Annual Privacy Notice Update; Rates They Are A-Changin’ Part II: Advertising and Marketing Variable Rate Products; The Truth About Ollie; Programming Note & Happy Holidays from the NAFCU Blog

Written by Elizabeth M. Young LaBerge, Regulatory Compliance Counsel

Annual Privacy Notice Update

When the relief measures regarding privacy notices were signed into law earlier this month as part of the transportation authorization bill, focus turned to the CFPB in hopes it would implement regulatory changes to the privacy notice requirements. Hearing the need for clarity from credit unions, NAFCU President and CEO Dan Berger wrote Director Cordray last week urging the Bureau to "act swiftly to implement these statutory changes and clarify the controlling law through a formal announcement or the promulgation of an interim final rule. As you may have already read, the CFPB responded to NAFCU's call for clarity yesterday and explained that it is conveying to its supervision and enforcement staff that no financial institution is expected to comply with the regulatory requirements which were superseded by that law. In the meantime, the CFPB is working with other regulators on a rulemaking to reconcile regulatory requirements with the law on the books. The full text of the response is available here. We will keep you updated as we hear more from the regulators on these changes.

Advertising and Marketing Variable Rate Products

Now that rates have budged for the first time in six years, we thought it might be good to refresh your memory regarding regulations specific to variable rate products. Last week, Benjamin Litchfield provided a summary of the disclosures requirements on variable rate products. Below is a quick outline of common regulations involved in advertising variable rate products.

Truth in Savings (TIS)

Section 707.8 of NCUA's Truth in Savings regulations addresses advertising, and would apply to the advertisement of share or deposit accounts. If the advertisement states a rate of return, it must state the rate as an annual percentage yield, though if that phrase has been stated once, the term APY may be used thereafter. See 12 C.F.R. 707.8(b). Under the regulation, the annual percentage yield (APY) is a trigger term, and if it is included in the advertisement, additional information must also be included, including whether the APY is variable. If the APY is variable, the advertisement must clearly and conspicuously state that the rate may change after the account is opened. See section 707.8(c)(1).

There are exemptions to this requirement for certain media outlets or methods of advertisement. If an advertisement is done over broadcast or electronic media (e.g. television or radio), outdoor media (e.g. billboards) or telephone response machines, then it is allowed to only use the shorter phrase APY, and the variable APY statement is not required. Also, if the advertisement is on a sign located inside a credit union or a share or deposit broker, or in a newsletter sent by the credit union, APY can be used throughout, and the variable statement if not required, though it must contain a statement advising members to contact an employee for further information about applicable fees and terms. See section 707.8(e).

Regulation Z

With regard to loans, Regulation Z contains multiple sections and subsections on advertising. More than one section may come into play, depending on the product advertised, the method of advertisement and the content of the advertisement.

When advertising variable rate, closed-end credit, if the APR is stated in the advertisement, it must also state that the APR is subject to increase. See 12 C.F.R. 1026.24(d)(2)(iii). If the loan is also secured by a dwelling, the advertisement must state a simple rate based on a reasonably current index and margin, the period of time each rate will apply and an APR. See section 1026.24(f)(2)(i). In subsection 1026.24(i), there are strict requirements for certain practices, such as using the word fixed in connection with a variable rate transaction or advertising comparisons of payments and rates. As in Truth in Savings, there are disclosure exceptions and alternatives related to the advertising media or method consult the full regulation for details.

Regarding open-end credit, Regulation Z requires that when the periodic rate is stated in the advertisement, it should be stated as an annual percentage rate. If the rate is variable, that must be disclosed. See section 1026.16(b)(1)(ii). To disclose the APR for a variable rate plan, a credit union can use an insert showing the current rate or provide a rate as of a specified recent date. When advertising home equity plans, the advertisement must clearly and conspicuously state the maximum annual percentage rate (APR) that may be imposed. See section 1026.16(d)(1)(iii). Again, the regulations includes exceptions and alternatives for disclosures with certain methods of advertisements. For example, television and radio advertisements can avoid some disclosures by listing a toll free number to obtain additional information. See section 1026.16(e).

When advertising promotional rates, there are similar requirements for both home secured and non-home secured open-end credit plans. The advertisements must disclose that the rate will be variable and disclose a reasonably current APR that will apply after the promotional period ends. See subsections 1026.16(d)(2) and (g)(4). An APR is reasonably current if it is based on an index and margin current within 60 days before mailing to a physical address, or 30 days before e-mailing, posting on a website or printing in a generally available publication. See sections 1026.60, 1026.16 and Supplement I to Part 1026, comment 1026.16(d)-6. For non-home secured open end credit, if the rate or margin is determined by the consumer's creditworthiness, the advertisement must disclose a list or range of rates that could apply. See section 1026.16(g)(4)(ii). There are slight differences between home secured and non-home secured disclosures, so be sure to check the correct subsection of 1026.16 when reviewing open-end credit advertisements.

If sending solicitations for credit cards, consult section 1026.60 which contains detailed requirements for solicitations, separated by the method of solicitation. For NAFCU members, the October 2015 Compliance Monitor contained an article entitled Opening Credits: Reminders For Advertising, Soliciting, Underwriting and Other Regulations Regarding Opening Credit Card Accounts which contains details regarding credit card solicitations and may be useful.

As always, if you are a NAFCU member struggling with finding the advertisement guidance you need, contact your NAFCU compliance team for assistance. We are here to help!

The Truth About Ollie

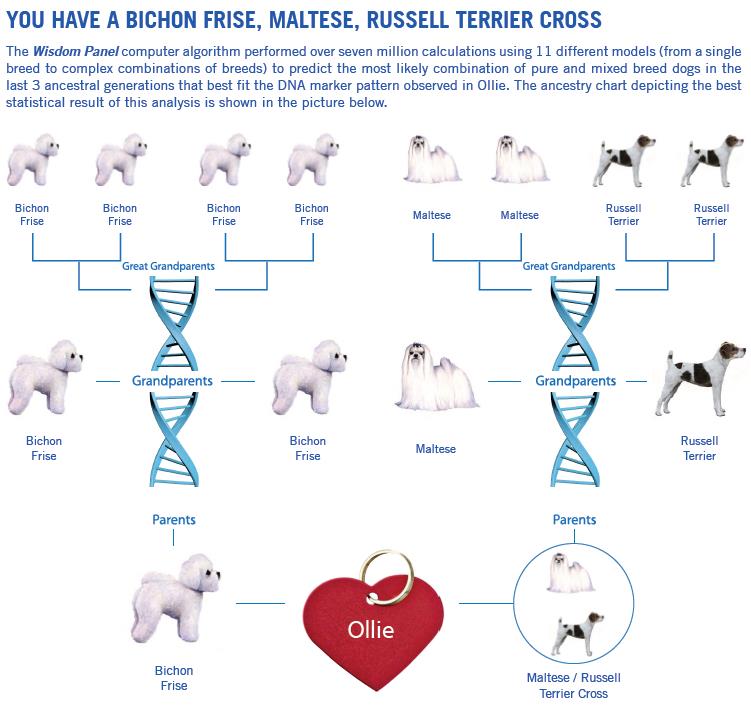

Earlier this month, I mentioned that I had ordered a genetic test to determine the breed of my dog Ollie. Guesses as to Ollie's breed included Maltese, Lhasa Apso, Maltipoo, Maltichons, Havenese, Cotonese, Coton de Tulear, and a variety of other breeds I have never heard of before. Who knew the universe of tiny, white dogs is so big? In the end, no one nailed it exactly.

The results are in and Ollie is

My husband and I have been referring to him as a Bichon-Maltijack, but a quick google search indicates that we may have made that up. If you are interested in reading the full report, it is here.

Programming Note & Happy Holidays From the NAFCU Blog

NAFCU will be closed on December 24th and 25th for the holidays, but we will be back to blogging on Monday, December 28th. From everyone here, we wish you and yours a safe and happy holiday!