Newsroom

CUs: Any concerns about a uniform mortgage-backed security?

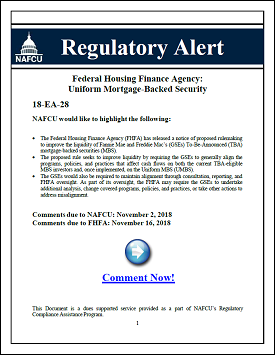

NAFCU would like to know if credit unions have any overarching concerns regarding the creation and use of a uniform mortgage-backed security (UMBS) per a recent proposal by the Federal Housing Finance Agency (FHFA). While NAFCU supports standardization and uniformity in the MBS market, it wants input from members via the association's Regulatory Alert, issued yesterday.

NAFCU would like to know if credit unions have any overarching concerns regarding the creation and use of a uniform mortgage-backed security (UMBS) per a recent proposal by the Federal Housing Finance Agency (FHFA). While NAFCU supports standardization and uniformity in the MBS market, it wants input from members via the association's Regulatory Alert, issued yesterday.

Earlier this month, the FHFA released a proposed rule on the UMBS meant to improve the liquidity of Fannie Mae and Freddie Mac's to-be-announced (TBA) eligible MBS.

This proposal, NAFCU points out, would also:

- seek to improve liquidity by requiring the government-sponsored enterprises (GSEs) to generally align the programs, policies and practices that affect cash flows on both the current TBA-eligible MBS investors and on the UMBS; and

- require the GSEs to maintain alignment through consultation, reporting and FHFA oversight.

In March, the FHFA announced that the GSEs would begin issuing its single security – the UMBS – June 3, 2019. The new security will take the place of TBA-eligible mortgage-backed securities and will be issued through Common Securitizations Solutions LLC (CSS) using the Common Securitization Platform (CSP).

Among other questions in its Regulatory Alert, NAFCU would like to know if this UMBS will remove barriers to entry for new secondary market participants and encourage competition in a future housing finance system. Along with maintaining a sustainable secondary mortgage market for credit unions and fair pricing based on loan quality rather than volume, NAFCU's core principles for housing finance reform include the continued implementation of the CSP and single security.

Comments on this proposal are due to NAFCU by Nov. 2; final comments are due to the FHFA by Nov. 16.

Share This

Related Resources

Get daily updates.

Subscribe to NAFCU today.