Newsroom

Panel provides economic updates, outlook; NAFCU's Long reviews survey results

During NAFCU’s State of the Industry event Thursday, NAFCU Chief Economist and Vice President of Research Curt Long shared the results of the pre-conference survey ahead of a panel from the industry-leading economists of the Credit Union Economic Group for a full overview of the economic situation.

During NAFCU’s State of the Industry event Thursday, NAFCU Chief Economist and Vice President of Research Curt Long shared the results of the pre-conference survey ahead of a panel from the industry-leading economists of the Credit Union Economic Group for a full overview of the economic situation.

Survey respondents in all four regions expect delinquencies and forbearances to be above average a year from now. In addition, respondents in all asset classes represented also expect delinquencies and forbearances to grow on net.

In addition, the survey tackled credit unions’ experiences with teleworking before and during the pandemic. While the largest percent of credit unions to report regular teleworking for non-branch staff pre-pandemic came from credit unions with larger assets, all asset sizes report the experience from working from home to be going better than expected.

This suggests, Long noted, that there are some benefits to be had with teleworking when you are able to “enter the crisis, hit the ground running and remain productive in spite of the obstacles.”

The full results of the survey will be shared in a report to conference attendees and NAFCU member credit unions as soon as it is available.

Following the review of the survey results, Long was joined by Fred Eisel of Vizo Financial Corporate Credit Union and Scott Knapp of CUNA Mutual Group.

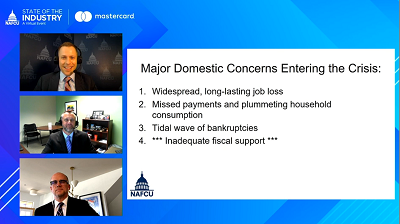

Long kicked off the panel to discuss major domestic concerns that are present when entering a domestic crisis, including widespread, long lasting job loss, plummeting household consumption, mass bankruptcies and inadequate fiscal support.

“A lot of the job loss totals, which are eyepopping, would still be categorized as temporary job losses,” Long said when discussing the concern of long lasting job loss. However, he noted, the number of permanent job losses – people who are not expected to be called back to their previous positions – is the number to watch.

In addition, Long discussed the economic impact stimulus payments, sent in April, noting that the fiscal support provided by the government through the CARES Act has been generous and helped bump the economy.

“Nearly half of the stimulus checks were spent in the market when they went out,” said Long.

Following Long’s presentation, Eisel explained the unprecedented influx of cash on balance sheets at credit unions and how credit unions may experience income challenges in the coming months due to lower fee income, less loan demand, and margins remaining compressed.

He encouraged credit unions to consider reviewing the prices they offer – including their share rates – and suggested making use of tiered rates based on credit score.

“In 2008, while loan yields fell, credit unions also had room to decrease deposit rates,” Eisel noted. “This time around, many cannot lower deposit rates any further, which will lead to additional margin compression.”

In addition to these challenges, Eisel discussed how credit unions may struggle to meet members’ varying needs. Some members, he noted, may be unemployed at this time while other members may be looking at the market as an opportunity.

Knapp wrapped up the session using crisis psychology to pinpoint how the market reacted amid the pandemic and how it often reacts in the face of panic.

Knapp broke down important characteristics that define a crisis, including:

- presenting challenges that are very difficult to solve;

- something extremely rare or unprecedented has happened; and

- if it seems long-term in nature or is likely to cause permanent change.

In addition, Knapp touched on the idea that “universal negativity skews the probability of market-moving surprises toward the positive” and reminded credit unions that depression-like numbers don’t signify the start of a depression in this case.

Sessions from the event, including Long, Eisel and Knapp’s presentation, will be available to watch on-demand online and on the event app Monday.

Share This

Related Resources

Add to Calendar 2024-05-02 14:00:00 2024-05-02 14:00:00 Mastering Resilience in Incident Response Plans About the Webinar An Incident Response (IR) plan is crucial for guiding credit unions through major incidents efficiently and effectively. However, many IR plans lack resilience, making them less adaptable to the evolving threat landscape. Join us for our webinar Mastering Resilience in Incident Response Plans where DefenseStorm cyber experts Elizabeth Houser and James Bruhl will delve into the importance of resiliency within cybersecurity IR plans. Don’t miss out on the opportunity to learn how to: Ensure IR plan accessibility so that all team members with assigned roles are prepared for effective incident response. Conduct efficient and regular reviews to ensure roles and responsibilities are current, tools are relevant, and compliance requirements are met. Implement and utilize tabletops to regularly test the effectiveness of your IR plan. Enhance preparedness, efficiency, and confidence among responders. View On-Demand Web NAFCU digital@nafcu.org America/New_York public

Mastering Resilience in Incident Response Plans

preferred partner

DefenseStorm

Webinar

Add to Calendar 2024-04-30 14:00:00 2024-04-30 14:00:00 State of Consumer Credit: How Behaviors have Shifted and Trends in US Bankcard Benchmarks About the Webinar In an era marked by volatility and evolving credit trends such as historic inflation and the rise of BNPL, credit unions must adapt to mitigate risks effectively. Join the experts at FICO in exploring how to leverage FICO Scores to enhance competitiveness while maintaining stability and compliance. Key Takeaways: Learn about the latest in consumer credit behaviors and score distributions since the pandemic Take a closer look at major US bankcard trends in comparison to the credit union industry, such as average card spend, balance, missed payments and more. View On-Demand Web NAFCU digital@nafcu.org America/New_York public

State of Consumer Credit: How Behaviors have Shifted and Trends in US Bankcard Benchmarks

preferred partner

FICO

Webinar

Add to Calendar 2024-04-25 14:00:00 2024-04-25 14:00:00 ChatGPT: What AI can do for you! ChatGPT has been created with one main objective – to predict the next word in a sentence, based on what's typically happened in the gigabytes of text data that it's been trained on. Did you ever hear of the saying, “People fear the unknown?” Artificial intelligence scares people, but it is the future, and you need to understand the tools and resources it offers. It’s also about saving time, that’s what technology and in this case, artificial intelligence can do for you. If you want to save time and have a better quality of life, this training is for you. Once you give ChatGPT a question or prompt, it passes through the AI model and the chatbot produces a response based on the information you've given and how that fits into its vast amount of training data. It's during this training that ChatGPT has learned what word, or sequence of words, typically follows the last one in a given context. During this webinar, ChatGPT: What AI can do for you, you’ll discover the background, purpose, usability, and the pros and cons. Don't miss this opportunity! Key Takeaways Learn the background of AI Understand the purpose of AI Identify the pros and cons Register Now $295 Members | $395 Nonmembers(Additional $50 for USB)One registration gives your entire team access to the live webinar and on-demand recording until April 25, 2025Go to the Online Training Center to access the webinar after purchase » Who Should Attend NCRMs Risk titles Education Credits NCRMs will recieve 1.0 CEUs for participating in this webinar Web NAFCU digital@nafcu.org America/New_York public

ChatGPT: What AI can do for you!

Credits: NCRM

Webinar

Add to Calendar 2024-04-25 14:00:00 2024-04-25 14:00:00 Unifying Two Different Executive Benefits Programs About the Webinar In part one we discussed how to retain key positions during a time of transition. In part two, we will look at how to combine executive benefits programs from two different organizations into a single high-performing program. Evaluating each program includes many different facets, from strategy and expense to performance and servicing. This session will provide important considerations, whether or not you have pending M&A activity. Key Takeaways: Is the plan design both retentive and efficient? Is the benefit expense properly mitigated? Does the legal agreement reflect the board’s intent? View On-Demand Web NAFCU digital@nafcu.org America/New_York public

Unifying Two Different Executive Benefits Programs

preferred partner

Gallagher

Webinar

Get daily updates.

Subscribe to NAFCU today.