Newsroom

Vehicle sales down in April, face continued headwinds

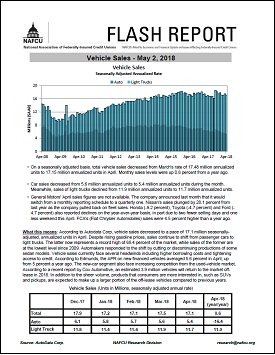

Total vehicle sales decreased in April as the industry faces several headwinds including higher borrowing costs and tightening access to credit. Sales during the month slowed to a seasonally adjusted 17.15 million annualized units from March's rate of 17.48 million annualized units.

Total vehicle sales decreased in April as the industry faces several headwinds including higher borrowing costs and tightening access to credit. Sales during the month slowed to a seasonally adjusted 17.15 million annualized units from March's rate of 17.48 million annualized units.

NAFCU Research Assistant Yun Cohen said that the new-car segment also faces increasing competition from the used-vehicle market. "According to a recent report by Cox Automotive, an estimated 3.9 million vehicles will return to the market off-lease in 2018," she said in a NAFCU Macro Data Flash report. "In addition to the sheer volume, products that consumers are more interested in, such as SUVs and pickups, are expected to make up a larger portion of the off-lease vehicles compared to previous years."

According to data from Autodata Corp., monthly sales levels were up 0.6 percent from a year ago.

Car sales decreased from 5.6 million to 5.4 million annualized units during April; sales of light trucks also declined from 11.9 million to 11.7 million annualized units during the month.

"Despite rising gasoline prices, sales continue to shift from passenger cars to light trucks," Cohen added. "The latter now represents a record high of 68.4 percent of the market, while sales of the former are at the lowest level since 2009. Automakers responded to the shift by cutting or discontinuing productions of some sedan models."

General Motors' April sales figures are not available as the company announced last month it would switch from a monthly reporting schedule to a quarterly one. Nissan's sales plunged 28.1 percent from last year as the company pulled back on fleet sales. Honda (-9.2 percent), Toyota (-4.7 percent) and Ford (-4.7 percent) also reported declines on the year-over-year basis, in part due to two fewer selling days and one less weekend this April. Fiat Chrysler Automobiles sales were 4.5 percent higher than a year ago.

Share This

Related Resources

Compliance Monitor - September 2018

Newsletter

NCUA Supervisory Priorities for 2018

Articles

Get daily updates.

Subscribe to NAFCU today.