Newsroom

Banking regulators move to loosen Volcker requirements

Yesterday, the FDIC and Office of the Comptroller of the Currency approved an interagency rule that would loosen Volcker rule requirements on big banks; three other banking regulators must still approve it. NAFCU had urged the agencies to withdraw their proposed rulemaking, arguing that relaxing the requirements could undermine financial stability.

The Volcker rule was put in place after the 2008 financial crisis to prevent improper, speculative trading. The final rule clarifies requirements related to bank relationships with covered funds and relaxes certain limits on proprietary trading, which is generally short-term and bears additional risk. It is revised from the proposal, but the changes dropped a bank-opposed provision that would have tied compliance with the rule to an accounting standard.

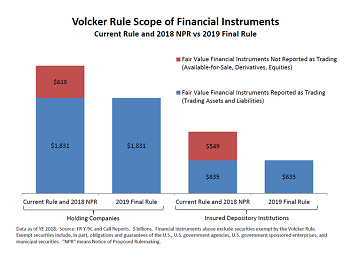

FDIC Board Member Martin Gruenberg opposed the rule and issued a statement which characterized the changes as opening up a "vast new opportunity – hundreds of billions of dollars of financial instruments – at both the bank and bank holding company level, for speculative proprietary trading funded by the public safety net."

NAFCU has vocalized its concerns about reducing oversight of banks that are still too big to fail. Last month, the five banking regulators confirmed NAFCU's interpretation of a provision in the Economic Growth, Regulatory Relief, and Consumer Protection Act (S. 2155) with a final rule that clarifies the Volcker rule relief provided in the provision applies only to community banks. The association has also called on Congress to consider enacting a modernized Glass-Steagall Act.

The association is supportive of reform efforts that allow credit unions and other financial institutions to compete without putting consumers at risk. However, NAFCU consistently works to set the record straight on the differences between credit unions and banks as the banking industry continues to lobby to have their requirements relaxed while trying to put the requirements on credit unions.

Share This

Related Resources

CFPB Reform Issue Brief

Whitepapers

Interchange Issue Brief

Whitepapers

Credit Union-Bank Mergers Issue Brief

Whitepapers

NCUA Third-Party Vendor Authority One-Pager

Whitepapers

Get daily updates.

Subscribe to NAFCU today.