Newsroom

Bold advocacy lifts NAFCU, CUs in 2019

Together, NAFCU and the credit union industry have achieved some great wins in 2019 as the association continues its mission of strengthening credit unions. As the industry's Washington Watchdog, NAFCU has been hard at work advocating for credit union priorities with administration officials, lawmakers, and regulators – all while fighting back against relentless banker attacks and keeping members informed of trends and new regulations that could impact their operations.

Together, NAFCU and the credit union industry have achieved some great wins in 2019 as the association continues its mission of strengthening credit unions. As the industry's Washington Watchdog, NAFCU has been hard at work advocating for credit union priorities with administration officials, lawmakers, and regulators – all while fighting back against relentless banker attacks and keeping members informed of trends and new regulations that could impact their operations.

Here are a few NAFCU and industry highlights to mark this momentous year:

Growth

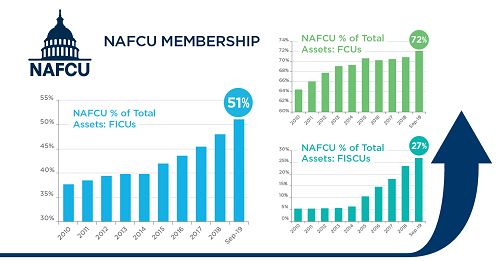

According to the most recent NCUA call report data, the entire credit union industry now serves 118 million Americans, with new members joining each day. As the industry has grown, so has NAFCU's base – in the past six years, NAFCU has seen its membership grow 37 percent and the association now represents 51 percent of the industry's assets.

In efforts to better connect the credit union community, NAFCU launched three new member-only NAFCU networks designed to connect credit union professions to training and their peers.

The association's Compliance Team continued to provide award-winning compliance assistance, answering more than 10,000 member questions via NAFCU's direct compliance assistance program and publishing more than 220 blog posts, articles, charts, guides and tools in efforts to assist credit unions in overcoming compliance challenges.

Furthering its commitment to its members, NAFCU welcomed Allyson Browning to its membership team in a new role as Senior Member Experience Strategist, working to ensure credit union leaders take full advantage of NAFCU's bold advocacy agenda and resources, responsive compliance assistance, and forward-looking education and training programs.

Advocacy

NAFCU has been hard at work setting the record straight on the differences between credit unions and banks as the banking industry continues to lobby to have their requirements relaxed while trying to put the requirements on credit unions.

The association led efforts to introduce over 20 bipartisan measures in support of credit unions in Congress. It continues to lead the charge to create national cyber and data security standards, establishing a new credit union task force to support its advocacy.

NAFCU also testified on Capitol Hill on a number of issues throughout the year:

- NAFCU Executive Vice President of Government Affairs and General Counsel Carrie Hunt shared the association's support of prohibiting volume-based discounts on pricing during her testimony in front of the Senate Banking Committee. NAFCU has been the leading voice for credit unions during housing finance reform discussions and the association continues to work closely with administration officials;

- NAFCU witness and Kinecta Federal Credit Union's Gail Jansen raised concerns about increased fees to the Small Business Administration's 7(a) loan program; and

- JetStream Federal Credit Union's Mara Falero urged Congress to take action to allow credit unions to better serve more Americans, specifically those in low-income and underserved communities.

On the regulatory front, NAFCU worked with stakeholders to push for a delay of both the Financial Accounting Standards Board's current expected credit loss standard and the NCUA's risk-based capital rules.

Additionally, NAFCU's Research Team connected representatives from member credit unions with Federal Reserve Banks in six meetings nationwide, and the association's 2019 Congressional Caucus featured a record number of meetings for credit unions with lawmakers and administration officials.

More industry accomplishments achieved by NAFCU and credit unions this year can be read here.

Stay up to date with NAFCU and the credit union industry by subscribing to NAFCU Today and engaging with the association on social media via Facebook, Twitter and LinkedIn.

Share This

Related Resources

Add to Calendar 2024-06-26 14:00:00 2024-06-26 14:00:00 Gallagher Executive Compensation and Benefits Survey About the Webinar The webinar will share trends in executive pay increases, annual bonuses, and nonqualified benefit plans. Learn how to use the data charts as well as make this data actionable in order to improve your retention strategy. You’ll hear directly from the survey project manager on how to maximize the data points to gain a competitive edge in the market. Key findings on: Total compensation by asset size Nonqualified benefit plans Bonus targets and metrics Prerequisites Demographics Board expenses Watch On-Demand Web NAFCU digital@nafcu.org America/New_York public

Gallagher Executive Compensation and Benefits Survey

preferred partner

Gallagher

Webinar

Add to Calendar 2024-06-21 09:00:00 2024-06-21 09:00:00 The Evolving Role of the CISO in Credit Unions Listen On: Key Takeaways: [01:30] Being able to properly implement risk management decisions, especially in the cyber age we live in, is incredibly important so CISOs have a lot of challenges here. [02:27] Having a leader who can really communicate cyber risks and understand how ready that institution is to deal with cyber events is incredibly important. [05:36] We need to be talking about risk openly. We need to be documenting and really understanding what remediating risk looks like and how you do that strategically. [16:38] Governance, risk, compliance, and adherence to regulatory controls are all being looked at much more closely. You are also seeing other technology that is coming into the fold directly responsible for helping CISOs navigate those waters. [18:28] The reaction from the governing bodies is directly related to the needs of the position. They’re trying to help make sure that we are positioned in a way that gets us the most possibility of success, maturing our postures and protecting the institutions. Web NAFCU digital@nafcu.org America/New_York public

The Evolving Role of the CISO in Credit Unions

preferred partner

DefenseStorm

Podcast

AI in Action: Redefining Disaster Preparedness and Financial Security

Strategy

preferred partner

Allied Solutions

Blog Post

Get daily updates.

Subscribe to NAFCU today.