CFPB; Bernanke on Regulations; Regulation CC

Posted by Anthony Demangone

Happy Monday, folks. Â Hopefully, everyone was nice to their favorite "mommies" yesterday. Â

To the 3 percent of you now swearing out loud because you missed Mother's Day, money, flowers and chocolates can cure many, many things.Â

CFPB.  Forty-four senators told President Obama that they will not consider a CFPB appointment until the structure of the CFPB has changed. (ABA Dodd-Frank tracker.)   It seems to me, and plenty of others, that this move improves the odds that President Obama will nominate Elizabeth Warren as a recess appointment.Â

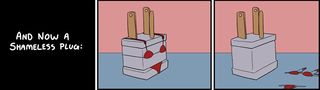

Bernanke.  Recently, Fed Chairman Ben Bernanke said that as the government works to implement Dodd-Frank, regulators must ensure that they issue effective rules that do not needlessly increase costs and regulatory burdens.  Really?  Mr. Bernanke, you are in charge of the Fed, one of the biggest offenders when it comes to hard-to-follow rulemakings that bury requirements and massively increase costs.Â

Exhibit one. Two. Three.  Four.  Five.  Six.  Seven.  Eight.  Nine. Ten.  You get the point. Â

Regulation CC. Â So, the Dodd-Frank change to Regulation CC - the one that bumps the $100 next day availability amount to $200 - when does it become effective? Â July 21, 2011. Â Some of you are thinking that you can wait, however, until the Fed finalizes its current Regulation CC rulemaking to comply. Â Wrong. Â Surprise, surprise, but the Fed buried this detail into its Reg CC proposal.Â

Section 1086(e) of the Dodd-Frank Act increases from $100 to $200 the minimum amount of funds deposited by check or checks on a given business day that a bank must make available by opening of business on the next business day pursuant to ç 603(a)(2)(D) of the EFA Act. That provision of the EFA Act is implemented in ç 229.10(c)(1)(vii) of Regulation CC, and the increase is expected to take effect on July 21, 2011, regardless of whether the Board and the Bureau have amended Regulation CC. See, 76 Fed. Reg. 16,869.

In addition, the Fed included this footnote to its proposal that clearly indicates that the change to $200 must take place by July 21, 2011:

Per ç 229.18(e), a bank must provide a change-in-terms notice to existing consumer customers by August 21, 2011.

Remember that under Regulation CC, even if a change is beneficial, such as the upcoming $200 amount, you still have to send out a change in terms notice. You just have to do so within 30 days of the change when it is beneficial.

Mr. Bernanke, I agree - regulators could do a better job of being clear with their regulations. Â Perhaps this could be exhibit 11.

Upcoming webcast. Â NAFCU has an upcoming webcast on ways credit unions can prepare for possible losses to their debit interchange income.Â