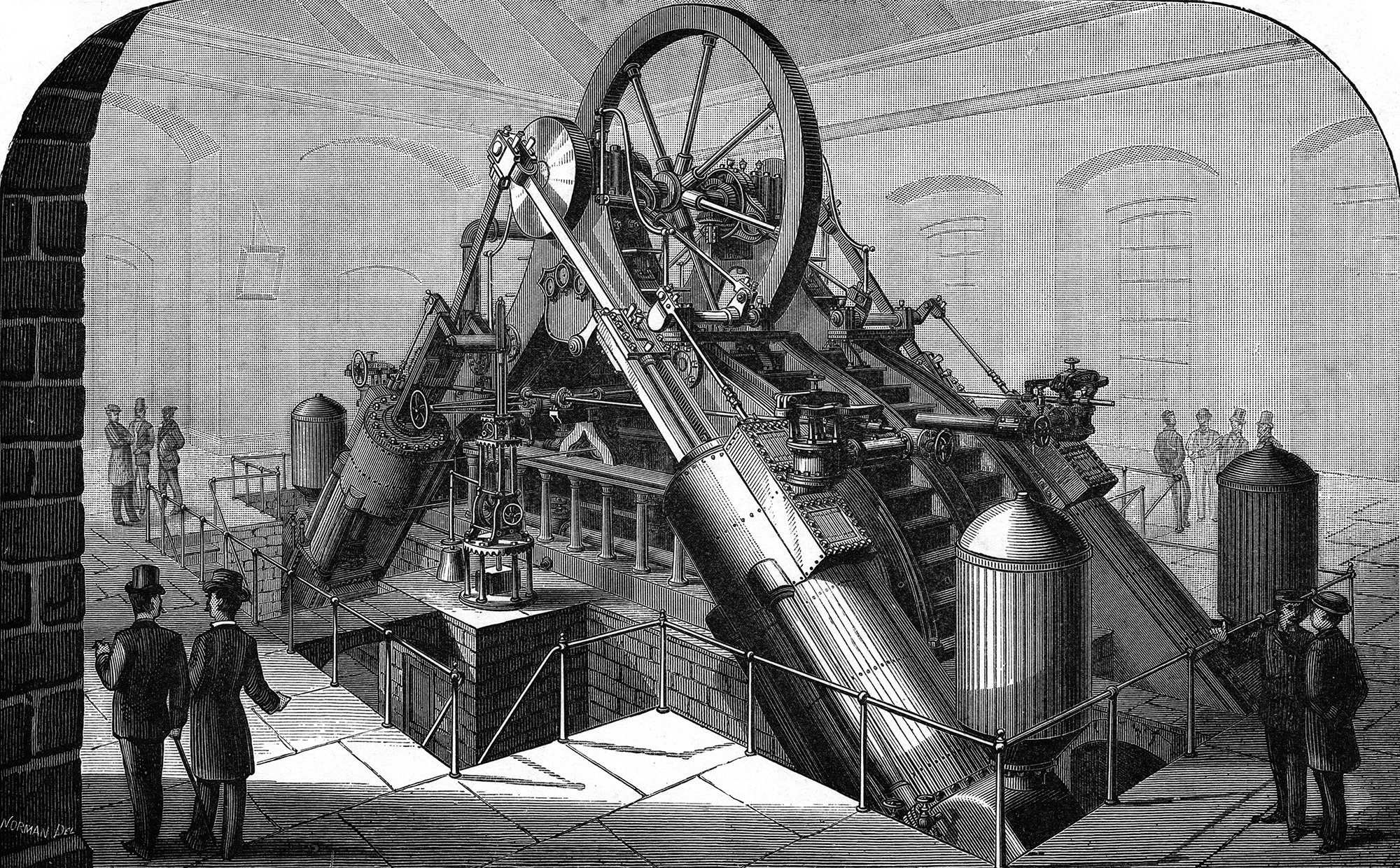

AI to the Tech Revolution: What the Steam Engine Was to the Industrial Revolution

By: Larry Pruss, Strategic Resource Management

[Blog post 2 of 2. Catch up with the first post.]

As a credit union leader, you may be asking yourself, Can I afford to implement artificial intelligence (AI) applications now? Is it a must-have? Is it going to have a measurable impact on my business? You’re not alone. Many CEOs are trying to determine its value before leveraging AI.

The top reasons companies today are using AI are for speed, efficiency, lower costs, and to make better decisions – in short all of the things you need to be competitive in the modern financial services market. How competitive you are will determine whether you retain your member relationships or lose them to newer, faster, sexier models, like fintechs. AI offers a great opportunity to get deeper product penetration by correctly matching products with member needs and so much more.

If you consider members’ behaviors online, they are logging this information for us. They’re on social media and they are connected with friends, family, and former schoolmates, buying products and gaming. They use online calendars for their scheduling and track where they are via Fitbit. Whether members like it or not, how they interact with the world is being captured, cataloged, measured, and analyzed every day by marketing and technology companies, governments, financial institutions and AIs. In fact, Google is training its AI with full access to everything Google captures. It’s scary and mind boggling.

AI For Credit Unions

In banking, especially if you’re using AI for lending decisions, we must be mindful of audit trails. AI cannot be a black box. Your credit union still must be able to explain to regulators and members why a decision may have been made by the AI. Some institutions are solving for this concern by using AI only for positive actions, like loan approvals, and routing declines for human review.

Ultimately, AI is going to be the mechanism for bringing all of these various data elements - social media, buying patterns, loan applications and the like - together. It derives value from the integration of voice, internet history, social media, transactional finance, and massive computing power. Massive amounts of money are being invested in AI by every industry, including the financial institutions. Partnerships are being formed and use cases created.

Ultimately, AI is going to be the mechanism for bringing all of these various data elements - social media, buying patterns, loan applications and the like - together. It derives value from the integration of voice, internet history, social media, transactional finance, and massive computing power. Massive amounts of money are being invested in AI by every industry, including the financial institutions. Partnerships are being formed and use cases created.

Listen to the recent podcast, "AI for the Credit Union CEO."

Where To Begin

Many CEOs ask where and how to start. Start internally. Many of you may already be doing this today in terms of fraud management, employing chat bots, using character or voice recognition. Now, identify someone within your organization who’s passionate about AI and appoint them to champion the cause. If you need or want to consider external resources, you could find a partner in your local colleges and universities.

So, in response to CEOs’ question on the value of AI: It definitely needs to be a priority. Significant adoption of AI across financial institutions won’t happen for a few more years, but from then it’s going to explode. AI is going to be what the steam engine was to the industrial revolution. AI will likely be the most significant event in our generation and perhaps all of history. It really depends on whether you want to be a leader or fast follower. What you don’t want to be, is left behind.