Newsroom

NAFCU meets with NCUA Chair Hood

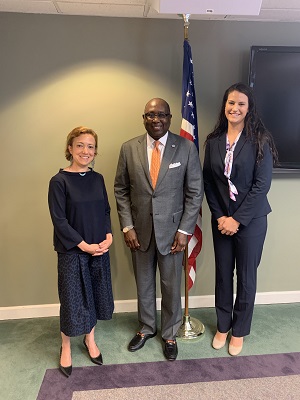

NCUA Board Chairman Rodney Hood met with NAFCU President and CEO Dan Berger at the association's headquarters Wednesday to discuss priorities for the agency.

"NAFCU thanks Chairman Hood for his leadership, and for taking the time to discuss regulatory burdens facing the industry and how our member credit unions would like to see them addressed," Berger said. "We look forward to working with Chairman Hood, and NCUA Board Members [J. Mark] McWatters and [Todd] Harper, to ensure credit unions have a regulatory environment that allows them to grow and thrive."

Berger was joined by NAFCU Executive Vice President of Government Affairs and General Counsel Carrie Hunt and Director of Regulatory Affairs Ann Kossachev. From NCUA with Chairman Hood were Sarah Vega and Owen Cole. The group also recently met with Board member Harper.

After being sworn in as chair, Hood identified several issues he plans to address during his tenure, many of which overlap with NAFCU priorities, including:

- reducing regulatory burdens – Hood has said he wants "effective but not excessive regulation";

- modernizing the federal credit union charter;

- addressing cybersecurity issues; and

- creating opportunities for credit unions to serve more communities.

Other regulatory priorities Berger has previously outlined for Hood and Harper include: field of membership reforms, the current expected credit loss (CECL) standard, risk-based capital (RBC), payday alternative loans and more.

The association has also encouraged the agency to expand eligibility for an extended 18-month exam cycle, increase budget efficiency and transparency, and return the National Credit Union Share Insurance Fund's (NCUSIF) normal operating level (NOL) to 1.3 percent as soon as possible.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 2024 Mid-Year Fraud Review Listen On: Key Takeaways: [01:16] Check fraud continues to be rampant across the country. Card fraud is affecting everyone. [04:31] Counterfeit US passport cards are just another new toolbox in the bad actors’ toolbox. [07:21] Blocking the fallback is the only way to defeat counterfeit cards. [11:17] The best way is constant education to your members in as many channels as you can. [13:02] We are still seeing overdraft lawsuits. Make sure the programming you have at your credit union matches what you have displayed for the members. Web NAFCU digital@nafcu.org America/New_York public

2024 Mid-Year Fraud Review

Strategy & Growth, Consumer Lending

preferred partner

Allied Solutions

Podcast

Get daily updates.

Subscribe to NAFCU today.