WASHINGTON, DC – National Association of Federally-Insured Credit Unions (NAFCU) President and CEO Dan Berger today issued the following statement in response to recent bank lobbyists efforts to mislead policy discourse regarding the Community Reinvestment Act (CRA), claiming with weak evidence that reforms should put credit unions under CRA regulation.

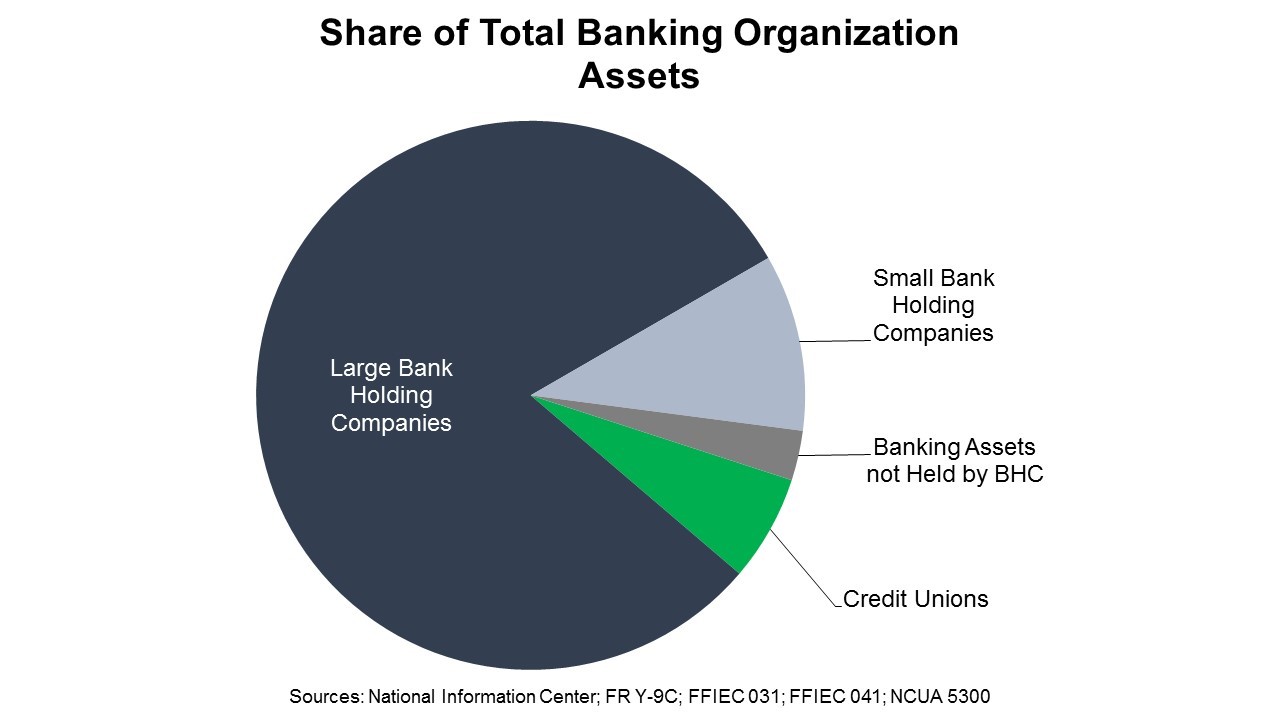

Despite benefitting from recent regulatory changes and maintaining a majority of the financial market share, bank lobbyists employ questionable arguments that claim their industry is a victim of an unleveled playing field. In an unusual hunt for attention, they continue to attempt to spin the dialogue against credit unions, causing unnecessary distractions from the real issues that should take precedence.

“Credit unions exist to serve the people in their communities, including millions of low- and middle-income households in need of affordable loans and safe and sound financial products. In fact, Federal Reserve data shows that bank customers have higher income and wealth than credit union members,” said Dan Berger, NAFCU President and CEO. “For credit unions, every loan made and every dollar earned is reinvested into their local community and serves their membership, whoever they may be.

“Instead of attempting to misinform lawmakers and American consumers with works of fiction, banks should concern themselves with cleaning up their own backyard. Banks have been caught red-handed refusing loans to particular consumers based solely on their zip code and socioeconomic background. Additionally, they have been subject to a seemingly endless stream of billion dollar fines -- roughly $174 billion -- stemming from their illegal, unscrupulous behavior that led to the 2008 financial crisis. Washington policymakers should reject bank lobbyists’ attempts to deflect attention onto financial institutions that are not the bad actors. The reforms Congress should take a long hard look at are a modernized Glass-Steagall Act and Volcker rule to reign in banks’ risky trading practices and limit the economic impact of ‘too big to fail.’”

Background

NAFCU has been on the forefront, defending credit unions against bank lobbyists efforts to hit credit unions at every turn, to include the credit union tax exemption and, as in this case, CRA. In a Credit Union Times op-ed, Berger lays out additional arguments where credit unions are prepared to help more of those who are underserved and how they continuously invest in their local communities. NAFCU’s advocacy team has also worked to get introduced a bipartisan bill by Reps. Gwen Moore (D-Wis.) and Paul Cook (R-Calif.) that would allow all credit unions to add underserved areas to their respective fields of membership. In recent testimony before the Senate Banking Committee, NCUA Chairman J. Mark McWatters openly supported this policy.

###

The National Association of Federally-Insured Credit Unions is the only national trade association focusing exclusively on federal issues affecting the nation’s federally-insured credit unions. NAFCU membership is direct and provides credit unions with the best in federal advocacy, education and compliance assistance. For more information on NAFCU, go to www.nafcu.org or @NAFCU on Twitter.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Get daily updates.

Subscribe to NAFCU today.