Recent Activity

What NAFCU Is Doing

NAFCU is standing with credit unions in the fight against unfair ADA lawsuits. We recognize the importance of the ADA and fully support the ability for all Americans to be free from discrimination, but credit unions should not be the victims of ambiguities in federal law.

- NAFCU has filed sixteen amicus briefs on behalf of thirteen credit unions in cases in seven states (Virginia, Pennsylvania, New Jersey, Texas, Alabama, Florida, and California) either on its own or jointly with other credit union organizations. Several of these cases have been dismissed. NAFCU continues to seek opportunities to support credit unions against predatory litigation.

- Where possible, NAFCU attends hearings to lend its support to credit unions and their motions to dismiss these cases.

- NAFCU has engaged with the DOJ by writing letters to former U.S. Attorney General (AG) William Barr and former U.S. AG Jeff Sessions, asking the DOJ to consider issuing additional guidance on website accessibility under the ADA. NAFCU has also met with DOJ staff to explain the impact of ambiguities in the law on credit unions and to ask for guidance.

- Following the Supreme Court deciding in October 2019 against hearing an appeal from Domino's Pizza, leaving in place the Ninth Circuit's ruling that ADA requirements are applicable to websites and mobile applications, NAFCU again urged the DOJ to provide clear guidance for website accessibility standards.

- NAFCU has educated Congress on the impact of these frivolous lawsuits on the credit union industry, and has urged Congress to address this important issue.

- NAFCU worked with a bipartisan group of House members to send a joint letter to the DOJ, urging the agency to clarify that, absent DOJ or Congressional action, there should be no ability for private action for ADA website compliance and asking the DOJ to adopt clear guidelines and standards on ADA applicability to websites.

- NAFCU supports legislative efforts such as the ADA Education and Reform Act of 2017 (H.R. 620) and is actively working to expand the bill's protections to cover website-related lawsuits. H.R. 620 was passed by the House on February 16, 2018 but, has yet to be reintroduced in the 117th Congress.

- NAFCU sent a letter to the National Association of Attorneys General asking them to look into the issue and to join us in urging the DOJ to address this issue in order to prevent unnecessary litigation.

- NAFCU President and CEO B. Dan Berger sent a letter to the most active law firm in these frivolous lawsuits, demanding that they retract threats of legal action and cease and desist from making further demands.

- NAFCU sent a letter to the Federal Trade Commission (FTC) urging the FTC to look into the issue for potential unfair or deceptive acts or practices (UDAPs) by law firms in violation of the FTC Act and to urge the DOJ to issue clear ADA website standards.

We remain at the forefront of this issue and proactive from all angles given the rapid increase in litigation risk. We are committed to fighting for credit unions and will continue to stand with our members in the face of these costly legal actions threatening the industry. We continue to work with member credit unions facing litigation over unclear website accessibility requirements under the ADA and urge credit unions impacted by this issue to reach out for assistance.

Wins for the Industry

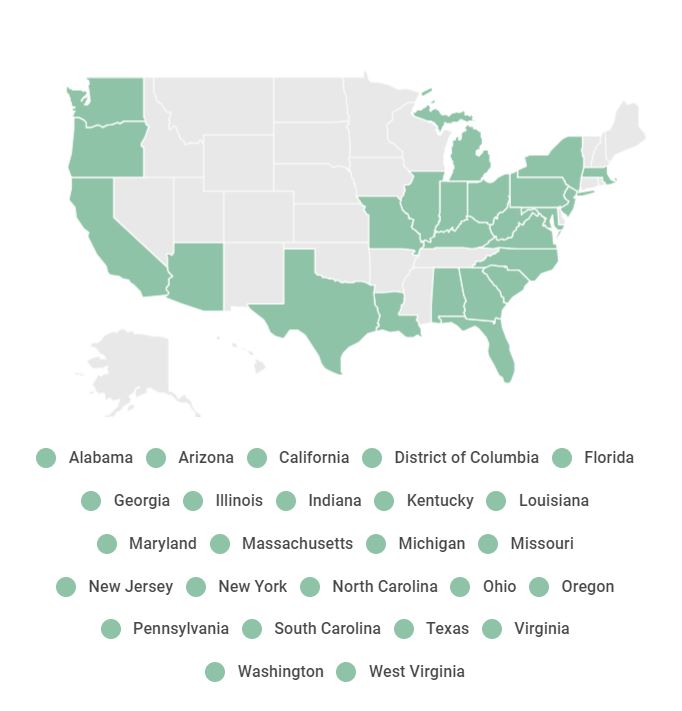

As of January 2020, credit unions in 26 states have been targeted with demand letters on this issue. However, credit unions facing ADA litigation are seeing favorable initial outcomes. Several federal trial court decisions recently came down on the side of the credit union in lawsuits over unclear website requirements under the ADA:

- In April 2021, the U.S. Court of Appeals for the Eleventh Circuit ruled in Gil v. Winn-Dixie that websites are not places of public accommodation under the ADA. The court’s decision explained that the ADA definition of public accommodation applies only to physical spaces.

- In August 2019, the Sixth Circuit Court of Appeals upheld the dismissal of an ADA website accessibility case against two credit unions, citing arguments from two NAFCU-supported appeals court decisions.

- In July 2019, the Seventh Circuit Court of Appeals upheld the dismissal of an ADA website accessibility case, citing arguments from a previous Fourth Circuit Court of Appeals decision.

- In May 2019, the Fourth Circuit Court of Appeals upheld the dismissal of an ADA website accessibility case, agreeing that the plaintiff lacked standing. NAFCU filed three amicus briefs in support of the credit union.

- On January 24, 2019, the United States District Court for the Southern District of Texas dismissed an ADA case holding that the credit union’s website is not considered a place of public accommodation under the ADA.

- On January 3, 2019, the Fourth Circuit Court of Appeals upheld a dismissal of an ADA website accessibility case finding that the plaintiff lacked legal standing. NAFCU filed an amicus brief in support of the credit union, and attended the oral argument held in October 2018.

- In August 2018, a Texas plaintiff voluntarily dismissed their case. A Northern District Illinois court judge dismissed an ADA case finding that the plaintiff was ineligible to join the credit union; therefore, the plaintiff lacked standing and had no injury.

- On July 10, 2018, a Southern District Georgia court dismissed an ADA case finding that the plaintiff failed to adequately explain how he was eligible to join the credit union, and he lacked an injury by the inability to research information about the credit unions services and locations.

- In June 2018, a federal Alabama judge dismissed a case against an Alabama credit union.

- Since January 2018, federal judges in Virginia have dismissed five out of five cases in which NAFCU filed amicus briefs. In June 2018, a federal judge in Ohio dismissed a case against a credit union, favorably citing the Virginia cases.

- On January 26, 2018, in the first victory for credit unions, a Virginia District Court found that the plaintiff lacked legal standing to sue the credit union because he was not eligible for membership and would not likely use the credit union's services. In addition, the court indicated that a website is not a place of public accommodation, thus certain ADA protections were not triggered. In this case, NAFCU filed an amicus brief supporting the credit union.

Members of Congress have taken action on the issue. For example, in June 2018, a bipartisan, NAFCU-backed effort saw more than 100 House members urge former AG Jeff Sessions and the DOJ to provide guidance and clarity regarding website accessibility under the ADA. In September 2018, a group of Senators highlighted in a letter to former AG Jeff Sessions the number of website accessibility lawsuits filed in 2018. In July 2019, a group of Republican Senators wrote to AG William Barr, following up on the September 2018 letter and asking for an update on the DOJ’s efforts to resolve regulatory uncertainty regarding website accessibility under the ADA.

Other stakeholders have also gotten involved with the issue. A group of 19 state Attorneys General wrote former AG Jeff Sessions on July 19, 2018, echoing NAFCU’s request that regulations be drafted pertaining to accessibility standards under the ADA.

Additionally, Representatives Ted Budd (R-NC), Luis Correa (D-CA), and Rick Hudson (R-NC) introduced H.R. 1100, the Online Accessibility Act, on February 18, 2021, which would amend the ADA by establishing website accessibility standards and would prohibit discrimination by any private owner or operator of a consumer-facing website or mobile application against an individual with a disability. H.R. 1100 would also require an aggrieved person with a disability to exhaust their administrative remedies prior to bringing a civil action. This bill has been referred to the House Energy and Commerce Committee and awaits further action. It was previously introduced in the 116th Congress as H.R. 8478.