Newsroom

RBC rule delayed one year, NAFCU pushing for more changes

The NCUA Board Thursday finalized a rule amending its 2015 risk-based capital (RBC) rule that, among other things, delays the rule's implementation date by one year to Jan. 1, 2020. As the lead on delay efforts – both on and off Capitol Hill – NAFCU is pleased with this change, but is still pushing for more.

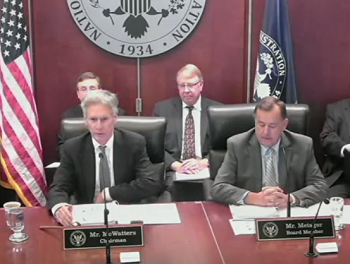

"We appreciate NCUA Chairman J. Mark McWatters and Board Member Rick Metsger's efforts, as a one-year delay of the NCUA's risk-based capital rule is a step in the right direction," said NAFCU President and CEO Dan Berger. "However, we remain concerned about the regulatory burdens and costs the rule will place on credit unions. NAFCU will continue to advocate for Congress to delay the rule's implementation by two years in order to give the NCUA time to revise it."

Among other changes, the agency's finalized RBC rule amends the definition of a complex credit union from $100 million to $500 million – exempting an additional 1,026 credit unions from the rule.

Following Thursday's meeting, NAFCU Vice President of Legislative Affairs Brad Thaler sent a letter to leaders of the Senate Banking and House Financial Services Committees explaining that this one-year delay "does not fully address all of the industry's concerns with the RBC rule."

"NAFCU believes a 2-year legislative delay until January 1, 2021, is still desirable to ensure that NCUA has additional time to re-examine specific issues with the RBC rule and its potential negative impacts on credit unions before it takes effect," Thaler added.

He reiterated that Congress should act on the bipartisan bill the Common Sense Credit Union Capital Relief Act of 2018 (H.R. 5288), which would ensure a two-year delay of the rule. At NAFCU's leading, this legislation has passed the House three times this year.

Also Thursday, the NCUA Board issued a proposal to modernize the Federal Credit Union (FCU) Bylaws. NAFCU has ardently advocated for bylaws changes and previously offered ways to modernize them. NAFCU's Regulatory Committee and NCUA staff discussed this modernization initiative in September; the bylaws have not been revised since 2007.

Of note, the proposal would add a section describing the concept of "member in good standing" to address the issue of violent and abusive members, but does not address the issue of expulsion. The association has urged the NCUA to give credit unions the flexibility to craft a policy that best suits their needs when dealing with members who engage in illegal or abusive activities. However, the proposal specifies that the board "continues to believe that having a uniform set of FCU Bylaws is more consistent with the spirit of the FCU Act."

The proposal also includes a 90-day deadline for bylaws amendments; NAFCU had urged a longer amendment deadline. Credit unions would have more flexibility to utilize technological resources for voting in elections under this proposal as well.

The association is reviewing this proposal and will issue a Regulatory Alert seeking member feedback on its provisions. The proposal will have a 60-day comment period once published in the Federal Register.

Share This

Related Resources

Get daily updates.

Subscribe to NAFCU today.