An Emphasis on Risk-Focused Supervision

Written by Shari R. Pogach, NAFCU Regulatory Paralegal

Earlier this week, the Federal Financial Institutions Examination Council (FFIEC) released an update on the continuing efforts to modernize the examination process by financial regulators. The project stems from a review of regulations under the Economic Growth and Regulatory Paperwork Reduction Act (EGRPRA) with a goal to reducing unnecessary regulatory burden on community financial intuitions.

Examination plans and procedures will be tailored and focused so that more resources will go to those institutions or areas that present heightened risk as opposed to where those that do not. As part of the review process, it was determined that similar programs and processes for risk tailoring examinations have been developed by the state and federal regulators with common risk tailoring principles and practices. If necessary, FFIEC members (including the National Credit Union Administration (NCUA)) have committed to issue additional guidance to their examination staffs on the risk-focused examination principles. The guidance has or will cover the following practices in developing an examination plan and procedures:

- Consider the institution’s unique risk profile, complexity and business model.

- Use existing information to help identify areas of higher and lower risk.

- Monitor between exams.

- Tailor document request lists to an institution’s business model, complexity, risk profile and the planned review scope.

- Minimize exam procedures for low risk institutions or areas.

- Discuss financial conditions, risk profiles, new or expanded business lines, and pertinent new supervisory or regulatory information with institution management before finalizing the review scope.

Examiners will also generally discuss the plan with an institution’s management at the beginning of the examination.

Although not required to do so, NCUA voluntarily participates in the EGRPRA process. In 2016, the agency launched its own exam flexibility initiative and it has incorporated parts of that initiative into its examination process. These include improving the coordination and scheduling of exams with state supervisors, enhancing its planning and notification procedures and reducing its onsite examination presence.

As part of the supervision discussion, there was also an interagency statement released in September clarifying the role of supervisory guidance. The statement highlighted that unlike a law or a regulation, supervisory guidance doesn’t have the force and effect of a law so the regulators do not take enforcement actions based on such guidance. Supervisory guidance outlines supervisory expectations or priorities and general views on appropriate practices for a given subject area. Such guidance will often give examples of practices that are generally considered consistent with safety-and-soundness standards or other applicable laws and regulations, including ones designed to protect consumers.

Supervisory guidance is intended to provide insight to industry and to supervisory staff to help “ensure consistency in the supervisory approach.” There is also an ongoing effort to clarify policies and practices related to supervisory guidance. In terms of examinations concerning supervisory guidance, according to the statement:

"Examiners will not criticize a supervised financial institution for a “violation” of supervisory guidance. Rather, any citations will be for violations of law, regulation, or non-compliance with enforcement orders or other enforceable conditions. During examinations and other supervisory activities, examiners may identify unsafe or unsound practices or other deficiencies in risk management, including compliance risk management, or other areas that do not constitute violations of law or regulation. In some situations, examiners may reference (including in writing) supervisory guidance to provide examples of safe and sound conduct, appropriate consumer protection and risk management practices, and other actions for addressing compliance with laws or regulations.”

Speaking of Exams...Recently, NAFCU has heard accounts from several credit unions regarding issues of exam consistency, particularly about the use of certain risk assessments as a factor in determining net worth. Have you had a similar experience or any other concerns regarding your most recent exam? Please let us know. NAFCU is committed to advocating for a fair and consistent examination process.

***

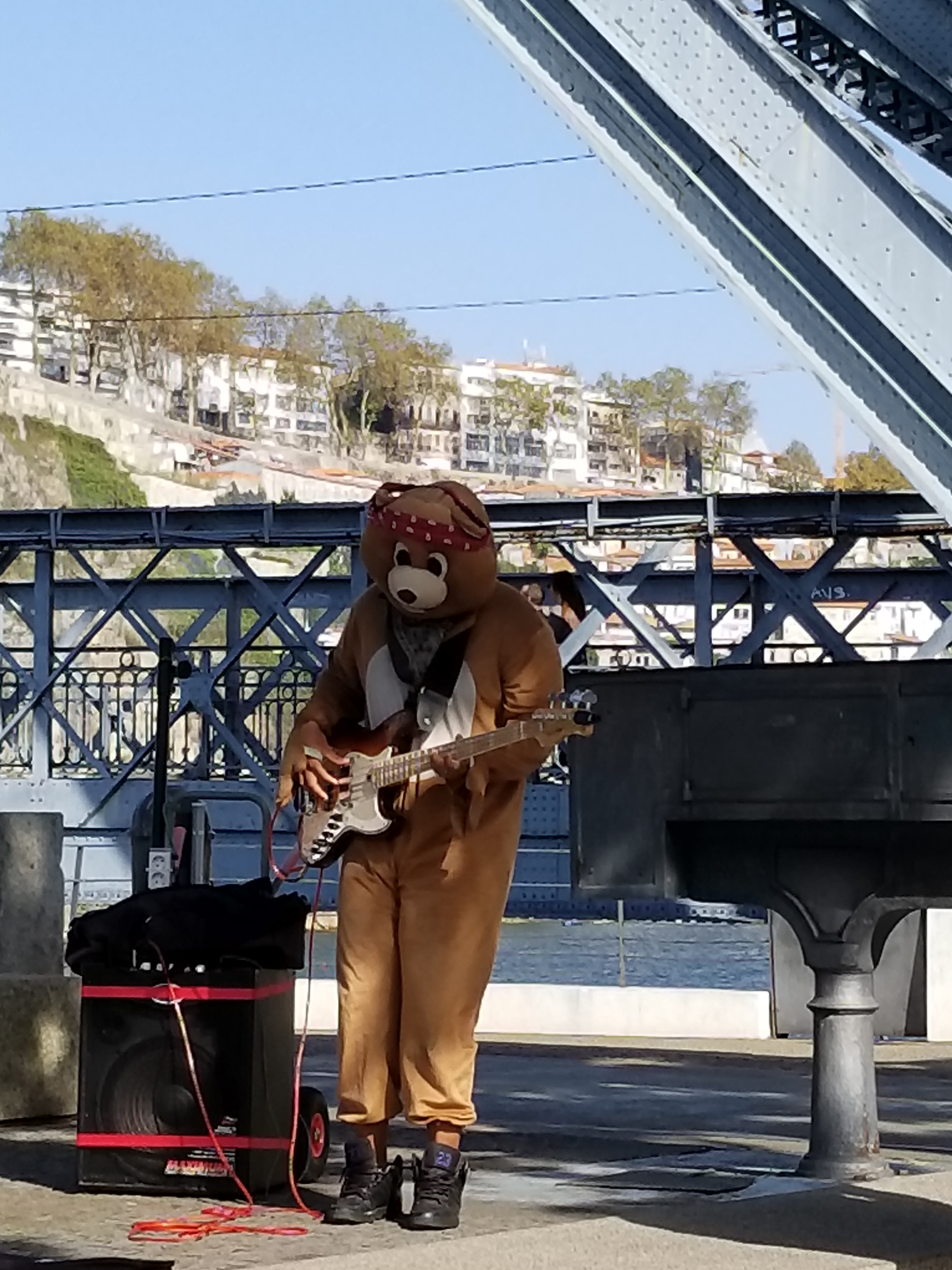

On a lighter note, this was a street performer in Porto, Portugal. Do you think the bear costume is to lower the risk of anyone finding out who he really is? I don’t think it was helping him earn any more coin.