Newsroom

NAFCU members detail challenges of rising interest rate environment

A third increase to the federal funds target rate is expected next month, and as credit unions adjust to this new environment they are facing increased levels of competition – especially in the area of member deposits. This month's NAFCU Economic & CU Monitor – now available for download – details industry challenges relating to rising interest rates and liquidity needs.

A third increase to the federal funds target rate is expected next month, and as credit unions adjust to this new environment they are facing increased levels of competition – especially in the area of member deposits. This month's NAFCU Economic & CU Monitor – now available for download – details industry challenges relating to rising interest rates and liquidity needs.

More than 80 percent of credit union respondents to NAFCU's Monitor survey indicated increased levels of competition over the past 12 months regarding member deposits. In an effort to be more competitive, roughly 45 percent of respondents have increased rates on share drafts or regular shares within the past three months. When asked about their savings rates relative to the competition, 36 percent of respondents said their rates are now either "somewhat" or "significantly" more competitive than they were last year.

Furthermore, some credit unions are exploring other sources of liquidity and making changes to their asset portfolios. Many credit union respondents identified Federal Home Loan Bank advances or other borrowing alternatives; others indicated that they are shortening their investment portfolio and ceasing to reinvest maturing securities. A smaller share of survey participants sold loans to provide for additional liquidity.

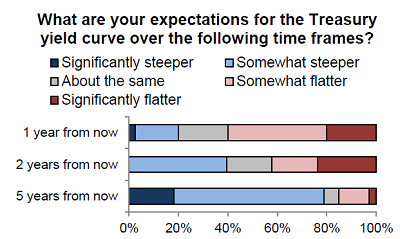

Regarding interest rate expectations over the next two years, credit unions respondents were nearly balanced between those anticipating a steeper curve (37 percent) versus those expecting a flatter one (39 percent). However, more than half of those expecting a flatter yield curve believe it will be "significantly flatter" in two years. Looking out five years, respondents expect a return to a more normal spread.

The August issue of the Economic & CU Monitor also includes results from the Credit Union Sentiment Index (CUSI), an index based on NAFCU member responses to eight questions on growth and earnings outlook, lending conditions and regulatory burden.

The CUSI surged to a record high in August as all four components improved during the month. In the area of growth, loan demand and the overall economy continue to be the most cited reasons for credit union optimism. Survey respondents had a more favorable reading on loan demand than they did in July, and more than 90 percent of respondents reported that applicant quality was "somewhat" or "very strong." The applicant quality score topped the previous record-high from February.

NAFCU relies on survey responses to provide its members a glimpse of trends affecting the credit union industry as a whole. The association also uses survey responses to inform its advocacy efforts on Capitol Hill and with regulatory agencies such as the NCUA, the Bureau of Consumer Financial Protection (previously the CFPB) and the Federal Reserve.

The next survey covers overdraft and small business lending. Participants can fill out the survey online or in PDF format; responses are due Sept. 7.

Share This

Related Resources

Compliance Monitor - September 2018

Newsletter

Get daily updates.

Subscribe to NAFCU today.