BSA Violation Civil Penalties Increase

You are likely more than well aware of the costs, time and personnel necessary to maintain Bank Secrecy Act (BSA) and anti-money laundering (AML) compliance, but are you also aware of the actual penalties for violating the BSA? Last month, the Financial Crimes Enforcement Network (FinCEN) published its final rule to reflect the annual inflation adjustment to its civil monetary penalty amounts for BSA violations. While this is an annual adjustment, it should still be a reminder that the federal regulator examiners are taking now a deeper look at BSA compliance. And, as many banks and credit unions have learned the hard way, noncompliance can be costly.

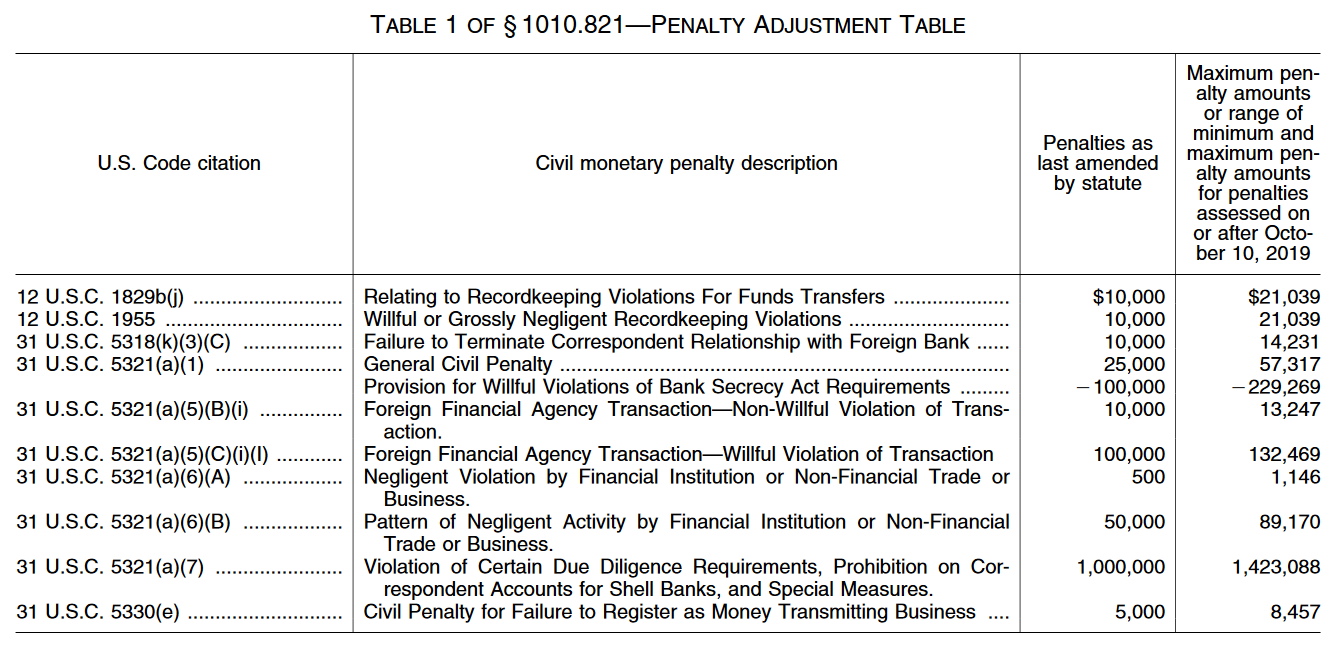

This chart from the Federal Register notice outlines the new penalty amounts for violations occurring after October10, 2019:

As the chart indicates, a negligent violation by a financial institution can result in a maximum penalty of $1,146, but a pattern of such negligence gets a maximum penalty of $89,170. Willful BSA violation penalties range from $57,317 to $229,269. Violating certain due diligence requirements can result in penalties of up to $1,423,088. Even violations related to funds transfer recordkeeping result in penalties of up to $21,039.

There are also criminal penalties for willful violations of the BSA and its implementing regulations or for structuring transactions to avoid the reporting requirements. Individual financial institution employees, including credit union employees, found willfully violating the BSA are subject to a criminal fine of up to $250,000 or five years in prison, or both. If the person commits a BSA violation in conjunction with violating other U.S. laws or participating in other criminal activity, that individual is subject to a fine of up to $500,000 or ten years in prison, or both. A financial institution that willfully violates certain provisions or special measures is subject to criminal money penalties up to the greater of $1 million or twice the value of the transaction.

As stated earlier, the federal regulator examiners have been taking a closer look at BSA compliance by financial institutions. It might be wise to review the adequacy of your credit union’s BSA/AML compliance program in order to avoid paying a penalty. The Federal Financial Institutions Examination Council (FFIEC) BSA/AML Examination Manual is a good place to start.