Newsroom

March 08, 2019

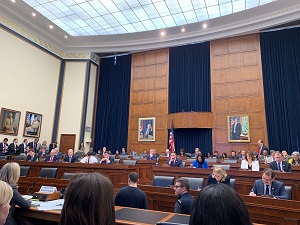

CU issues raised during House panel hearing with Kraninger

A number of issues important to credit unions were raised during Thursday's House Financial Services Committee hearing with CFPB Director Kathy Kraninger, including reforms to the bureau, its consumer complaint database and the Military Lending Act (MLA). NAFCU attended the hearing.

Committee Ranking Member Patrick McHenry, R-N.C., during the hearing said the bureau should be subject to the congressional appropriations process and its structure should be reformed from a single director to panel of commissioners. NAFCU has long supported both of these reforms.

Kraninger was also asked by committee members about the bureau's consumer complaint database and the MLA. NAFCU has previously told the bureau that unverified complaint information should not be publicly published in order to reduce the risk of reputational harm. On MLA, Kraninger in January asked Congress to pursue legislation to give the bureau clear authority to supervise institutions for compliance with the MLA. Former bureau Acting Director Mick Mulvaney said the CFPB would stop examining lenders for compliance because the bureau lacks oversight authority. Whether the bureau's approach to MLA oversight will change in the meantime is not clear. NCUA's 2019 supervisory priorities do include examining for compliance with the MLA, as well as additional resources related to its requirements. As credit unions continue to grapple with the parameters of the MLA rule, NAFCU has a host of resources available here and an updated version of its Military Lending Act Guide. NAFCU President and CEO Dan Berger met with Kraninger earlier this week; Berger has communicated credit unions' concerns and priorities with Kraninger since she was confirmed as director in December. Following Kraninger's confirmation, NAFCU hand delivered a letter with bureau-specific priorities, and Kraninger followed up on the letter with a call to Berger to further discuss credit union priorities. NAFCU also attended a financial services industry roundtable with Kraninger in January.Share This

Related Resources

CFPB Priorities Issue Brief

Whitepapers

CFPB Recent Action Issue Brief

Whitepapers

CDFIs Issue Brief

Whitepapers

UDAAP Issue Brief

Whitepapers

Get daily updates.

Subscribe to NAFCU today.