Newsroom

NCUA Chairman Harper, Berger discuss agency priorities during NAFCU's State of the Industry

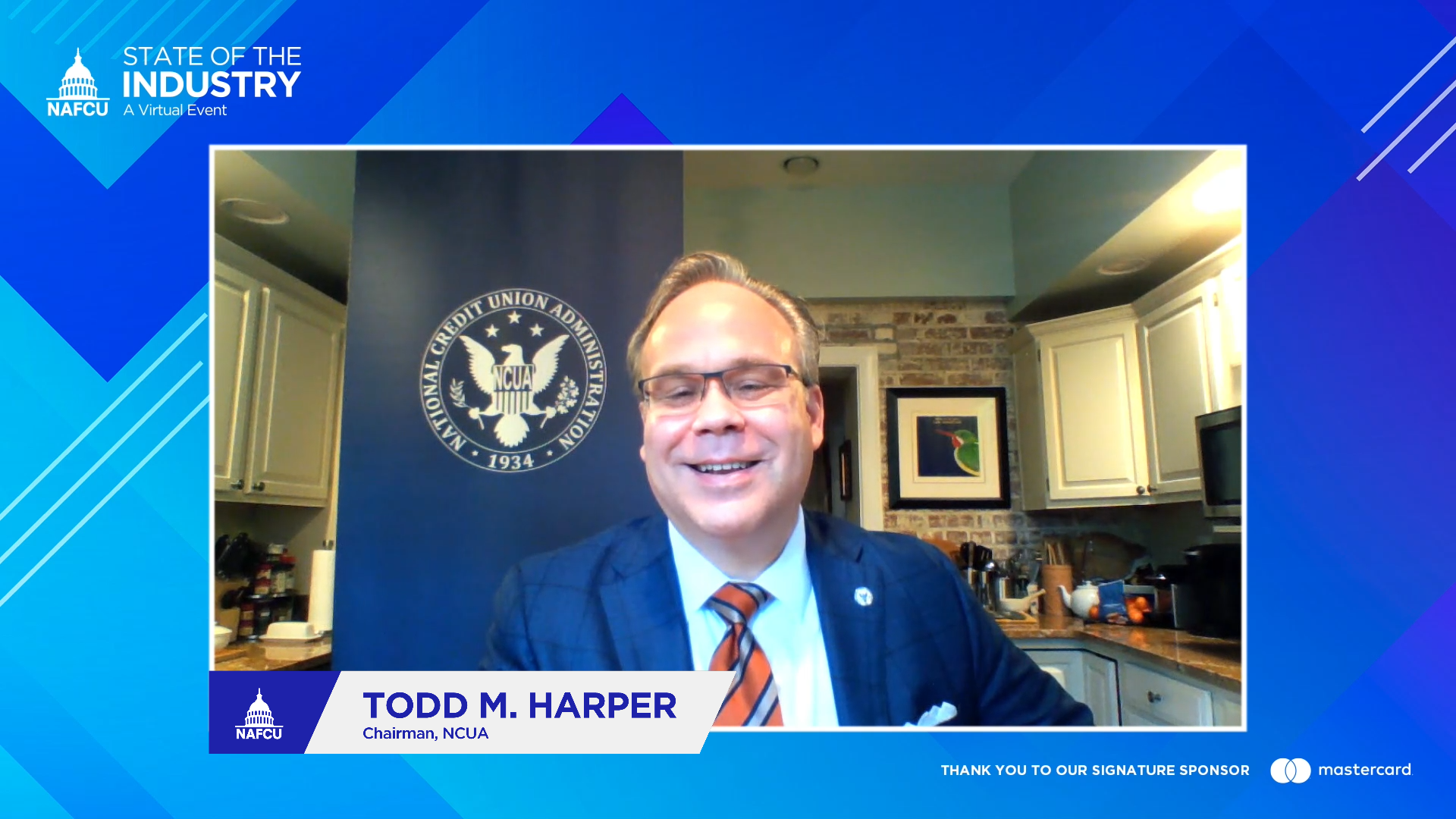

NCUA Board Chairman Todd Harper offered an overview of the current priorities at the agency before joining NAFCU President and CEO Dan Berger for a one-on-one chat during NAFCU's State of the Industry virtual event yesterday.

NCUA Board Chairman Todd Harper offered an overview of the current priorities at the agency before joining NAFCU President and CEO Dan Berger for a one-on-one chat during NAFCU's State of the Industry virtual event yesterday.

"Although the clouds of the COVID-19 pandemic appear to be lifting, the economic fallout continues to pose many challenges for our country and the credit union system," said Harper during his opening remarks. "Despite these challenges, however, credit unions have pressed forward doing their part to support their members and the communities they serve as financial first responders."

Harper noted that credit unions, like other financial institutions, have seen growth in deposits and assets and a substantial amount of loans remain in forbearance status.

"In general, economic growth is expected to be solid through the remainder of this year and into next year, with shrinking unemployment rates and strong GDP growth," said Harper. "Despite the improving outlook, credit unions may still face a difficult environment for the foreseeable future."

Harper provided an overview of what credit unions should monitor as the nation emerges from the coronavirus pandemic, including interest rate risk, capital, asset quality, earnings, and liquidity.

At the NCUA, Harper explained, the top priority is ensuring the credit union system and the share insurance fund are prepared to weather any economic fallout related to the pandemic.

"To protect the fund, we continue to monitor certain segments of the system," said Harper. As the credit union industry grows and becomes more complex, the NCUA's regulations must also keep pace with that new reality, Harper noted.

Following his remarks, Harper was joined by Berger for a discussion about the current state of the credit union industry and the NCUA’s efforts to provide relief for credit unions as they grapple with the COVID-19 pandemic.

Harper and Berger tackled several industry hot topics, including the National Credit Union Share Insurance Fund (NCUSIF), credit unions adding underserved areas to their field of membership, credit union and bank mergers, and more.

In closing, Berger reiterated NAFCU's position on financial technology (fintech) companies and asked Harper what the NCUA is doing to explore ways to foster innovation - including credit union fintech partnerships - while also providing regulatory flexibility for credit unions to invest in fintechs to better serve their members.

Harper responded that he fully recognizes financial technologies and innovation are the future, specifically noting that they can be a great way to connect communities of color and other underserved populations to the financial system. In addition, the NCUA has created a new unit focused on financial technology and innovation and Harper noted they are currently moving to hire the first director of that office.

The association's award-winning staff and other industry experts gathered during NAFCU's State of the Industry – with the support of signature sponsor Mastercard - to equip industry leaders with data, trends, and key takeaways that are necessary to plan for the future.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 2024 Mid-Year Fraud Review Listen On: Key Takeaways: [01:16] Check fraud continues to be rampant across the country. Card fraud is affecting everyone. [04:31] Counterfeit US passport cards are just another new toolbox in the bad actors’ toolbox. [07:21] Blocking the fallback is the only way to defeat counterfeit cards. [11:17] The best way is constant education to your members in as many channels as you can. [13:02] We are still seeing overdraft lawsuits. Make sure the programming you have at your credit union matches what you have displayed for the members. Web NAFCU digital@nafcu.org America/New_York public

2024 Mid-Year Fraud Review

Strategy & Growth, Consumer Lending

preferred partner

Allied Solutions

Podcast

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

Get daily updates.

Subscribe to NAFCU today.