Newsroom

NAFCU, lawmakers discuss strengthening the credit union industry

NAFCU president and CEO Dan Berger Wednesday met with Representatives Tom Emmer, R-Minn., to discuss ways to champion credit unions and their 130 million members. Of note, Emmer was recently awarded the NAFCU Credit Union Champion award in recognition of his leadership and dedication supporting important credit union industry issues. NAFCU Senior Vice President of Government Affairs Greg Mesack, Vice President of Legislative Affairs Brad Thaler, and Associate Director of Legislative Affairs Lewis Plush, and Associate Director Janelle Relfe were also in attendance.

Emmer, who also serves as the Chair of the National Republican Congressional Committee, coordinating efforts for House Republicans in the 2022 midterm elections, introduced the NAFCU-supported Credit Union Governance Modernization Act (CUGMA) to streamline member expulsion processes in 2020.

He later reintroduced the legislation in 2021, assembling a bipartisan group of lawmakers including Rep. Ed Perlmutter, D-Colo., to improve existing language in the Federal Credit Union Act related to expulsion in order to protect credit unions, members, and employees. Emmer and his colleague’s hard fought efforts eventually led to the bill’s inclusion in the fiscal year 2022 omnibus spending package, which was signed into law earlier this year.

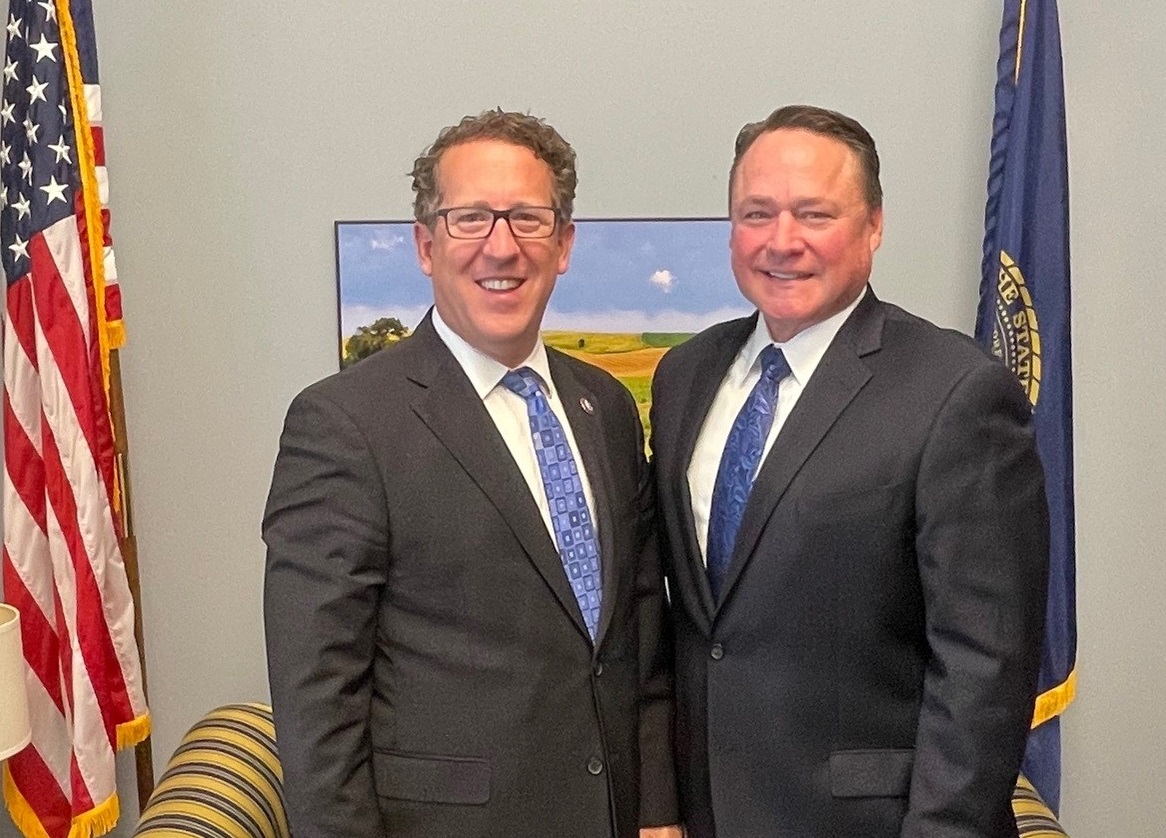

Berger, Thaler and Associate Director of Legislative Affairs Janelle Relfe also met with Representative Adrian Smith, R-Neb., to thank him for his longstanding support of credit unions and to discuss the outlook for the industry, as well as how credit unions are helping meet the needs of those in rural Nebraska.

Emmer, Smith and more than 200 lawmakers last year also successfully led efforts to oppose the proposal to increase the IRS reporting requirement threshold from $600 to $10,000 or higher. NAFCU President and CEO Dan Berger stated that the threshold increase was “nothing more than window dressing in an attempt to shore up support for a flawed proposal,” urging Treasury and the IRS to instead “focus its attention on the data it already has to increase tax compliance.”

NAFCU continues to work with Reps. Emmer and Smith and other lawmakers to ensure credit union priorities remain top of mind for Congress.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Get daily updates.

Subscribe to NAFCU today.