RBC-Nuts and Bolts, pt 3

Written by Alicia Nealon, Director of Regulatory Affairs

Happy Friday and welcome back to the third installment of our RBC series where NAFCU's Compliance Blog will break down different portions of the final rule in order to help our compliance colleagues learn the basic framework of NCUA's new RBC requirements. Over the past 22 months, credit unions and NCUA alike have lived what can only be dubbed the RBC Saga. While this saga features many actors and subplots, one that I want to highlight today is investments in CUSOs, as this asset class underwent significant character development and emerged as one of the fan favorites in the saga's conclusion. For today's post, let's take a look at how the investment risk weight in CUSOs unfolded.

TAKE 1: In RBC 1, there was a 250 percent risk weight for investments in CUSOs with no allowance made for wholly owned, consolidated CUSOs. Understandably, credit unions were not a fan of this. The stage was set for a great battle.

TAKE 2: In the rule's second iteration, NCUA clarified there would be no separate applicable CUSO risk weight if the CUSO was consolidated into a credit union's financial statement under GAAP. However, if GAAP didn't allow an equity investment in a CUSO to be consolidated, then equity investments in CUSOs were assigned a risk weight of 150 percent. The plot was improving, but credit unions were still not impressed.

TAKE 3 - THE FINAL CUT: A fan favorite, this installment maintained that investments in CUSOs fall under category 6 and are still assigned a risk-weight of 150 percent. HOWEVER, a credit union could apply a risk weight of 100 percent for investments in CUSOs if its overall equity exposure deemed to be non-significant. NCUA estimates 95 percent of credit unions with such investments will receive the lower risk weight. So this begs the question, how do I determine if my credit union's equity exposure is non-significant?

For credit unions that are not required to consolidate their CUSO investments under GAAP, a credit union has non-significant equity exposures if the aggregate amount of its equity exposure does not exceed 10 percent of the sum of the credit union's capital elements of the risk-based capital numerator. When determining the aggregate amount of its equity exposures, a credit union must include total amounts of the following:

- Equity investments in CUSOs,

- Perpetual contributed capital at corporate credit unions;

- Nonperpetual capital at corporate credit unions, and

- Equity investments subject to a risk weight in excess of 100 percent.

It is important to note two things with this provision:

- This approach is available for CUSOs not subject to consolidation under GAAP; and

- This is an all-or-nothing approach. If a credit union's aggregate equity exposure exceeds 10 percent of the sum of the credit union's capital elements of the risk-based capital numerator, then that credit union must disaggregate each equity exposure listed, and individually weight each exposure based on the appropriate risk weights.

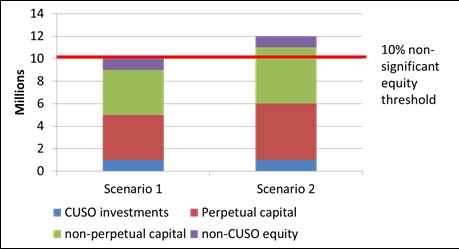

It might be helpful to walkthrough two examples of how this might apply, and how slight variances can have ripple effects throughout the determination. For this example, imagine a credit union has capital in the numerator portion of the RBC ratio totaling $100m. (For a refresher on how to calculate the numerator portion of RBC ratio, see here.)

In scenario 1, this credit union has $1 million invested in a CUSO, as well $4 million each in perpetual contributed capital and nonperpetual capital at corporate credit unions, and $1 million of publically traded equity. These equity investments total $10 million, which does not exceed the 10 percent threshold of numerator portion of the ratio. Therefore, these equity investments can all be treated as non-significant equity investments and weighted at 100 percent.

In scenario 2, the credit union still has $1 million equity each in a CUSO and publically traded instruments, but now, it has $5 million each in perpetual contributed and nonperpetural capital at corporate credit unions. This means that the credit union's equity investments total $12 million, which exceeds that 10 percent threshold. Now, the credit union must disaggregate and weigh each equity asset according to its standard risk weight (ie., nonperpetual at 100 percent, CUSO investments and perpetual contributed capital at 150 percent, and publically traded equity at 300 percent). Just by increasing its nonperpetual and perpetual capital at corporate credit unions, the credit union can no longer risk weight its CUSO investment at 100 percent.

As always, for more information on the final RBC rule, please be sure to take a look at NAFCU's Final Regulations 15-EF-15, our Capital Reform Issue Page, or reach out to me directly (anealon@nafcu.org, 703-842-2266) with any RBC questions.

***

Servicemembers Civil Relief and Military Lending Acts Are We There Yet?

Live Webcast: Thursday, November 12 | 2:00 p.m. - 3:30 p.m. EST

These military-focused acts are easy to miss; often, credit unions think they've done enough when they've barely just scratched the surface of compliance. Attend this webcast to explore and understand the potential regulatory concerns of these acts. You'll receive an overview of the proper policies, procedures, and processes you need to have in place to withstand an SCRA or MLA violation challenge and to protect the rights of our service-members.