Newsroom

NAFCU survey: CUs still waiting for CECL guidance

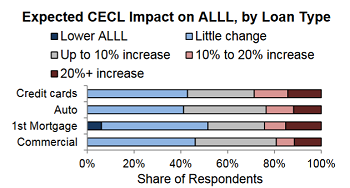

While the current expected credit loss (CECL) standard represents a “seismic shift in the way credit unions have traditionally accounted for credit losses,” the industry is still waiting for substantive guidance on the standard, according to the results of this month's Economic & CU Monitor survey.

While the current expected credit loss (CECL) standard represents a “seismic shift in the way credit unions have traditionally accounted for credit losses,” the industry is still waiting for substantive guidance on the standard, according to the results of this month's Economic & CU Monitor survey.

This standard goes into effect for credit unions fiscal years beginning after Dec. 15, 2021. NAFCU has remained in close communication with the Financial Accounting Standards Board (FASB) over its CECL standard and still strongly believes that credit unions should not be included within the scope of the standard.

Furthermore, despite the NCUA stating that examiners would take CECL into account when evaluating credit unions’ “capital adequacy,” among other changes, 71 percent of respondents expressed concerns regarding post-CECL examinations.

Also, more than half of survey respondents (57 percent) think that CECL will have a negative impact on their profitability.

“It is critical that credit unions are afforded the flexibility to adopt a size-appropriate solution and to manage the initial capital impact following adoption of CECL,” the Monitor states.

As credit unions begin putting a model in place to ensure smooth data collection for the CECL standard, NAFCU encourages the industry to make use of its study and webinars to help.

The July issue of the Economic & CU Monitor also includes results from the Credit Union Sentiment Index (CUSI), an index based on NAFCU member responses to eight questions on growth and earnings outlook, lending conditions and regulatory burden.

The CUSI declined for the second consecutive month in July as every component score fell. While most respondents remain optimistic due to a strong economy and solid loan demand, a larger share rated growth conditions as “somewhat strong” rather than “very strong.” Also noteworthy, survey participants had a less negative assessment of the regulatory burden seen over the past 12 months, but their outlook over the next year faded.

NAFCU relies on survey responses on to provide its members a glimpse of trends affecting the credit union industry as a whole. The association also uses survey responses to inform its advocacy efforts on Capitol Hill and with regulatory agencies such as the NCUA, the Bureau of Consumer Financial Protection and the Federal Reserve.

The next survey covers credit unions’ liquidity. Participants can fill out the survey online or in PDF format; responses are due Aug. 7.

Share This

Related Resources

Get daily updates.

Subscribe to NAFCU today.