Newsroom

NAFCU economist: 'Mediocre' jobs report could mean another rate cut

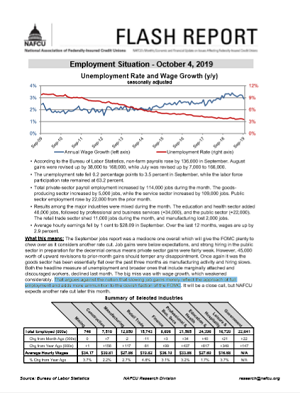

September's job report fell below expectations with only 136,000 jobs added even as the unemployment rate dropped to 3.5 percent. NAFCU Chief Economist and Vice President of Research Curt Long described the report as "mediocre…which will give the [Federal Open Market Committee (FOMC)] plenty to chew over as it considers another rate cut."

September's job report fell below expectations with only 136,000 jobs added even as the unemployment rate dropped to 3.5 percent. NAFCU Chief Economist and Vice President of Research Curt Long described the report as "mediocre…which will give the [Federal Open Market Committee (FOMC)] plenty to chew over as it considers another rate cut."

"Job gains were below expectations, and strong hiring in the public sector in preparation for the decennial census means private sector gains were fairly weak," Long said. "…The big miss was with wage growth, which weakened considerably. That argues against the notion that slowing job gains merely reflect the approach of full employment and adds more ammunition to the dovish faction of the FOMC."

Average hourly earnings in September fell 1 cent to $28.09; wages are up 2.9 percent over the year.

Total private-sector payroll employment increased 114,000 jobs, the goods-producing sector increased 5,000 jobs, the service sector increased 109,000 jobs, and public sector employment rose 22,000 jobs in September.

In the major industries, however, the results were more mixed during the month: The education and health sector added 40,000 jobs and professional and business services added 34,000, while the retail trade sector lost 11,000 jobs and manufacturing lost 2,000 jobs.

The FOMC meets Oct. 29-30 and Long said the decision "will be a close call, but NAFCU expects another rate cut."

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 2024 Mid-Year Fraud Review Listen On: Key Takeaways: [01:16] Check fraud continues to be rampant across the country. Card fraud is affecting everyone. [04:31] Counterfeit US passport cards are just another new toolbox in the bad actors’ toolbox. [07:21] Blocking the fallback is the only way to defeat counterfeit cards. [11:17] The best way is constant education to your members in as many channels as you can. [13:02] We are still seeing overdraft lawsuits. Make sure the programming you have at your credit union matches what you have displayed for the members. Web NAFCU digital@nafcu.org America/New_York public

2024 Mid-Year Fraud Review

Strategy & Growth, Consumer Lending

preferred partner

Allied Solutions

Podcast

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

Get daily updates.

Subscribe to NAFCU today.