Give Members a Home Experience Not a Mortgage

Anne Legg, Director of Client/Market Strategies, AdvantEdge Analytics

As technology continues to transform the lives and expectations of members, they increasingly turn to businesses that can provide them an end-to-end solution combined with a customized experience, before they may even know they need it. To achieve this, the credit union needs to provide a Platform, Personalization, and Prediction.

Platform

A platform is a group of technologies that are used as a base upon which other applications, processes or technologies are developed. Think of an iPhone. It is a platform for many processes, such as email, phone, movies, games etc. To carry the concept of a platform to a credit union, the products are the deposits, loans and services and the member is the base. So, the member experience is the platform.

A platform is a group of technologies that are used as a base upon which other applications, processes or technologies are developed. Think of an iPhone. It is a platform for many processes, such as email, phone, movies, games etc. To carry the concept of a platform to a credit union, the products are the deposits, loans and services and the member is the base. So, the member experience is the platform.

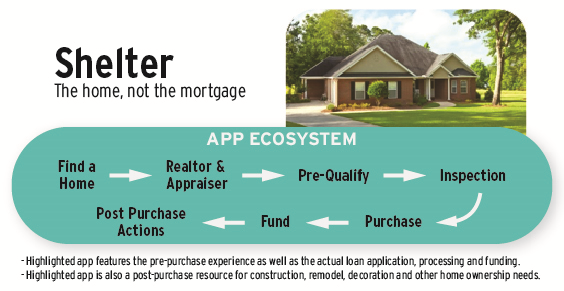

A member requires shelter with adequate proximity to work, family, âplayâ and space for family and their belongings. The member fills this need with a home. Not a home loan. A loan does not exist in the target neighborhood. Their loved ones do not live in a loan. The loan does not contain their prized collections.

Traditionally, credit union members have compartmentalized their home experience. They go to one source to find a neighborhood, another to find the home, yet another to find the loan and then even another to furnish/improve the home. And it can be a lot of work and include a lot of uncertainty. In the platform, the credit union brings all these sources together in an app ecosystem (see graph below )and creates the home experience. The credit union can guide the member through the entire home experience, providing an exceptional experience that would be real value for them.

The platform as a business model is powerful because it uses technology to connect people, organizations, and resources in an interactive ecosystem where amazing amounts of value can be created and exchanged. This experience involves the features and benefits of the home itself, ownership properties, maintenance, as well as the community of homeowners who share their experiences on solving home problems. And, of course, there is the financing of the home.

Prediction

Notice the first step in the home process (pictured): find a home. Traditionally, credit unions have not been deeply involved in this process. Obviously, there is business value in getting out ahead of the competition. Courtesy of our connected world, members reward those businesses that doâ¦those that can give them what they need before they need it.

With big data, specifically leveraging predictive analytics, credit unions are in a position to identify when moving might be an important consideration for a member.

- Life trigger events: Has your member recently had a baby? Switched jobs? Retired? All of these life events frequently associated with moving can be uncovered.

- Purchase behavior: Is your member regularly shopping and playing far from their current home? This might be an indication that their current location is no longer ideal for them.

- Relative financial situation: Is your memberâs income or net worth significantly higher than those in their neighborhood? This might be an indication the member would be open to a move.

Personalization

This same big data can also be used to personalize the experience. Having a baby? Let's include recommendations for baby-proofing your new home. Moving closer to your new job? Let's connect to title companies conveniently located in that area. Retiring? Maybe the right loan for you is less than you qualify for, given your current income bracket.

But there's more. As users interact with your new technology, they reveal more and more of themselves.

- Are they looking at small houses even though they could afford more? Perhaps a jewel box house is for them. Let's connect them with others who have downsized in style.

- Do they shy away from older homes that meet all their needs? Let's connect them to contractors, those well-regarded by others in the ecosystem community.

- Are they looking for builder contractors? Perhaps it's time to engage them with a home equity loan discussion.

For endless scenarios, these member insights gained from connected data will allow credit unions to shift from being a provider of commoditized products to that of a member engagement ecosystem host. More importantly, you are providing value to their lives while they are returning value to the credit union.

What's Next

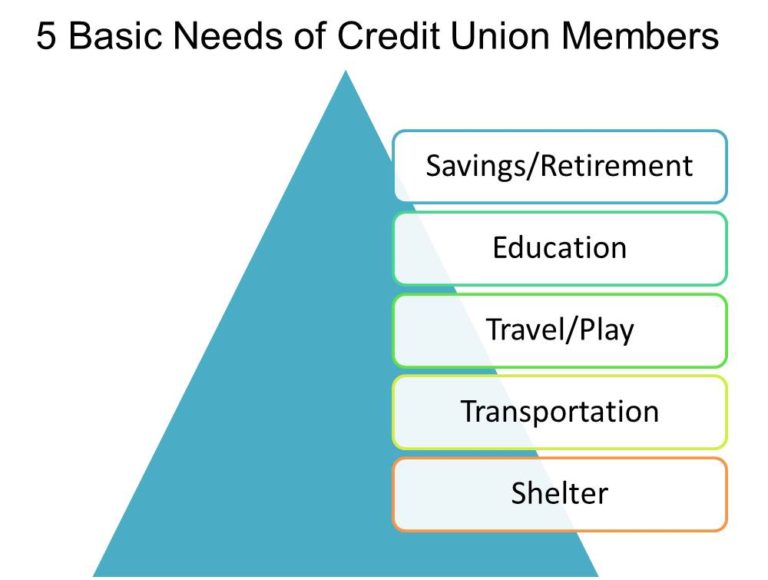

The examples above are just for the home experience. It could just have easily have been based on one of the other five member needs: the auto experience, the vacation experience, the learning experience, the savings/senior living experience.

But credit unions should start small and create a member experience for just one, learn, and refine. Credit unions will be amazed at how this shift from product to platform allows them to collaborate in ways they just can't imagine now.

Learn more from Anne during her recent podcast "Quantifiable Self and Zero User Interface." Anne addresses why these concepts are becoming increasingly important to credit unions. Members rely on technology to help them make healthier, smarter, and more successful decisions. With your credit union's vast access to data, you are in a unique position to deliver this experience to members.

CUNA Mutual Group is the NAFCU Services Preferred Partner for Analytics, TruStage® Auto & Home and Life Insurance Products. More information and educational materials are available at nafcu.org/CUNAMutualGroup

CUNA Mutual Group is the NAFCU Services Preferred Partner for Analytics, TruStage® Auto & Home and Life Insurance Products. More information and educational materials are available at nafcu.org/CUNAMutualGroup