Newsroom

NAFCU-sought RBC-delay intact in approps bill, awaits House action

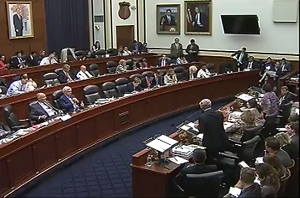

The House Appropriations Committee on Wednesday reported out the Financial Services and General Government appropriation's bill leaving intact a NAFCU-sought, two-year delay of the NCUA's risk-based capital (RBC) rule. The appropriation's bill now awaits action by the full House.

The House Appropriations Committee on Wednesday reported out the Financial Services and General Government appropriation's bill leaving intact a NAFCU-sought, two-year delay of the NCUA's risk-based capital (RBC) rule. The appropriation's bill now awaits action by the full House.

This RBC-delay provision, also included in the House Financial Services Committee-passed Foreign Investment Risk Review Modernization Act of 2018 (H.R. 5841), comes from the Common Sense Capital Relief Act (H.R. 5288), which was introduced by Reps. Bill Posey, R-Fla., and Denny Heck, D-Wash., in March. NAFCU President and CEO Dan Berger met with Posey and Heck last month to thank them for their ongoing efforts to protect the industry from the adverse effects of this rule.

In a letter to committee leaders ahead of Wednesday's mark-up of the appropriation's bill, NAFCU Vice President of Legislative Affairs Brad Thaler explained that if the RBC rule is allowed to go into effect as written – currently slated for Jan. 1, 2019 – it will have a negative impact on the industry.

NAFCU supports an appropriate RBC system for credit unions, but has been opposed to NCUA's RBC rulemaking since its passage and has urged the rule be modified or effective date delayed, particularly because of increased regulatory burdens and costs.

The Financial Services and General Government appropriation's bill also includes a number of other NAFCU-backed regulatory relief measures, including language from the Mortgage Choice Act, the Financial Institutions Examination Fairness and Reform Act, and the TRID Improvement Act.

The bill also retains funding for the NCUA's Community Development Revolving Loan Fund (CDRLF) and the Community Development Financial Institutions Fund (CDFI). Funding for CDFIs was increased $25 million due to an amendment offered by Rep. Steven Palazzo, R-Miss., and agreed to by the committee.

Full funding levels for the Small Business Administration's 7(a) and 504 loan programs are in the bill.

NAFCU will monitor this bill as it makes its way through the legislative process.

Share This

Get daily updates.

Subscribe to NAFCU today.